B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a country's budget deficit increases, then in the market for foreigncurrency exchange,

A) the supply of its currency shifts right, so the exchange rate falls.

B) the demand for its currency shifts right, so the exchange rate rises.

C) the supply of its currency shifts left, so the exchange rate rises.

D) the demand for its currency shifts left.so the exchange rate falls.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the supply of dollars in the market for foreign-currency exchange shifts left, then the exchange rate

A) rises and the quantity of dollars exchanged falls.

B) rises and the quantity of dollars exchanged does not change.

C) rises and the quantity of dollars exchanged rises.

D) falls and the quantity of dollars exchanged does not change.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a country suffers from capital flight, the exchange rate

A) depreciates, because demand in the market for foreign-currency exchange shifts left.

B) depreciates, because supply in the market for foreign-currency exchange shifts right.

C) appreciates, because demand in the market for foreign-currency exchange shifts right.

D) appreciates, because supply in the market for foreign-currency exchange shifts left.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

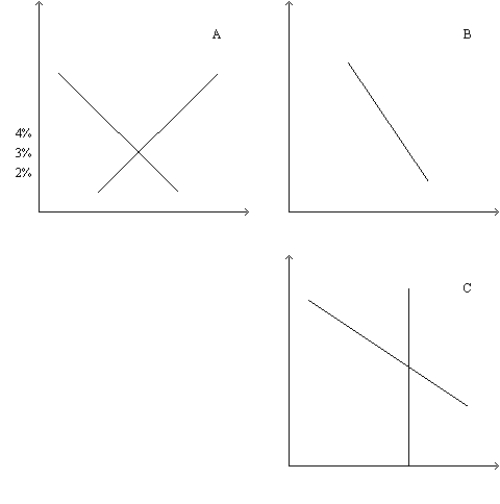

Figure 32-4

Refer to this diagram of the open-economy macroeconomic model to answer the questions below.  -Refer to Figure 32-4. Suppose that the government goes from a budget surplus to a budget deficit. The effects of the change could be illustrated by

-Refer to Figure 32-4. Suppose that the government goes from a budget surplus to a budget deficit. The effects of the change could be illustrated by

A) shifting the demand curve in panel a to the right and the demand curve in panel c to the left.

B) shifting the demand curve in panel a to the left and the supply curve in panel c to the left.

C) shifting the supply curve in panel a to the right and the demand curve in panel c to the right.

D) shifting the supply curve in panel a to the left and the supply curve in panel c to the left.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a country has a positive net capital outflow, then

A) on net it is purchasing assets from abroad. This adds to its demand for domestically generated loanable funds.

B) on net it is purchasing assets from abroad. This subtracts from its demand for domestically generated loanable funds.

C) on net other countries are purchasing assets from it. This adds to its demand for domestically generated loanable funds.

D) on net other countries are purchasing assets from it. This subtracts from its demand for domestically generated loanable funds.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a country imposes an import quota, its exchange rate

A) rises because the supply of dollars in the market for foreign-currency exchange falls.

B) falls because the supply of dollars in the market for foreign-currency exchange rises.

C) rises because the demand for dollars in the market for foreign-currency exchange rises.

D) falls because the demand for dollars in the market for foreign-currency exchange falls.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The country of Solidia is politically very stable and has a long tradition of respecting property rights. If several other countries suddenly became politically unstable, we would expect Solidia's

A) real interest rate to rise.

B) real exchange rate to rise.

C) net exports to rise.

D) None of the above is likely.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A rise in the budget deficit

A) shifts both the supply of loanable funds in the market for loanable funds and the supply of dollars in the market for foreign-currency exchange right.

B) shifts both the supply of loanable funds in the market for loanable funds and the supply of dollars in the market for foreign-currency exchange left.

C) shifts both the demand for loanable funds in the market for loanable funds and the demand for dollars in the market for foreign-currency exchange right.

D) shifts both the demand for loanable funds in the market for loanable funds and the demand for dollars in the market for foreign-currency exchange left.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If for some reason Americans desired to decrease their purchases of foreign assets, then other things the same

A) both the real exchange rate and the quantity of dollars exchanged in the market for foreign-currency exchange would fall.

B) both the real exchange rate and the quantity of dollars exchanged in the market for foreign-currency would rise.

C) the real exchange rate would rise and the quantity of dollars exchanged in the market for foreign-currency would fall.

D) the real exchange rate would fall and the quantity of dollars exchanged in the market for foreign-currency would rise.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, an increase in the U.S. interest rate

A) raises net capital outflow which decreases the quantity of loanable funds demanded.

B) raises net capital outflow which increases the quantity of loanable funds demanded.

C) lowers net capital outflow which decreases the quantity of loanable funds demanded.

D) lowers net capital outflow which increases the quantity of loanable funds demanded.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the French government increases its expenditures and reduces taxes, then France's interest rate

A) and its exchange rate rise.

B) rises and its exchange rate falls.

C) falls and its exchange rate rises.

D) and its exchange rate fall.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If C+I+G>Y, then net exports and net capital outflow are both greater than zero.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the quantity of loanable funds supplied is greater than the quantity demanded, then there is a

A) shortage of loanable funds and the interest rate will fall.

B) shortage of loanable funds and the interest rate will rise.

C) surplus of loanable funds and the interest rate will fall.

D) surplus of loanable funds and the interest rate will rise.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Capital flight raises a country's interest rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would both raise the U.S. exchange rate?

A) capital flight from other countries to the U.S. occurs and the U.S. moves from budget surplus to budget deficit

B) capital flight from other countries to the U.S. occurs and the U.S. moves from budget deficit to budget surplus

C) capital flight from the U.S. to other countries occurs, the U.S. moves from budget surplus to budget deficit

D) capital flight from U.S. to other countries occurs, the U.S. moves from budget deficit to budget surplus

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If Argentina suffers from capital flight, Argentinean domestic investment and Argentinean net exports will both decline.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S. government imposes an import quota on beef, U.S. net exports will

A) increase, the real exchange rate of the dollar will appreciate, and domestic sales of U.S. beef will increase.

B) increase, the real exchange rate of the dollar will depreciate, and domestic sales of U.S. beef will not change

C) not change, the real exchange rate of the dollar will appreciate, and domestic sales of U.S. beef will increase.

D) not change, the real exchange rate of the dollar will depreciate, and domestic sales of U.S. beef will not change.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S. government imposes a quota on imports of jet planes, then

A) net capital outflow rises.

B) net exports rise.

C) the exchange rate rises.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would do the most to reduce a trade deficit?

A) increase domestic saving

B) increase domestic political stability and respect of property rights

C) other countries reduce their trade restrictions

D) raise tariffs

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 475

Related Exams