B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, the supply of loanable funds comes from

A) national saving. Demand comes from only domestic investment.

B) national saving. Demand comes from domestic investment and net capital outflow.

C) Only net capital outflow. Demand for loanable funds comes from national saving.

D) domestic investment and net capital outflow. Demand for loanable funds comes from national saving.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If U.S. residents chose to travel overseas less due to concerns about the safety of foreign travel, then in the open- economy macroeconomic model

A) the demand for dollars in the market for foreign-currency exchange shifts right.

B) the demand for dollars in the market for foreign-currency exchange shifts left.

C) the supply of dollars in the market for foreign-currency exchange shifts right.

D) the supply of dollars in the market for foreign-currency exchange shifts left.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S. imposed an import quota on farm machinery, then sales of U.S. farm machinery equipment producers would

A) rise and the exports of other U.S. industries would rise.

B) rise and the exports of other U.S. industries would fall.

C) fall and the exports of other U.S. industries would rise.

D) fall and the exports of other U.S. industries would fall.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most accurate statement?

A) Trade policy has neither microeconomic nor macroeconomic effects.

B) Trade policy has similar microeconomic and macroeconomic effects.

C) The effects of trade policy are more macroeconomic than microeconomic.

D) The effects of trade policy are more microeconomic than macroeconomic.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is consistent with moving from a surplus to equilibrium in the market for foreign currency exchange?

A) the exchange rate falls causing U.S. residents to import more

B) the exchange rate falls causing U.S. residents to import less

C) the exchange rate rises causing U.S. residents to import more

D) the exchange rate rises causing U.S. residents to import less

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a country experiences capital flight, which curves shift right?

A) the demand for loanable funds and the demand for its currency in the market for foreign-currency exchange

B) the demand for loanable funds and the supply of its currency in the market for foreign-currency exchange

C) the supply of loanable funds and the demand for its currency in the market for foreign-currency exchange

D) the supply of loanable funds and the supply of its currency in the market for foreign-currency exchange

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, as the real interest rate rises

A) domestic investment and net capital outflow both rise.

B) domestic investment and net capital outflow both fall.

C) domestic investment rises and net capital outflow falls.

D) domestic investment falls and net capital outflow rises.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country has GDP of $700 billion, consumption of $450 billion, government expenditures of $100 billion, and domestic investment of $200 billion. What is its supply of loanable funds?

A) $350 billion

B) $250 billion

C) $200 billion

D) $150 billion

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If for some reason Americans desired to increase their purchases of foreign assets, then other things the same

A) both the real exchange rate and the quantity of dollars exchanged in the market for foreign-currency exchange would fall.

B) both the real exchange rate and the quantity of dollars exchanged in the market for foreign-currency would rise.

C) the real exchange rate would rise and the quantity of dollars exchanged in the market for foreign-currency would fall.

D) the real exchange rate would fall and the quantity of dollars exchanged in the market for foreign-currency would rise.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Other things the same, when the real exchange rate of the dollar appreciates, U.S. goods become more desirable to U.S. residents, but less desirable to foreign residents.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, the supply of dollars in the market for foreign-currency exchange comes from

A) national saving

B) domestic investment

C) net exports

D) net capital outflow

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following leads to an increase in net exports in the long run?

A) either a decrease in the budget deficit or imposing an import quota

B) a decrease in the budget deficit but not imposing an import quota

C) imposing an import quota but not a decrease in the budget deficit

D) neither a decrease in the budget deficit nor imposing an import quota

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In the 1980s, both the U.S. government budget and U.S. trade deficits increased.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things the same, if foreigners desire to purchase more U.S. bonds, then the demand for loanable funds shifts left.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

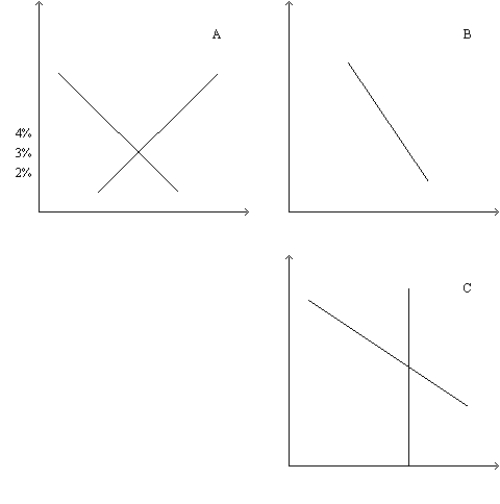

Figure 32-4

Refer to this diagram of the open-economy macroeconomic model to answer the questions below.  -Refer to Figure 32-4. Suppose that U.S. firms desire to purchase more capital in the U.S. The effects of this could be illustrated by

-Refer to Figure 32-4. Suppose that U.S. firms desire to purchase more capital in the U.S. The effects of this could be illustrated by

A) shifting the demand curve in panel a to the right and the demand curve in panel c to the left.

B) shifting the demand curve in panel a to the right and the supply curve in panel c to the left.

C) shifting the supply curve in panel a to the right and the demand curve in panel c to the left.

D) shifting the supply curve in panel a to the right and the supply curve in panel c to the right.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If U.S. citizens decide to save a smaller fraction of their incomes, U.S. domestic investment

A) increases, and U.S. net capital outflow increases.

B) increases, and U.S. net capital outflow decreases.

C) decreases, and U.S. net capital outflow increases.

D) decreases, and U.S. net capital outflow decreases.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a country raises its budget deficit then

A) both its supply of and demand for loanable funds shift.

B) its supply of but not its demand for loanable funds shifts.

C) its demand for but not its supply of loanable funds shifts.

D) neither its supply nor its demand for loanable funds shift.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is consistent with moving from a shortage to equilibrium in the market for foreign currency exchange?

A) the exchange rate falls so foreign residents want to buy more U.S. goods and services

B) the exchange rate falls so foreign residents want to buy fewer U.S. goods and services

C) the exchange rate rises so foreign residents want to buy more U.S. goods and services

D) the exchange rate rises so foreign residents want to buy fewer U.S. goods and services

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In equilibrium a country has a net capital outflow of $200 billion and domestic investment of $150 billion. What is the quantity of loanable funds demanded?

A) $50 billion

B) $150 billion

C) $200 billion

D) $350 billion

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 475

Related Exams