A) 70.

B) 60.

C) 50.

D) 40.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) Two key elements of welfare reform are work requirements and limiting the time that recipients can receive benefits.

B) The Earned Income Tax Credit (EITC) is very similar to a negative income tax.

C) Minimum wage laws will likely increase unemployment.

D) The elderly are more likely to be poor than single mothers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to utilitarians, the ultimate objective of public actions should be to

A) ensure the poor can afford an adequate diet.

B) distribute income uniformly.

C) maximize the sum of individual utility.

D) prevent all people from experiencing diminishing marginal utility.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liberalism is the political philosophy espoused by

A) Robert Nozick.

B) John Stuart Mill.

C) John Rawls.

D) Jeremy Bentham.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S. welfare system was revised by a 1996 law that

A) consolidated all of the previous assistance programs into a single program.

B) limited the amount of time that people could receive assistance.

C) said it was no longer necessary for poor people to demonstrate an additional "need," such as small children or a disability, to qualify for assistance.

D) turned all federally-run welfare programs over to the states.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

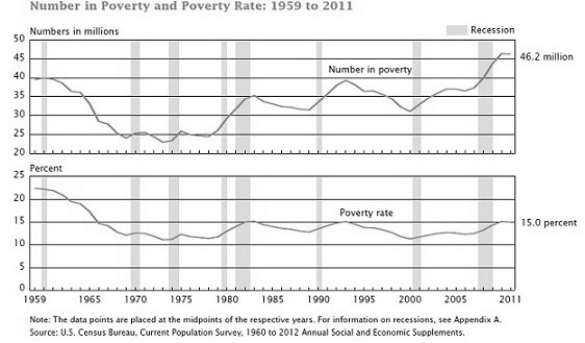

Figure 20-1 Number of Poor  -Refer to Figure 20-1. The absolute number of people in poverty

-Refer to Figure 20-1. The absolute number of people in poverty

A) is higher in 2011 than in 1959.

B) is lower in 2011 than in 1959.

C) has not changed between 1959 and 2011.

D) has steadily decreased between 1959 and 2011.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The maximin criterion suggests that social policy should

A) expropriate the factors of production from the capitalist class.

B) ensure an equal distribution of income.

C) elevate the well-being of those at the bottom of the income distribution.

D) elevate the well-being of all workers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Toys for Tots, a program that collects new toys to distribute to poor children at Christmas, is an example of an in-kind transfer.

B) Supporters advocate the use of in-kind transfers because they restrict the ability of recipients to purchase alcohol and drugs.

C) Critics argue that in-kind transfers are inefficient and disrespectful.

D) For a program to qualify as an in-kind transfer, it must have government approval.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

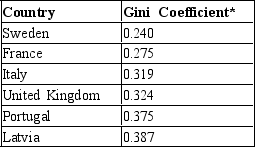

Table 20-10  *A Gini coefficient is a commonly used measure of income inequality, with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income, and 1 corresponds to perfect inequality where one person has all the income, while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-10. Which country has the most unequal income distribution?

*A Gini coefficient is a commonly used measure of income inequality, with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income, and 1 corresponds to perfect inequality where one person has all the income, while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-10. Which country has the most unequal income distribution?

A) Latvia

B) Italy

C) France

D) Sweden

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Callaway family owns a small bait and tackle shop in a resort town in Wisconsin. An economic recession reduces the number of tourists for one summer, which reduces the family's income for that year. For the Callaway family, their

A) transitory income for the year of the recession likely exceeds their permanent income.

B) permanent income likely exceeds their transitory income for the year of the recession.

C) permanent income will be more affected by the recession than their transitory income.

D) Both a and c are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Raising the welfare of the worst-off person in society is an important goal of which political philosophy?

A) utilitarianism

B) liberalism

C) libertarianism

D) secularism

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) The percentage of the population that suffers from long-term poverty is far smaller than the percentage of the population that suffers from short-term poverty because there is a high level of economic mobility in the United States.

B) Permanent income is a better measure of a family's ability to buy the necessities of life than is transitory income.

C) The economic life cycle theory explains why gifts of goods and services reduce poverty for the very young and the very old.

D) Because people can borrow and save to smooth out changes in income, their standard of living in any one year depends more on lifetime income than on a particular year's income.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Would the maximin criterion achieve perfect income equality?

A) Yes. There would be no way to reallocate resources to raise the utility of the poor.

B) Yes. The maximin criterion would eliminate poverty.

C) No. It is impossible for complete equality to benefit the worst-off people in society.

D) No. Complete equality would reduce incentives to work, which would reduce total income, which would reduce the incomes of the worst-off people in society.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

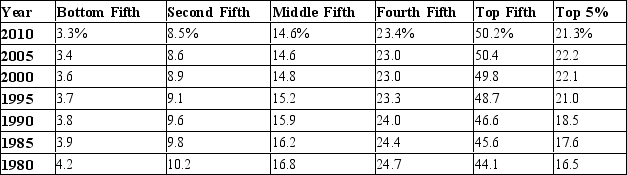

Table 20-9

Income Inequality in the United States

The values in the table reflect the percentages of pre-tax-and transfer income.  Source: US Census Bureau

-Refer to Table 20-9. In 2010, the top fifth of the US population had

Source: US Census Bureau

-Refer to Table 20-9. In 2010, the top fifth of the US population had

A) 50.2% more income than the remainder of the population.

B) a lower share of income than the top fifth in 1980.

C) about 15 times as much income as the bottom fifth.

D) about 6 times as much income as the middle fifth.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States, labor earnings are about what percent of total income?

A) 75 percent

B) 70 percent

C) 67 percent

D) 50 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

Suppose the government used the following formula to compute a family's tax liability: Taxes owed = 28% of income - $8,000. How much would a family that earned $75,000 owe?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

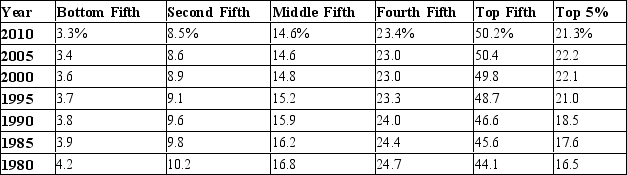

Table 20-9

Income Inequality in the United States

The values in the table reflect the percentages of pre-tax-and transfer income.  Source: US Census Bureau

-Refer to Table 20-9. Which of the following statements best describes the trends in the table?

Source: US Census Bureau

-Refer to Table 20-9. Which of the following statements best describes the trends in the table?

A) From 1980 to 2010, the distribution of income has become less equal.

B) From 1980 to 2010, the distribution of income has remained the same.

C) From 1980 to 2010, the distribution of income has become more equal.

D) None of the above is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represents a problem in measuring inequality?

A) Measurements of income distributions typically include in-kind transfers, which distort the measure of inequality.

B) A normal life-cycle pattern causes inequality in the income distribution but may not reflect inequality in living standards.

C) Transitory income is a better measure of inequality than permanent income.

D) Both a and b are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which two of the Ten Principles of Economics are illustrated in this chapter?

A) A country's standard of living depends on its ability to produce goods & People face tradeoffs.

B) Prices rise when the government prints too much money & Governments can sometimes improve market outcomes.

C) Governments can sometimes improve market outcomes & People face tradeoffs.

D) People face tradeoffs & Prices rise when the government prints too much money .

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of diminishing marginal utility is embedded in the utilitarian rationale for

A) trickle-down effects.

B) enhancing market efficiency.

C) redistributing income.

D) maintaining the status quo income distribution.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 455

Related Exams