A) (ii) only

B) (ii) and (iii) only

C) (i) , (ii) , and (iii) only

D) (i) , (ii) , (iii) , and (iv)

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The marginal tax rate serves as a measure of the extent to which the tax system discourages people from working.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In choosing the form of a tax, there is often a tradeoff between

A) allocative and productive efficiency.

B) profits and revenues.

C) efficiency and fairness.

D) fairness and profits.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In designing a tax system, policymakers have two objectives that are often conflicting. They are

A) maximizing revenue and minimizing costs to taxpayers.

B) efficiency and minimizing costs to taxpayers.

C) efficiency and equity.

D) maximizing revenue and reducing the national debt.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

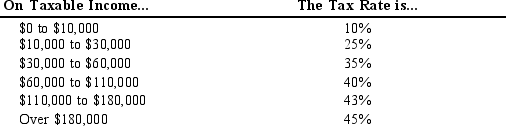

Table 12-6

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.  -Refer to Table 12-6. For this tax schedule, what is the marginal tax rate for an individual with $212,000 in taxable income?

-Refer to Table 12-6. For this tax schedule, what is the marginal tax rate for an individual with $212,000 in taxable income?

A) 0%

B) 1%

C) 2%

D) 45%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Economics alone cannot determine the best way to balance the goals of efficiency and equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicare is the

A) government's health plan for the elderly.

B) government's health plan for the poor.

C) another name for Social Security.

D) Both a and c are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

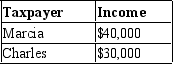

Table 12-12  -Refer to Table 12-12. If the government imposes a $3,000 lump-sum tax, the marginal tax rate for Charles would be

-Refer to Table 12-12. If the government imposes a $3,000 lump-sum tax, the marginal tax rate for Charles would be

A) 0 percent.

B) 5 percent.

C) 6.7 percent.

D) 10 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payroll tax differs from the individual income tax because the payroll tax is primarily earmarked to pay for

A) employer-provided pensions.

B) Social Security and Medicare.

C) employer-provided health benefits.

D) job loss and training programs.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An estate tax is an example of a(n)

A) individual income tax.

B) social insurance tax.

C) corporate income tax.

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1789, the average American paid approximately what percent of income in taxes?

A) 5%

B) 15%

C) 33%

D) 50%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The notion that similar taxpayers should pay similar amounts of taxes is known as

A) vertical equity.

B) the benefits principle.

C) horizontal equity.

D) taxpayer efficiency.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Incentives to work and save are reduced when

A) income taxes are higher.

B) consumption taxes replace income taxes.

C) corrective taxes are implemented.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2011, approximately how much of federal government spending went to income security?

A) 10%

B) 25%

C) 33%

D) 50%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a tax of 10 percent on the first $40,000 of income and 20 percent on all income above $40,000. What is the average tax rate when income is $50,000?

A) 20 percent

B) 15 percent

C) 12 percent

D) 10 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tax systems could not be structured to satisfy conditions of vertical equity?

A) a proportional tax

B) a regressive tax

C) a progressive tax

D) a lump-sum tax

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many economists believe that

A) the corporate income tax satisfies the goal of horizontal equity.

B) the corporate income tax does not distort the incentives of customers.

C) the corporate income tax is more efficient than the personal income tax.

D) workers and customers bear much of the burden of the corporate income tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pat calculates that for every extra dollar she earns, she owes the government 33 cents. Her total income now is $35,000, on which she pays taxes of $7,000. Determine her average tax rate and her marginal tax rate.

A) Her average tax rate is 33 percent and her marginal tax rate is 20 percent.

B) Her average tax rate is 20 percent and her marginal tax rate is 33 percent.

C) Her average tax rate is 20 percent and her marginal tax rate is 20 percent.

D) Her average tax rate is 33 percent and her marginal tax rate is 33 percent.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in 2020 the average citizen's federal tax bill is $9,372, and total federal spending is $10,824 per person. In 2020, the federal government will have

A) a budget surplus.

B) a budget deficit.

C) horizontal equity.

D) vertical equity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following tax systems do taxes increase as income increases?

A) both proportional and progressive

B) proportional but not progressive

C) progressive but not proportional

D) neither proportional nor progressive

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 461 - 480 of 549

Related Exams