A) $7.

B) $5.

C) $4.

D) $3.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a tax is imposed on a good, consumer surplus decreases and producer surplus remains unchanged.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

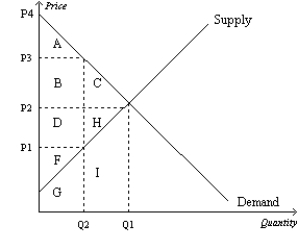

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5. The benefit to the government is measured by

-Refer to Figure 8-5. The benefit to the government is measured by

A) tax revenue and is represented by area A+B.

B) tax revenue and is represented by area B+D.

C) the net gain in total surplus and is represented by area B+D.

D) the net gain in total surplus and is represented by area C+H.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

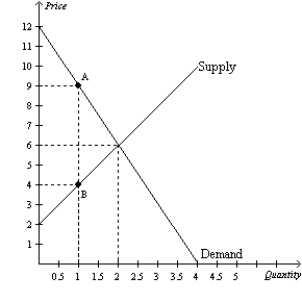

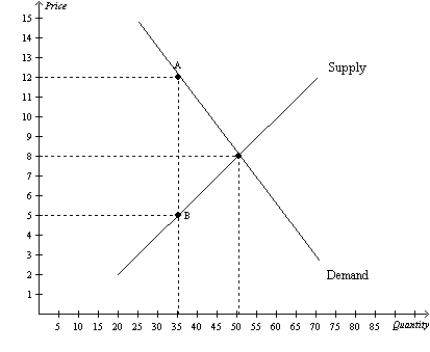

Figure 8-2

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-2. The loss of consumer surplus as a result of the tax is

-Refer to Figure 8-2. The loss of consumer surplus as a result of the tax is

A) $1.50.

B) $3.

C) $4.50.

D) $6.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

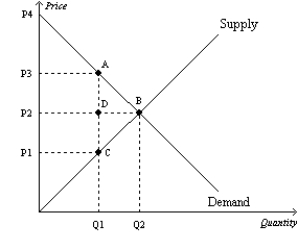

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3. The amount of deadweight loss associated with the tax is equal to

-Refer to Figure 8-3. The amount of deadweight loss associated with the tax is equal to

A) P3ACP1.

B) ABC.

C) P2ADP3.

D) P1DCP2.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax is imposed on the sellers of fast-food French fries. The burden of the tax will

A) fall entirely on the buyers of fast-food French fries.

B) fall entirely on the sellers of fast-food French fries.

C) be shared equally by the buyers and sellers of fast-food French fries.

D) be shared by the buyers and sellers of fast-food French fries but not necessarily equally.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the size of a tax rises, the deadweight loss

A) rises, and tax revenue first rises, then falls.

B) rises as does tax revenue.

C) falls, and tax revenue first rises, then falls.

D) falls as does tax revenue.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the tax on automobile tires is increased so that the tax goes from being a "medium" tax to being a "large" tax. As a result, it is likely that

A) tax revenue increases, and the deadweight loss increases.

B) tax revenue increases, and the deadweight loss decreases.

C) tax revenue decreases, and the deadweight loss increases.

D) tax revenue decreases, and the deadweight loss decreases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed on the sellers of a good, the

A) demand curve shifts downward by less than the amount of the tax.

B) demand curve shifts downward by the amount of the tax.

C) supply curve shifts upward by less than the amount of the tax.

D) supply curve shifts upward by the amount of the tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

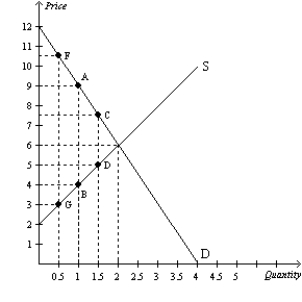

Figure 8-19

The vertical distance between points A and B represents the original tax.  -Refer to Figure 8-19. If the government changed the per-unit tax from $5.00 to $2.50, then the price paid by buyers would be $7.50, the price received by sellers would be $5, and the quantity sold in the market would be 1.5 units. Compared to the original tax rate, this lower tax rate would

-Refer to Figure 8-19. If the government changed the per-unit tax from $5.00 to $2.50, then the price paid by buyers would be $7.50, the price received by sellers would be $5, and the quantity sold in the market would be 1.5 units. Compared to the original tax rate, this lower tax rate would

A) increase government revenue and increase the deadweight loss from the tax.

B) increase government revenue and decrease the deadweight loss from the tax.

C) decrease government revenue and increase the deadweight loss from the tax.

D) decrease government revenue and decrease the deadweight loss from the tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Using demand and supply diagrams, show the difference in deadweight loss between (a) a market with inelastic demand and supply and (b) a market with elastic demand and supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4. The tax results in a loss of consumer surplus that amounts to

-Refer to Figure 8-4. The tax results in a loss of consumer surplus that amounts to

A) $105.

B) $140.

C) $170.

D) $210.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The decrease in total surplus that results from a market distortion, such as a tax, is called a

A) wedge loss.

B) revenue loss.

C) deadweight loss.

D) consumer surplus loss.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The Social Security tax is a labor tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10 ![Figure 8-10 -Refer to Figure 8-10. Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2. With the tax, the total surplus is A) [1/2 x (P0-P5) x Q5] + [1/2 x (P5-0) x Q5]. B) [1/2 x (P0-P2) x Q2] +[(P2-P8) x Q2] + [1/2 x (P8-0) x Q2]. C) (P2-P8) x Q2. D) 1/2 x (P2-P8) x (Q5-Q2) .](https://d2lvgg3v3hfg70.cloudfront.net/TB2179/11eaab0e_1b7f_7118_acdb_75a276f5b9a5_TB2179_00_TB2179_00_TB2179_00_TB2179_00_TB2179_00_TB2179_00_TB2179_00_TB2179_00_TB2179_00_TB2179_00_TB2179_00.jpg) -Refer to Figure 8-10. Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2. With the tax, the total surplus is

-Refer to Figure 8-10. Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2. With the tax, the total surplus is

A) [1/2 x (P0-P5) x Q5] + [1/2 x (P5-0) x Q5].

B) [1/2 x (P0-P2) x Q2] +[(P2-P8) x Q2] + [1/2 x (P8-0) x Q2].

C) (P2-P8) x Q2.

D) 1/2 x (P2-P8) x (Q5-Q2) .

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax of $0.25 is imposed on each bag of potato chips that is sold. The tax decreases producer surplus by $600 per day, generates tax revenue of $1,220 per day, and decreases the equilibrium quantity of potato chips by 120 bags per day. The tax

A) decreases consumer surplus by $645 per day.

B) decreases the equilibrium quantity from 6,000 bags per day to 5,880 bags per day.

C) decreases total surplus from $3,000 to $1,800 per day.

D) creates a deadweight loss of $15 per day.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kate is a personal trainer whose client William pays $80 per hour-long session. William values this service at $100 per hour, while the opportunity cost of Kate's time is $75 per hour. The government places a tax of $10 per hour on personal trainers. After the tax, what is likely to happen in the market for personal training?

A) Kate and William will agree to a new price somewhere between $85 and $100.

B) Kate and William will agree to a new price somewhere between $70 and $110.

C) Kate will no longer offer personal training services to William because she must charge more than $100 in order to cover her opportunity costs and pay the tax.

D) The price will remain at $80, and Kate will pay the $10 tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A tax places a wedge between the price buyers pay and the price sellers receive.

B) False

Correct Answer

verified

Correct Answer

verified

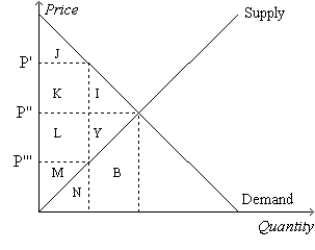

Multiple Choice

Figure 8-1  -Refer to Figure 8-1. Suppose the government imposes a tax of P' - P'''. The area measured by M represents

-Refer to Figure 8-1. Suppose the government imposes a tax of P' - P'''. The area measured by M represents

A) consumer surplus after the tax.

B) consumer surplus before the tax.

C) producer surplus after the tax.

D) producer surplus before the tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Normally, both buyers and sellers of a good become worse off when the good is taxed.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 401 - 420 of 513

Related Exams