B) False

Correct Answer

verified

Correct Answer

verified

True/False

Minimum-wage laws dictate the lowest wage that firms may pay workers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a tax is imposed on a good, the result is always a shortage of the good.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the buyers of sofas

A) increases the size of the sofa market.

B) decreases the size of the sofa market.

C) has no effect on the size of the sofa market.

D) may increase, decrease, or have no effect on the size of the sofa market.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

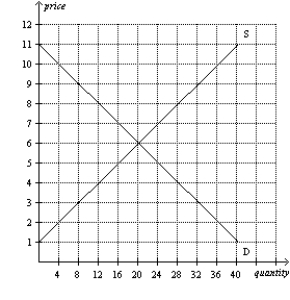

Figure 6-9  -Refer to Figure 6-9. At which price would a price ceiling be nonbinding?

-Refer to Figure 6-9. At which price would a price ceiling be nonbinding?

A) $4

B) $5

C) $3

D) $7

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers increases the size of a market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

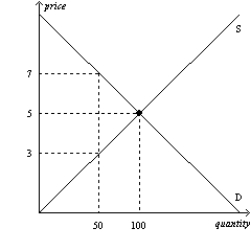

Figure 6-4  -Refer to Figure 6-4. A government-imposed price of $6 in this market could be an example of a

-Refer to Figure 6-4. A government-imposed price of $6 in this market could be an example of a

A) (i) only

B) (ii) only

C) (i) and (iv) only

D) (ii) and (iii) only

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Renters of rent-controlled apartments will likely benefit from both lower rents and higher quality of apartments.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage causes the quantity of labor demanded to exceed the quantity of labor supplied.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Lawmakers can decide whether the buyers or the sellers must send a tax to the government, but they cannot legislate the true burden of a tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of coffee mugs

A) increases the size of the coffee mug market.

B) decreases the size of the coffee mug market.

C) has no effect on the size of the coffee mug market.

D) may increase, decrease, or have no effect on the size of the coffee mug market.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Price is the rationing mechanism in a free, competitive market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

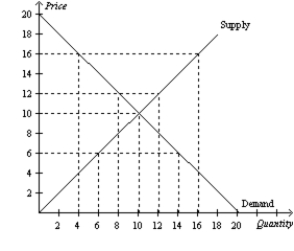

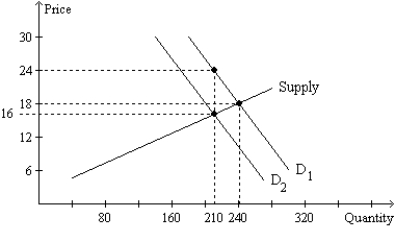

Figure 6-26  -Refer to Figure 6-26. The effective price received by sellers after the tax is imposed is

-Refer to Figure 6-26. The effective price received by sellers after the tax is imposed is

A) $8.

B) $16.

C) $14.

D) $12.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

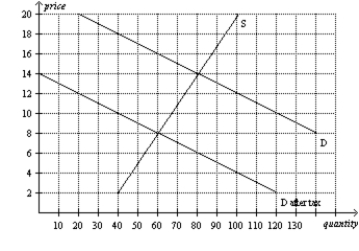

Figure 6-19  -Refer to Figure 6-19. Suppose a tax of $2 per unit is imposed on this market. Which of the following is correct?

-Refer to Figure 6-19. Suppose a tax of $2 per unit is imposed on this market. Which of the following is correct?

A) One-fourth of the burden of the tax will fall on buyers, and three-fourths of the burden of the tax will fall on sellers.

B) One-third of the burden of the tax will fall on buyers, and two-thirds of the burden of the tax will fall on sellers.

C) One-half of the burden of the tax will fall on buyers, and one-half of the burden of the tax will fall on sellers.

D) Two-thirds of the burden of the tax will fall on buyers, and one-third of the burden of the tax will fall on sellers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers decreases the quantity of the good sold in the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a 25-cent tax on the buyers of incandescent light bulbs. Which of the following is not correct? The tax would

A) shift the demand curve downward by 25 cents.

B) lower the equilibrium price by 25 cents.

C) reduce the equilibrium quantity.

D) discourage market activity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum-wage laws dictate the

A) average price employers must pay for labor.

B) highest price employers may pay for labor.

C) lowest price employers may pay for labor.

D) the highest and lowest prices employers may pay for labor.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A nonbinding price ceiling

A) (i) only

B) (iii) only

C) (i) and (iii) only

D) (ii) and (iv) only

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-24  -Refer to Figure 6-24. The price paid by buyers after the tax is imposed is

-Refer to Figure 6-24. The price paid by buyers after the tax is imposed is

A) $24.

B) 21.

C) $18.

D) $16.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $5 tax per ticket on buyers of NFL game tickets, then the price paid by buyers of NFL game tickets would

A) increase by less than $5.

B) increase by exactly $5.

C) increase by more than $5.

D) decrease by an indeterminate amount.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 541 - 560 of 645

Related Exams