A) Monetary policy is neutral in both the short run and the long run.

B) Though monetary policy is neutral in the long run, it may have effects on real variables in the short run.

C) Monetary policy has profound effects on real variables in both the short run and the long run.

D) Monetary policy has profound effects on real variables in the long run, but is neutral in the short run.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, as the price level increases, the value of money

A) increases, so the quantity of money demanded increases.

B) increases, so the quantity of money demanded decreases.

C) decreases, so the quantity of money demanded decreases.

D) decreases, so the quantity of money demanded increases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When inflation causes relative-price variability,

A) consumer decisions are distorted and the ability of markets to efficiently allocate factors of production is impaired.

B) consumer decisions are distorted, but markets are still able to efficiently allocate factors of production.

C) consumer decisions are not distorted, but the ability of markets to efficiently allocate factors of production is impaired.

D) consumer decisions are not distorted and markets are still able to efficiently allocate factors of production.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose over some period of time the money supply tripled, velocity doubled, and real GDP doubled. According to the quantity equation the price level is now

A) 6 times its old value.

B) 3 times its old value.

C) 1.5 times its old value.

D) 0.75 times its old value.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The quantity theory of money can explain hyperinflations but not moderate inflation.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

According to the quantity theory of money, an increase in the money supply causes the price level to _____ and the value of money to _____.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When inflation falls, people

A) make less frequent trips to the bank and firms make less frequent price changes.

B) make less frequent trips to the bank while firms make more frequent price changes.

C) make more frequent trips to the bank while firms make less frequent price changes.

D) make more frequent trips to the bank and firms make more frequent price changes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

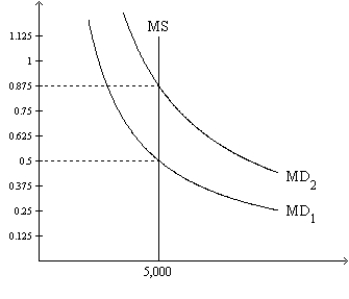

Figure 30-2. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.  -Refer to Figure 30-2. At the end of 2009 the relevant money-demand curve was the one labeled MD2. At the end of 2010 the relevant money-demand curve was the one labeled MD1. Assuming the economy is always in equilibrium, what was the economy's approximate inflation rate for 2010?

-Refer to Figure 30-2. At the end of 2009 the relevant money-demand curve was the one labeled MD2. At the end of 2010 the relevant money-demand curve was the one labeled MD1. Assuming the economy is always in equilibrium, what was the economy's approximate inflation rate for 2010?

A) -43 percent

B) -57 percent

C) 57 percent

D) 75 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You put money into an account and earn a real interest rate of 5 percent. Inflation is 2 percent, and your marginal tax rate is 35 percent. What is your after-tax real rate of interest?

A) 5.25 percent

B) 3.05 percent

C) 2.55 percent

D) 1.25 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is consistent with the idea that high money supply growth leads to high inflation?

A) the quantity theory and evidence from four hyperinflations during the 1920's

B) the quantity theory but not evidence from four hyperinflations during the 1920's

C) evidence from four hyperinflations during the 1920's but not the quantity theory

D) neither the quantity theory nor evidence from four hyperinflation during the 1920's

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose one year ago the price index was 120 and Maria purchased $20,000 worth of bonds. One year later the price index is 126. Maria redeems her bonds for $22,700 and is in a 40 percent tax bracket. What is Maria's real after-tax rate of interest to the nearest tenth of a percent?

A) 5.1 percent

B) 3.1 percent

C) 2.1 percent

D) 2.4 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monetary neutrality means that a change in the money supply

A) does not change real variables. Most economists think this is a good description of the economy in the short run and in the long run.

B) does not change real variables. Most economists think this is a good description of the economy in the long run but not the short run.

C) does not change nominal variables. Most economists think this is a good description of the economy in the short-run and the long run.

D) does not change nominal variables. Most economists think this is a good description of the economy in the long run but not the short run.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If M = 3,000, P = 2, and Y = 6,000, what is velocity?

A) 1/4

B) 2

C) 4

D) 1

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If real output in an economy is 1,000 goods per year, the money supply is $300, and each dollar is spent an average of 4 times per year, then according to the quantity equation, the average price level is

A) 3.33.

B) 0.83.

C) 1.20.

D) 13.33.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, the price level increases if

A) either money demand or money supply shifts right.

B) either money demand or money supply shifts left.

C) money demand shifts right or money supply shifts left.

D) money demand shifts left or money supply shifts right.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The money demand curve is downward sloping because as the value of money falls people desire to hold a larger quantity of money.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, the money demand curve slopes

A) upward, because at higher prices people want to hold more money.

B) downward, because at higher prices people want to hold more money.

C) downward, because at higher price people want to hold less money.

D) upward, because at higher prices people want to hold less money.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose the nominal interest rate is 10 percent, the tax rate on interest income is 28 percent, and the inflation rate is 6 percent. Then the after-tax real interest rate is -3.2 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Relativeprice variability is "automatic" when

A) firms change prices only once in a while.

B) firms change prices often.

C) people increase the frequency of their trips to the bank.

D) people decrease the frequency of their trips to the bank.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Higher inflation makes relative prices

A) more variable, making it more likely that resources will be allocated to their best use.

B) more variable, making it less likely that resources will be allocated to their best use.

C) less variable, making it more likely that resources will be allocated to their best use.

D) less variable, making it less likely that resources will be allocated to their best use.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 461 - 480 of 487

Related Exams