A) $637.50 after 5 years and $822.09 after 10 years.

B) $637.50 after 5 years and $775.00 after 10 years.

C) $653.48 after 5 years and $854.07 after 10 years.

D) $688.36 after 5 years and $915.56 after 10 years.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

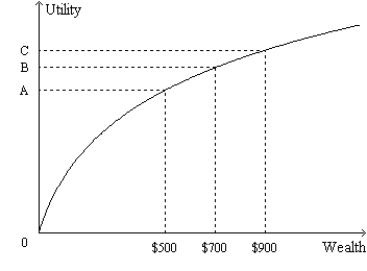

Figure 27-3

The following figure shows the utility function for Paul.  -Refer to Figure 27-3. Suppose Paul begins with $900 in wealth. Starting from there,

-Refer to Figure 27-3. Suppose Paul begins with $900 in wealth. Starting from there,

A) Paul would be willing to accept a coinflip bet that would result in him winning $200 if the result was "heads" or losing $200 if the result was "tails."

B) the pain of losing $200 of his wealth would equal the pleasure of adding $200 to his wealth.

C) the pain of losing $200 of his wealth would exceed the pleasure of adding $200 to his wealth.

D) the pleasure of adding $200 to his wealth would exceed the pain of losing $200 of his wealth.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, an increase in the interest rate makes the quantity of loanable funds demanded

A) rise, and investment spending rise.

B) rise, and investment spending fall.

C) fall, and investment spending rise.

D) fall, and investment spending fall.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A manufacturing company is thinking about building a new factory. The factory, if built, will yield the company $300 million in 7 years, and it would cost $220 million today to build. The company will decide to build the factory if the interest rate is

A) no less than 4.53 percent.

B) no greater than 4.53 percent.

C) no less than 5.81 percent.

D) no greater than 5.81 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Melissa offers you $1,000 today or $1,500 in 5 years. You would prefer to take the $1,500 in 5 years if the interest rate is

A) 8 percent.

B) 9 percent.

C) 10 percent.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Studies find that mutual fund managers who do well in one year are likely to do well the next year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the 15 years ending June 2010, most active portfolio managers failed to beat the market.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Which of the following is the correct way to compute the future value of $1 put into an account that earns 5 percent interest for 16 years?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diminishing marginal utility of wealth implies that the utility function

A) has increasing slope and a person is risk averse.

B) has increasing slope and a person is not risk averse.

C) has decreasing slope and a person is risk averse

D) has decreasing slope and a person is not risk averse.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A risk-averse person

A) has a utility curve where the slope increases with wealth, and might take a bet with a 80 percent chance of winning $300 and a 20 per chance of losing $300.

B) has a utility curve where the slope increases with wealth, and would never take a bet with a 80 percent chance of winning $300 and a 20 per cent chance of losing $300.

C) has a utility curve where the slope decreases with wealth, and might take a bet with a 80 percent chance of winning $300 and a 20 per chance of losing $300.

D) has a utility curve where the slope decreases with wealth, and would never take a bet with a 80 percent chance of winning $300 and a 20 per cent chance of losing $300.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The utility function of a risk-averse person has a

A) positive slope and gets steeper as wealth increases.

B) positive slope but gets flatter as wealth increases.

C) negative slope but gets steeper as wealth increases.

D) negative slope and gets flatter as wealth increases.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct concerning diversification?

A) It only reduces firm-specific risk, but most of the reduction comes from increasing the number of stocks in a portfolio to well above 30.

B) It only reduces firm-specific risk; much of the reduction comes from increasing the number of stocks in a portfolio from 1 to 30.

C) It only reduces market risk, but most of the reduction comes from increasing the number of stocks in a portfolio to well above 30.

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The present value of $100 to be paid in two years is less than the present value of $100 to be paid in three years.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Draw graphs showing the following three relationships. 1. The relation between utility and wealth for a risk averse consumer. 2. The relation between standard deviation and the number of stocks in a portfolio. 3. The relation between return and risk.

Correct Answer

verified

Correct Answer

verified

True/False

Managed mutual funds usually outperform mutual funds that are supposed to follow some stock index.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your financial advisor tells you that if you earn the historical rate of return on a certain mutual fund, then in three years your $20,000 will grow to $23,152.50. What rate of interest does your financial advisor expect you to earn?

A) 5 percent

B) 6 percent

C) 7 percent

D) 8 percent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shawn determines that if Lexall Corporation has high revenues, then Waters Corporation will have low revenues, and that if Lexall Corporation has low revenues, then Waters Corporation will have high revenues. Shawn buys stock in both corporations.

A) He has reduced firm-specific risk but not market risk.

B) He has reduced market risk, but not firm-specific risk.

C) He had reduce both firm-specific risk and market risk.

D) He has reduced neither firm-specific risk nor market risk.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

As the interest rate increases, the present value of future sums decreases, so firms will find fewer investment projects profitable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you win the lottery and one of your payment options is to receive $20,000 today, $20,000 one year from now, and $20,000 two years from now. If the interest rate is 5%, what is the present value of this option?

A) $51,830.26

B) $54,464.96

C) $57,188.21

D) $58,237.71

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The market for insurance is one example of reducing risk by using diversification.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 381 - 400 of 513

Related Exams