B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would likely have the smallest deadweight loss relative to the tax revenue?

A) a head tax that is, a tax everyone must pay regardless of what one does or buys)

B) an income tax

C) a tax on compact discs

D) a tax on caviar

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the government imposes a $3 tax in a market, the buyers and sellers will share an equal burden of the tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements correctly describes the relationship between the size of the deadweight loss and the amount of tax revenue as the size of a tax increases from a small tax to a medium tax and finally to a large tax?

A) Both the size of the deadweight loss and tax revenue increase.

B) The size of the deadweight loss increases, but the tax revenue decreases.

C) The size of the deadweight loss increases, but the tax revenue first increases, then decreases.

D) Both the size of the deadweight loss and tax revenue decrease.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The optimal tax is difficult to determine because although revenues rise and fall as the size of the tax increases, deadweight loss continues to increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

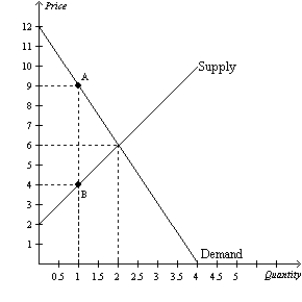

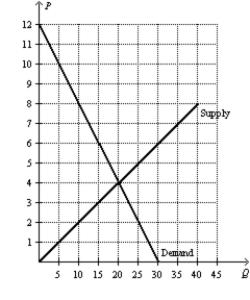

Figure 8-2

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-2. Total surplus without the tax is

-Refer to Figure 8-2. Total surplus without the tax is

A) $10, and total surplus with the tax is $2.50.

B) $10, and total surplus with the tax is $7.50.

C) $20, and total surplus with the tax is $2.50.

D) $20, and total surplus with the tax is $7.50.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

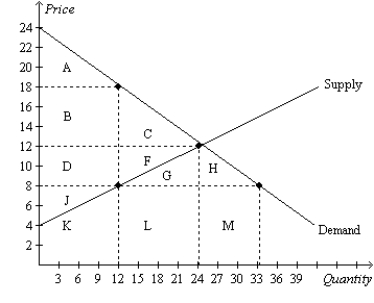

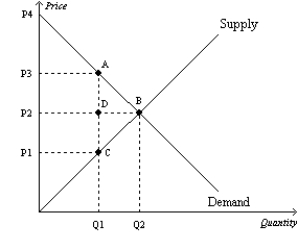

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.  -Refer to Figure 8-8. The deadweight loss of the tax is the area

-Refer to Figure 8-8. The deadweight loss of the tax is the area

A) B+D.

B) C+F.

C) A+C+F+J.

D) B+C+D+F.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a 2012 Wall Street Journal column, economists Edward Prescott and Lee Ohanian claimed that, in order to promote faster economic growth, the government should

A) increase tax rates on individuals with high incomes, and leave tax rates on other individuals unchanged.

B) equalize tax rates on all individuals, regardless of how much they earn.

C) decrease tax rates on income and increase tax rates on consumption.

D) increase the after-tax benefits to successful entrepreneurship and risk-taking.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on buyers of a good,

A) government collects too little revenue to justify the tax if the equilibrium quantity of the good decreases as a result of the tax.

B) there is an increase in the quantity of the good supplied.

C) a wedge is placed between the price buyers pay and the price sellers effectively receive.

D) the effective price to buyers decreases because the demand curve shifts leftward.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

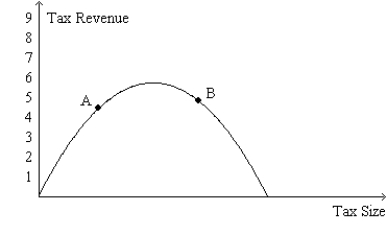

The Laffer curve illustrates how taxes in markets with greater elasticities of demand compare to taxes in markets with smaller elasticities of supply.

B) False

Correct Answer

verified

Correct Answer

verified

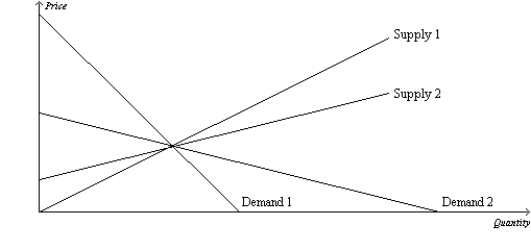

Multiple Choice

Figure 8-14  -Refer to Figure 8-14. Which of the following statements is correct?

-Refer to Figure 8-14. Which of the following statements is correct?

A) Supply 1 is more elastic than supply 2.

B) Demand 2 is more elastic than demand 1.

C) Demand 1 is more elastic than supply 1.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that for good X the supply curve for a good is a typical, upward-sloping straight line, and the demand curve is a typical downward-sloping straight line. If the good is taxed, and the tax is tripled, the

A) base of the triangle that represents the deadweight loss triples.

B) height of the triangle that represents the deadweight loss triples.

C) deadweight loss of the tax increases by a factor of nine.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government places a per-unit tax on a good. The smaller the price elasticities of demand and supply for the good, the

A) smaller the deadweight loss from the tax.

B) greater the deadweight loss from the tax.

C) less efficient is the tax.

D) more equitable is the distribution of the tax burden between buyers and sellers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

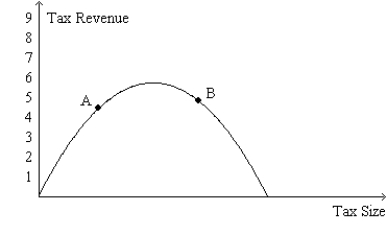

Figure 8-23. The figure represents the relationship between the size of a tax and the tax revenue raised by that tax.  -Refer to Figure 8-23. If the economy is at point A on the curve, then a small increase in the tax rate will

-Refer to Figure 8-23. If the economy is at point A on the curve, then a small increase in the tax rate will

A) increase the deadweight loss of the tax and increase tax revenue.

B) increase the deadweight loss of the tax and decrease tax revenue.

C) decrease the deadweight loss of the tax and increase tax revenue.

D) decrease the deadweight loss of the tax and decrease tax revenue.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-12  -Refer to Figure 8-12. Suppose a $3 per-unit tax is placed on this good. The amount of deadweight loss resulting from this tax is

-Refer to Figure 8-12. Suppose a $3 per-unit tax is placed on this good. The amount of deadweight loss resulting from this tax is

A) $7.50.

B) $15.00.

C) $22.50.

D) $45.00.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To measure the gains and losses from a tax on a good, economists use the tools of

A) macroeconomics.

B) welfare economics.

C) international-trade theory.

D) circular-flow analysis.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3. The per-unit burden of the tax on sellers is

-Refer to Figure 8-3. The per-unit burden of the tax on sellers is

A) P3 - P1.

B) P3 - P2.

C) P2 - P1.

D) P4 - P3.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes cause deadweight losses because taxes

A) reduce the sum of producer and consumer surpluses by more than the amount of tax revenue.

B) prevent buyers and sellers from realizing some of the gains from trade.

C) cause marginal buyers and marginal sellers to leave the market, causing the quantity sold to fall.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Taxes affect market participants by increasing the price paid by the buyer and decreasing the price received by the seller.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-23. The figure represents the relationship between the size of a tax and the tax revenue raised by that tax.  -Refer to Figure 8-23. If the economy is at point B on the curve, then a small decrease in the tax rate will

-Refer to Figure 8-23. If the economy is at point B on the curve, then a small decrease in the tax rate will

A) increase the deadweight loss of the tax and increase tax revenue.

B) increase the deadweight loss of the tax and decrease tax revenue.

C) decrease the deadweight loss of the tax and increase tax revenue.

D) decrease the deadweight loss of the tax and decrease tax revenue.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 514

Related Exams