A) Higher average returns come at the price of higher risk.

B) People who are risk averse should never hold stock.

C) Diversification cannot eliminate all of the risk in stock portfolio.

D) None of her conclusions are incorrect.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the Internet you find the following offers for opening an online account. Which of them is the best offer if you have $2,000 to save for two years?

A) an interest rate of 5 percent, with the bank charging you a $15 processing fee at the time you open your account

B) an interest rate of 3.5 percent, with the bank giving you a $35 bonus to open your account

C) an interest rate of 4 percent, with the bank giving you a $20 bonus at the time you open your account

D) an interest rate of 4.5 percent, with no processing fee and no bonus

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the number of stocks in a portfolio rises,

A) both firm-specific risks and market risk fall.

B) firm-specific risks fall; market risk does not.

C) market risk falls; firm-specific risks do not.

D) neither firm-specific risks nor market risk falls.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to fundamental analysis, a saver should prefer to buy stocks that are

A) undervalued. This means the price of the stock is low given the value of the corporation.

B) undervalued. This means the value of the corporation is low given the price of stock.

C) overvalued. This means the price of the stock is high given the value of the corporation.

D) overvalued. This means the value of the corporation is high given the price of stock.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

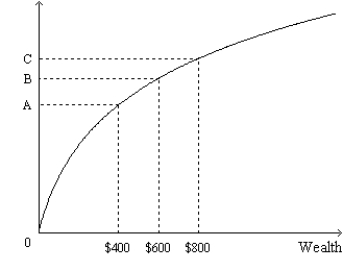

Figure 27-1. The figure shows a utility function.  -Refer to Figure 27-1. Let 0A represent the distance between the origin and point A; let AB represent the distance between point A and point B; etc. Which of the following ratios best represents the marginal utility per dollar when wealth increases from $400 to $600?

-Refer to Figure 27-1. Let 0A represent the distance between the origin and point A; let AB represent the distance between point A and point B; etc. Which of the following ratios best represents the marginal utility per dollar when wealth increases from $400 to $600?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you are convinced that stock prices are impossible to predict from available information, then you probably also believe that

A) the efficient markets hypothesis is not a correct hypothesis.

B) the stock market is informationally efficient.

C) the stock market is informationally inefficient.

D) there is no reason to establish a diversified portfolio of stocks.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Missy recently rearranged her portfolio so that it has a higher average return. As a result of this rearranging, Missy

A) raised both firm-specific risk and market risk.

B) raised firm-specific risk, but not market risk.

C) raised market risk, but not firm-specific risk.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions best illustrates adverse selection?

A) A person adds risky stock to his portfolio.

B) A person who has narrowly avoided many accidents applies for automobile insurance.

C) A person is unwilling to buy a stock when she believes its price has an equal chance of rising or falling $10.

D) A person purchases homeowners insurance and then checks his smoke detector batteries less frequently.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Write the formula for finding the future value of $1,000 today in 10 years if the interest rate is 4 percent.

Correct Answer

verified

Correct Answer

verified

True/False

If you are faced with the choice of receiving $500 today or $800 6 years from today, you will be indifferent between the two possibilities if the interest rate is 8.148 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stockholders of ComfortAir Corporation, an air conditioner and furnace manufacturer, are concerned that the companies executives may take on greater risks than stockholders desire. This example illustrates

A) moral hazard and market risk.

B) moral hazard and firm specific risk.

C) adverse selection and market risk.

D) adverse selection and firm specific risk.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value of a payment to be made in the future falls as

A) the interest rate rises and the time until the payment is made increases.

B) the interest rate rises and the time until the payment is made decreases.

C) the interest rate falls and the time until the payment is made increases.

D) the interest rate falls and the time until the payment is made decreases.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Laura says that the present value of $700 to be received one year from today if the interest rate is 6 percent is less than the present value of $700 to be received two years from today if the interest rate is 3 percent. Cassie says that $700 saved for one year at 6 percent interest has a smaller future value than $700 saved for two years at 3 percent interest.

A) Both Laura and Cassie are correct.

B) Both Laura and Cassie are incorrect.

C) Only Laura is correct.

D) Only Cassie is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

People who are risk averse dislike bad outcomes more than they like comparable good outcomes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

La Rossa Pasta Company is considering expanding its factory. In which case would both the change in the cost and the change in the interest rate each make it less likely that La Rossa's would expand?

A) a decrease in the cost of expanding and a decrease in the interest rate.

B) a decrease in the cost of expanding and an increase in the interest rate.

C) an increase in the cost of expanding and a decrease in the interest rate.

D) an increase in the cost of expanding and an increase in the interest rate.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the present value of a payment of $200 to be made one year from today if the interest rate is 10 percent?

A) $180

B) $181.82

C) $220

D) $222.22

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A risk-averse person

A) has a utility curve where the slope increases with wealth, and might take a bet with a 80 percent chance of winning $300 and a 20 per chance of losing $300.

B) has a utility curve where the slope increases with wealth, and would never take a bet with a 80 percent chance of winning $300 and a 20 per cent chance of losing $300.

C) has a utility curve where the slope decreases with wealth, and might take a bet with a 80 percent chance of winning $300 and a 20 per chance of losing $300.

D) has a utility curve where the slope decreases with wealth, and would never take a bet with a 80 percent chance of winning $300 and a 20 per cent chance of losing $300.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that John can buy a savings bond for $500 that matures in ten years and pays John $1,000 with certainty. He is indifferent between this bond and another $500 bond that has some risk but on which the interest rate is 5% higher. How much, to the nearest penny, does the riskier bond pay in ten years?

A) $1,275.91

B) $1,422.63

C) $1,577.69

D) $1,631.17

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $80.25 one year from today equal to $75 today?

A) 4 percent

B) 5 percent

C) 6 percent

D) 7 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nancy would like to double the money in her retirement account in five years. According to the rule of 70, what rate of interest would she need to earn to attain her objective?

A) 5 percent

B) 7 percent

C) 10 percent

D) 14 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 510

Related Exams