A) the supply of loanable funds does not change; a higher interest rate reduces private saving

B) the supply of loanable funds does not change; a higher interest rate raises private saving

C) at any interest rate the supply of loanable funds is less; a higher interest rate reduces private saving

D) at any interest rate the supply of loanable funds is less; a higher interest rate raises private saving

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A high demand for a company's stock is an indication that

A) the company is in need of funds.

B) the company has recently sold a large quantity of bonds.

C) people are optimistic about the company's future.

D) people are pessimistic about the company's future.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By definition, equity finance

A) is accomplished when units of government sell bonds.

B) is accomplished when firms sell bonds.

C) is accomplished when firms sell shares of stock.

D) involves "fair" interest rates or dividend yields.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009 and 2010, the federal government's budget deficit was about

A) 5 percent of GDP, and this was the highest debt-GDP ratio in U.S history.

B) 10 percent of GDP, and this was the highest debt-GDP ratio in U.S history.

C) 5 percent of GDP, and this was the highest debt-GDP ratio since World War II.

D) 10 percent of GDP, and this was the highest debt-GDP ratio since World War II.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is a shortage of loanable funds, then

A) the quantity of loanable funds demanded is greater than the quantity of loanable funds supplied and the interest rate is above equilibrium.

B) the quantity of loanable funds demanded is greater than the quantity of loanable funds supplied and the interest rate is below equilibrium.

C) the quantity of loanable funds supplied is greater than the quantity of loanable funds demanded and the interest rate is above equilibrium.

D) the quantity of loanable funds supplied is greater than the quantity of loanable funds demanded and the interest rate is below equilibrium.

F) B) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

The source of the supply of loanable funds

A) is saving and the source of demand for loanable funds is investment.

B) is investment and the source of demand for loanable funds is saving.

C) and the demand for loanable funds is saving.

D) and the demand for loanable funds is investment.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) By saving a larger portion of its GDP, a country can raise its output per worker.

B) Savers supply their money to the financial system with the expectation that they will get it back with interest at a later date.

C) Financial intermediaries are the only type of financial institution.

D) The financial system helps match people's saving with other people's borrowing.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would necessarily create a surplus at the original equilibrium interest rate in the loanable funds market?

A) an increase in the supply of or a decrease in the demand for loanable funds

B) an increase in the supply of or an increase in the demand for loanable funds

C) a decrease in the supply of or a decrease in the demand for loanable funds

D) a decrease in the supply of or an increase in the demand for loanable funds

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S. government increases its budget deficit, but at the same time Congress eliminates an investment tax credit. Which of the following is correct?

A) The interest rate will increase; investment may increase or decrease.

B) The interest rate will decrease; investment may increase or decrease.

C) The interest rate may increase or decrease; investment will decrease.

D) The interest rate may increase or decrease; investment will increase.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If national saving in a closed economy is greater than zero, which of the following must be true?

A) Either public saving or private saving must be greater than zero.

B) Investment is positive.

C) Y - C - G > 0.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

A higher interest rate makes less attractive. Therefore the quantity of loanable funds demanded decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If people expect future earnings of Galt Corporation to be high relative to current earnings, then

A) the P/E ratio of its stock will be high. A P/E ratio of 8 is relatively high.

B) the P/E ratio of its stock will be high. A P/E ratio of 8 is relatively low.

C) the P/E ratio of its stock will be low. A P/E ratio of 8 is relatively high.

D) the P/E ratio of its stock will be low. A P/E ratio of 8 is relatively low.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

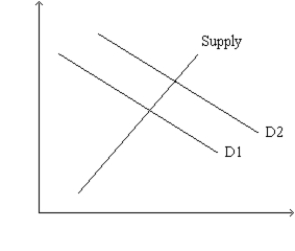

Figure 26-2. The figure depicts a supply-of-loanable-funds curve and two demand-for-loanable-funds curves.  -Refer to Figure 26-2. What is measured along the horizontal axis of the graph?

-Refer to Figure 26-2. What is measured along the horizontal axis of the graph?

A) the quantity of loanable funds

B) the size of the government budget deficit or surplus

C) the real interest rate

D) the nominal interest rate

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The country of Bienmundo does not trade with any other country. Its GDP is $30 billion. Its government purchases $5 billion worth of goods and services each year and collects $6 billion in taxes. Private saving in Bienmundo amounts to $5 billion. What are consumption and investment in Bienmundo?

A) $17 billion and $8 billion, respectively.

B) $19 billion and $6 billion, respectively.

C) $19 billion and $8 billion, respectively.

D) $17 billion and $6 billion, respectively.

F) A) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Camp Company had total earnings of $600 million in 2013, out of which it retained 20 percent for future investments. In 2013, its stock featured a dividend yield of 4 percent and 100 million shares were outstanding. The price-earnings ratio for Camp Company stock was

A) 5.

B) 150.

C) 20.

D) 25.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Congress were to repeal an investment tax credit. What would happen in the market for loanable funds?

A) The demand and supply of loanable funds would shift right.

B) The demand and supply of loanable funds would shift left.

C) The supply of loanable funds would shift right.

D) The demand for loanable funds would shift left.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a country saves a larger portion of its GDP than it did before, it will have

A) more capital and higher productivity.

B) more capital and lower productivity.

C) less capital and higher productivity.

D) less capital and lower productivity.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Anything other than a change in the interest rate that decreases national saving shifts the supply of loanable funds to the left.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

In the national income accounting identity showing the equality between national saving and investment, what are the algebraic expressions for private saving and public saving?

Correct Answer

verified

Private saving is Y - C - T, Public Saving is T - G

Correct Answer

verified

Multiple Choice

The indirect provision of funds by savers to borrowers is accomplished by

A) banks and other financial markets.

B) banks and other financial intermediaries.

C) stock markets and other financial markets.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 565

Related Exams