A) the nation's monetary and fiscal policies are made by the Federal Open Market Committee, which meets about every six weeks.

B) the nation's monetary and fiscal policies are made by the Federal Open Market Committee, which meets twice a year.

C) the nation's monetary policy is made by the Federal Open Market Committee, which meets about every six weeks.

D) the nation's monetary policy is made by the Federal Open Market Committee, which meets twice a year.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

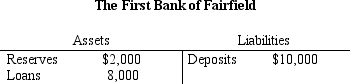

Table 11-3.

-Refer to Table 11-3. If $1,000 is deposited into the First Bank of Fairfield, and the bank takes no other actions, its

-Refer to Table 11-3. If $1,000 is deposited into the First Bank of Fairfield, and the bank takes no other actions, its

A) reserves will increase by $200.

B) liabilities will decrease by $1,000.

C) assets will increase by $1,000.

D) reserves will increase by $800.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The agency responsible for regulating the money supply in the United States is

A) the Comptroller of the Currency.

B) the U.S. Treasury.

C) the Federal Reserve.

D) the U.S. Bank.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

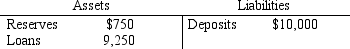

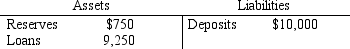

Table 11-2. An economy starts with $10,000 in currency. All of this currency is deposited into a single bank, and the bank then makes loans totaling $9,250. The T-account of the bank is shown below.

-Refer to Table 11-2. If all banks in the economy have the same reserve ratio as this bank, then the value of the economy's money multiplier is

-Refer to Table 11-2. If all banks in the economy have the same reserve ratio as this bank, then the value of the economy's money multiplier is

A) 1.33.

B) 10.00.

C) 10.81.

D) 13.33.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In December 1999 people feared that there might be computer problems at banks as the century changed. Consequently, people wanted to hold relatively more in currency and relatively less in deposits. In anticipation banks raised their reserve ratios to have enough cash on hand to meet depositors' demands. These actions by the public

A) would increase the multiplier. If the Fed wanted to offset the effect of this on the size of the money supply, it could have sold bonds.

B) would increase the multiplier. If the Fed wanted to offset the effect of this on the size of the money supply, it could have bought bonds.

C) would reduce the multiplier. If the Fed wanted to offset the effect of this on the size of the money supply, it could have sold bonds.

D) would reduce the multiplier. If the Fed wanted to offset the effect of this on the size of the money supply, it could have bought bonds.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

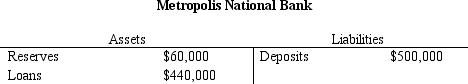

Table 11-7

Metropolis National Bank is currently holding 2% of its deposits as excess reserves.

-Refer to Balance Sheet of Metropolis National Bank. Metropolis National Bank is holding 2% of its deposits as excess reserves. Assume that no banks in the economy want to maintain holdings of excess reserves and that people only hold deposits and no currency. The Fed makes open market purchases of $10,000. The person who sold bonds to the Fed deposits all the funds in Metropolis National Bank. If the bank now loans out all its excess reserves, by how much will the money supply increase?

-Refer to Balance Sheet of Metropolis National Bank. Metropolis National Bank is holding 2% of its deposits as excess reserves. Assume that no banks in the economy want to maintain holdings of excess reserves and that people only hold deposits and no currency. The Fed makes open market purchases of $10,000. The person who sold bonds to the Fed deposits all the funds in Metropolis National Bank. If the bank now loans out all its excess reserves, by how much will the money supply increase?

A) $190,000

B) $200,000

C) $240,000

D) None of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) All items that are included in M1 are included also in M2.

B) All items that are included in M2 are included also in M1.

C) Credit cards are included in both M1 and M2.

D) Savings deposits are included in both M1 and M2.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of barter?

A) A parent gives a teenager a $10 bill in exchange for her babysitting services.

B) A homeowner gives an exterminator a check for $50 in exchange for extermination services.

C) A barber gives a plumber a haircut in exchange for the plumber fixing the barber's leaky faucet.

D) All of the above are examples of barter.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People can write checks against

A) demand deposits and money market mutual funds

B) demand deposits but not money market mutual funds

C) money market mutual funds but not demand deposits

D) neither demand deposits nor money market mutual funds

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a store of value?

A) cash and stocks

B) cash but not stocks

C) stocks but not cash

D) neither cash nor stocks

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Members of the Board of Governors of the Federal Reserve System are appointed for life.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists use the word "money" to refer to

A) income generated by the production of goods and services.

B) those assets regularly used to buy goods and services.

C) fianncial assets such as stocks and bonds.

D) any type of wealth.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To increase the money supply, the Fed could

A) sell government bonds.

B) decrease the discount rate.

C) increase the reserve requirement.

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 11-2. An economy starts with $10,000 in currency. All of this currency is deposited into a single bank, and the bank then makes loans totaling $9,250. The T-account of the bank is shown below.

-Refer to Table 11-2. If all banks in the economy have the same reserve ratio as this bank, then an increase in reserves of $150 for this bank has the potential to increase deposits for all banks by

-Refer to Table 11-2. If all banks in the economy have the same reserve ratio as this bank, then an increase in reserves of $150 for this bank has the potential to increase deposits for all banks by

A) $866.67.

B) $1,666.67.

C) $2,000.00.

D) an infinite amount.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

One plausible explanation for the large amount of U.S. currency outstanding is that many dollars are held abroad.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a 100-percent-reserve banking system, if people decided to decrease the amount of currency they held by increasing the amount they held in checkable deposits, then

A) M1 would increase.

B) M1 would decrease.

C) M1 would not change.

D) M1 might rise or fall.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Draw a simple T-account for First National Bank which has $5,000 of deposits, a required reserve ratio of 10 percent, and excess reserves of $300. Make sure your balance sheet balances.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Deposit Insurance Corporation

A) protects depositors in the event of bank failures.

B) has become insolvent in recent years due to a large number of bank failures.

C) is part of the Federal Reserve System.

D) in practice has seldom been of much use.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Designers of the Federal Reserve System were concerned that the Fed might form policy favorable to one part of the country or to a particular party. What are some ways that the organization of the Fed reflects such concerns?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following individuals serve a four-year term?

A) the members of the Board of Governors

B) the Chair of the Board of Governors

C) the members of the FOMC

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 421

Related Exams