A) Supplies.

B) Revenues.

C) Expenses.

D) Cash.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the future benefits of existing assets are used up in the ordinary course of business:

A) an expense is recorded.

B) a loss is recorded.

C) a credit to a liability is recorded.

D) a debit to assets is recorded.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is done last at the end of the year?

A) Prepare adjusting journal entries.

B) Prepare an adjusted trial balance.

C) Prepare closing journal entries.

D) Prepare a post-closing trial balance.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recording an adjusting journal entry to recognize amortization would cause which of the following?

A) An increase in liabilities and expenses,and a decrease in shareholders' equity.

B) A decrease in assets,and an increase in expenses.

C) A decrease in assets,an increase in liabilities,and an increase in expenses.

D) None of the above.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A post-closing trial balance should be prepared before temporary accounts are closed. BT: Comprehension

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An adjusted trial balance should be prepared immediately:

A) after posting normal journal entries.

B) before analyzing transactions.

C) after posting adjusting journal entries.

D) after posting closing journal entries.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

You mistakenly include a contra account of $20,000 in the same column of your trial balance as the account it offsets.All other things equal,your debit and credit column totals will differ by $40,000. BT: Comprehension

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When closing journal entries are prepared,retained earnings is credited if a company has a net loss. BT: Comprehension

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Purrfect Pets had a beginning balance in its retained earnings account of $385,600.During the year,the company declared and paid a $4,700 dividend,and at the end of the year,it reported retained earnings of $399,860.The company's net income for the year was:

A) $14,260.

B) $18,960.

C) $9,560.

D) none of the above.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

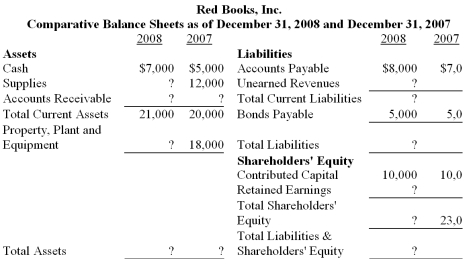

Complete the following comparative balance sheet for Red Books,Inc.,if Retained Earnings increased by $1,000,Property,Plant and Equipment decreased by $500,and Accounts Receivable was unchanged during 2008.

Correct Answer

verified

Correct Answer

verified

True/False

Adjustments are needed to ensure that the accounting system records all of the revenues and expenses that relate to that period. BT: Knowledge

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company pays wages every two weeks.Wages amount to $100 a day.On March 31,the company pays wages for the two weeks ending March 24.At the end of the month,the related adjusting journal entry will include a

A) debit to Retained Earnings for $700 and a credit to Cash for $700.

B) debit to Wage Expense for $700 and a credit to Wages Payable for $700.

C) debit to Wages Payable for $700 and a credit to Cash for $700.

D) debit to Retained Earnings for $700 and a credit to Wages Payable for $700.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts would be classified as a current liability?

A) Service revenue.

B) Wages expense.

C) Accumulated amortization.

D) None of the above.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The carrying value of an asset is an approximation of the asset's market value. BT: Knowledge

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One major difference between deferral and accrual adjustments is:

A) deferral adjustments involve previously recorded transactions and accruals involve new transactions.

B) deferral adjustments are made after taxes and accrual adjustments are made before taxes.

C) deferral adjustments are made annually and accrual adjustments are made monthly.

D) deferral adjustments are influenced by estimates of future events and accrual adjustments are not.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

All real accounts will have zero balances when the closing process is complete. BT: Knowledge

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not the value at which an asset is reported on a financial statement?

A) the carrying value.

B) the book value.

C) the net book value.

D) the depreciated Value.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Financial statements are prepared only after the trial balance has shown that debits equal credits. BT: Knowledge

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Closing journal entries are only recorded at the end of each accounting year. BT: Knowledge

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Treasury Bank Corporation had retained earnings at the end of December 31,2007 of $450,000.During 2008,the company had net income of $170,000 and declared dividends of $20,000.Retained earnings on the balance sheet as of December 31,2008 will be:

A) $430,000.

B) $600,000.

C) $620,000.

D) $640,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 105

Related Exams