A) debit Bonds Payable, credit Cash

B) debit Cash and Discount on Bonds Payable, credit Bonds Payable

C) debit Cash, credit Premium on Bonds Payable and Bonds Payable

D) debit Cash, credit Bonds Payable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The amortization of a premium on bonds payable decreases bond interest expense.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year, a company issues a $1,000,000, 7%, 5 year bond that pays semi-annual interest of $35,000 ($1,000,000 × 7% × 1/2), receiving cash of $884,171. Journalize the first interest payment and the amortization of the related bond discount using the straight-line method. Round answer to the nearest dollar.

Correct Answer

verified

Correct Answer

verified

Essay

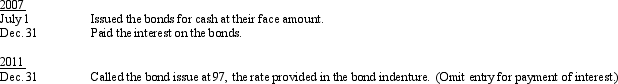

Dennis Corp. issued $2,500,000 of 20-year, 9% callable bonds on July 1, 2007, with interest payable on June 30 and December 31. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions:

Correct Answer

verified

Correct Answer

verified

True/False

Only callable bonds can be purchased by the issuing corporation before maturity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An equal stream of periodic payments is called an annuity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the issuance of bonds when the contract rate and the market rate are the same is

A) debit Bonds Payable, credit Cash

B) debit Cash and Discount on Bonds Payable, credit Bonds Payable

C) debit Cash, credit Premium on Bonds Payable and Bonds Payable

D) debit Cash, credit Bonds Payable

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value of $40,000 to be received in one year, at 6% compounded annually, is (rounded to nearest dollar)

A) $37,736

B) $42,400

C) $40,000

D) $2,400

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

If $1,000,000 of 8% bonds are issued at 105, the amount of cash received from the sale is

A) $1,080,000

B) $950,000

C) $1,000,000

D) $1,050,000

F) C) and D)

Correct Answer

verified

D

Correct Answer

verified

True/False

If the amount of a bond premium on an issued 11%, 4-year, $100,000 bond is $12,928, the semiannual straight-line amortization of the premium is $1,416.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sinking Fund Cash would be classified on the balance sheet as

A) a current asset

B) a fixed asset

C) an intangible asset

D) an investment

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If sinking fund cash is used to purchase investments, those investments are reported on the balance sheet as marketable securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A bond is usually divided into a number of individual bonds of $500 each.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the first day of the fiscal year, Lisbon Co. issued $1,000,000 of 10-year, 7% bonds for $1,050,000, with interest payable semiannually. Orange Inc. purchased the bonds on the issue date for the issue price. The journal entry to record the amortization of the premium (by the straight line method) for the year by Lisbon Co. includes a debit to:

A) Interest Expense for $2,500

B) Premium on Bonds Payable for $2,500

C) Interest Expense for $5,000

D) Premium on Bonds Payable for $5,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Callable bonds can be redeemed by the issuing corporation at the fair market price of the bonds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value of $30,000 to be received in two years, at 12% compounded annually, is (rounded to nearest dollar)

A) $23,916

B) $37,632

C) $23,700

D) $30,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

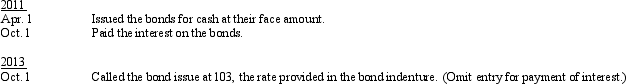

A company issued $2,000,000 of 30-year, 8% callable bonds on April 1, 2011, with interest payable on April 1 and October 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions:

Correct Answer

verified

Correct Answer

verified

Essay

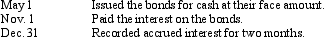

Brubeck Co. issued $10,000,000 of 30-year, 8% bonds on May 1 of the current year, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions for the current year:

Correct Answer

verified

Correct Answer

verified

True/False

Bonds payable would be listed at their carrying value on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in Discount on Bonds Payable

A) should be reported on the balance sheet as an asset because it has a debit balance

B) should be allocated to the remaining periods for the life of the bonds by the straight-line method, if the results obtained by that method materially differ from the results that would be obtained by the interest method

C) would be added to the related bonds payable to determine the carrying amount of the bonds

D) would be subtracted from the related bonds payable on the balance sheet

F) A) and B)

Correct Answer

verified

D

Correct Answer

verified

Showing 1 - 20 of 185

Related Exams