A) issuance of bonds payable

B) issuance of capital stock

C) purchase of treasury stock

D) purchase of noncurrent assets

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rogers Company reported net income of $35,000 for the year. During the year, accounts receivable increased by $7,000, accounts payable decreased by $3,000 and depreciation expense of $8,000 was recorded. Net cash provided by operating activities for the year is

A) $53,000.

B) $47,000.

C) $33,000

D) $37,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a business issued bonds payable in exchange for land, the transaction would be reported in a separate schedule on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

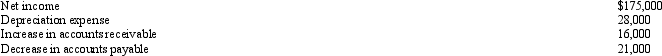

The following information is available from the current period financial statements:  The net cash flow from operating activities using the indirect method is

The net cash flow from operating activities using the indirect method is

A) $166,000

B) $184,000

C) $110,000

D) $240,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The last item on the statement of cash flows prior to the schedule of noncash investing and financing activities reports

A) the increase or decrease in cash

B) cash at the end of the year

C) net cash flow from investing activities

D) net cash flow from financing activities

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

To determine cash payments for income tax for the cash flow statement using the direct method, an increase in income taxes payable is added to the income tax expense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash paid to purchase long-term investments would be reported in the statement of cash flows in

A) the cash flows from operating activities section

B) the cash flows from financing activities section

C) the cash flows from investing activities section

D) a separate schedule

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Under the direct method of preparing a Statement of Cash Flows, the gain on the sale of land is not adjusted or reported as part of cash flows from operating activities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows is an optional financial statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

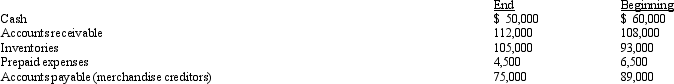

The net income reported on the income statement for the current year was $275,000. Depreciation recorded on fixed assets and amortization of patents for the year were $40,000 and $9,000, respectively. Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows:  What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

A) $198,000

B) $324,000

C) $352,000

D) $296,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Cash paid to acquire treasury stock should be shown on the statement of cash flows from investing activities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from investing activities, as part of the statement of cash flows, include payments for the purchase of treasury stock.

B) False

Correct Answer

verified

Correct Answer

verified

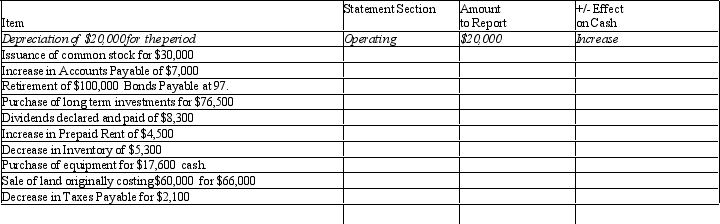

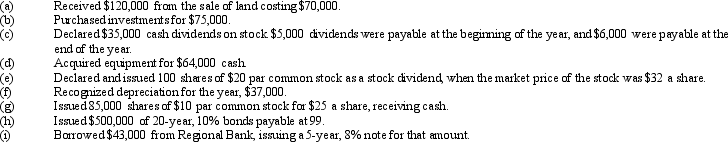

Essay

Complete each of the columns on the table below, indicating in which section each item would be reported on the statement of cash flow (Operating, Investing, or Financing), the amount that would be reported, and whether the item would create an increase or decrease in cash. For item that affect more than one section of the statement, indicate all affected. Assume the indirect method of reporting cash flows operating activities.

The first item has been completed as an example.

Correct Answer

verified

Correct Answer

verified

True/False

Cash inflows and outflows are netted in the investing or financing sections of the statement of cash flows but are separately disclosed to give the reader full information.

B) False

Correct Answer

verified

Correct Answer

verified

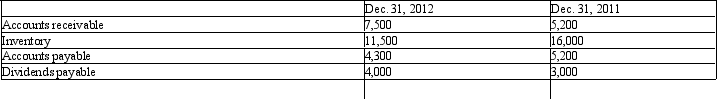

Essay

Fortune Corporation's comparative balance sheet for current assets and liabilities was as follows:

Adjust 2012 net income of $65,000 for changes in operating assets and liabilities to arrive at cash flows from operating activities using the indirect method.

Adjust 2012 net income of $65,000 for changes in operating assets and liabilities to arrive at cash flows from operating activities using the indirect method.

Correct Answer

verified

Correct Answer

verified

True/False

Sales reported on the income statement were $372,000. The accounts receivable balance declined $4,500 over the year. The amount of cash received from customers was $367,500.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

State the section(s) of the statement of cash flows prepared by the indirect method (operating activities, investing activities, financing activities, or not reported) and the amount that would be reported for each of the following transactions:

Correct Answer

verified

Correct Answer

verified

True/False

In determining the cash flows from operating activities for the statement of cash flows by the indirect method, the depreciation expense for the period is added to the net income for the period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Rarely would the cash flows from operating activities, as reported on the statement of cash flows, be the same as the net income reported on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows, the cash flows from financing activities section would include

A) receipts from the sale of investments

B) payments for the acquisition of investments

C) receipts from a note receivable

D) receipts from the issuance of capital stock

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 160

Related Exams