Correct Answer

verified

Correct Answer

verified

Essay

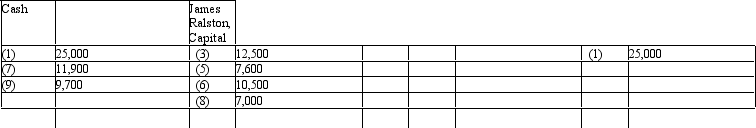

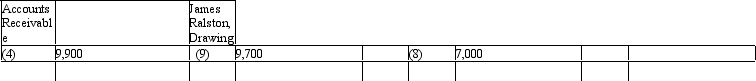

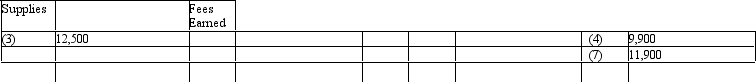

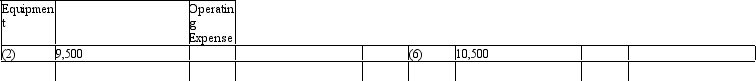

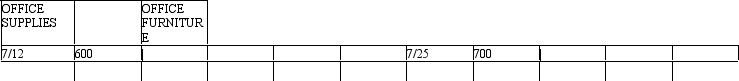

Exhibit 2-1

All nine transactions for Ralston Sports Co. for September 2011, the first month of operations, are recorded in the following T accounts:

Refer to Exhibit 2-1. Prepare a trial balance, listing the accounts in their proper order.

Refer to Exhibit 2-1. Prepare a trial balance, listing the accounts in their proper order.

Correct Answer

verified

Correct Answer

verified

True/False

For a month's transactions for a typical medium-sized business, the salary expense account is likely to have only credit entries.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

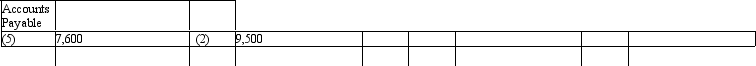

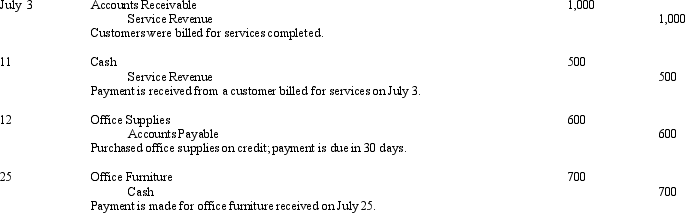

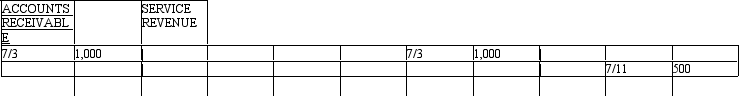

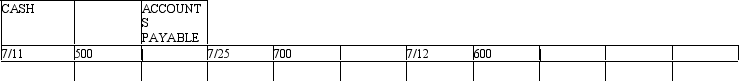

The bookkeeper for Brockton Industries prepared the following journal entries and posted the entries to the general ledger as indicated in the T accounts presented. Assume that the dollar amounts and the descriptions of the entries are correct.

Journal entries:

Required: If you assume that all journal entries have been recorded correctly, use the above information to:

(1) Identify the postings to the general ledger that were made incorrectly.

(2) Describe how the each incorrect posting should have been made.

Required: If you assume that all journal entries have been recorded correctly, use the above information to:

(1) Identify the postings to the general ledger that were made incorrectly.

(2) Describe how the each incorrect posting should have been made.

Correct Answer

verified

(1) The bookkeeper incorrectly posted th...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

Expenses can result from:

A) increasing owner's equity.

B) consuming services.

C) using up liabilities.

D) all are true.

F) None of the above

Correct Answer

verified

B

Correct Answer

verified

True/False

Liabilities are debts owed by the business entity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Revenue accounts are increased by credits.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

All owner's equity accounts record increases to the accounts with credits.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On September 1st, Erika Company purchased land for $47,500 cash. Write the journal entry in the space below.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will increase owner's equity?

A) Expenses > revenues

B) the owner draws money for personal use

C) Revenues > expenses

D) Cash is received from customers on account.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An account has three parts to it; a title, an increase side, and a decrease side.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following entries records the collection of cash from cash customers?

A) Fees Earned, debit; Cash, credit

B) Fees Earned, debit; Accounts Receivable, credit

C) Cash, debit; Fees Earned, credit

D) Accounts Receivable, debit; Fees Earned, credit

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total dollar amount of the debits equal the total dollar amount of the credits in the ledger can be verified through:

A) ledger

B) trial balance

C) account

D) balance sheet

F) A) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Of the following financial reports, which one is the one that will determine if the accounting equation is in balance?

A) Journal entry

B) Income statement

C) Trial balance

D) Account reconciliation

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owner's equity will be reduced by all of the following accounts except:

A) Revenues

B) Expenses

C) Drawing account

D) All are true.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A credit to the cash account will increase the account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following types of accounts are decreases recorded by credits?

A) liabilities

B) owner's capital

C) drawing

D) revenues

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which are the parts of the T account?

A) title, date, total

B) date, debit side, credit side

C) title, debit side, credit side

D) title, debit side, total

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not true about liabilities?

A) Liabilities are debts owed to outsiders.

B) Account titles of liabilities often include the term "payable".

C) Cash received before services are performed are considered to be liabilities.

D) Liabilities do not include wages owed to employees of the company.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The T account got its name because it resembles the letter "T."

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 224

Related Exams