B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

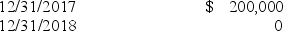

Summary data for Benedict Construction Co.'s (BCC) Job 1227, which was completed in 2018, are presented below:  Estimated cost to complete:

Estimated cost to complete:  -Assuming BCC recognizes revenue upon project completion, what would gross profit have been in 2017 and 2018 (rounded to the nearest thousand) ?

-Assuming BCC recognizes revenue upon project completion, what would gross profit have been in 2017 and 2018 (rounded to the nearest thousand) ?

A) option a

B) option b

C) option c

D) option d

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 1, 2018, Emmet Property Management entered into a 2-year contract to oversee leasing and maintenance for an apartment building. The contract starts on July 1, 2018. Under the terms of the contract, Emmet will be paid a fixed fee of $50,000 per year and will receive an additional 15% of the fixed fee at the end of each year provided that building occupancy exceeds 90%. Emmet estimates a 30% chance it will exceed the occupancy threshold, and concludes the revenue recognition over time is appropriate for this contract. -Assume that Emmet accrues revenue each month, and estimates variable consideration as the most likely amount. On November 1, Emmet revises its estimate of the chance the building will exceed the 90% occupancy threshold to a 70% chance. What is the total amount of revenue Emmet should recognize on this contract in November of 2018?

A) $3,125

B) $4,167

C) $4,792

D) $7,291

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following does not apply to a seller who is a principal?

A) Has control over goods or services

B) Primarily responsible for providing goods or services to customer

C) Exposed to risks associated with holding inventory

D) Primary performance obligation is to facilitate the transfer of goods or services

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lake Power Sports sells jet skis and other powered recreational equipment. Customers pay one-third of the sales price of a jet ski when they initially purchase the ski, and then pay another one-third each year for the next two years. Because Lake has little information about the ability to collect these receivables, it uses the installment sales method for revenue recognition. In 2017, Lake began operations and sold jet skis with a total price of $900,000 that cost Lake $450,000. Lake collected $300,000 in 2017, $300,000 in 2018, and $300,000 in 2019 associated with those sales. In 2018, Lake sold jet skis with a total price of $1,500,000 that cost Lake $900,000. Lake collected $500,000 in 2018, $400,000 in 2019, and $400,000 in 2020 associated with those sales. In 2020, Lake also repossessed $200,000 of jet skis that were sold in 2018. Those jet skis had a fair value of $75,000 at the time they were repossessed. - In 2017, Lake would recognize realized gross profit of:

A) $150,000.

B) $0.

C) $300,000.

D) $450,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

No allocation of contract price is required if the transaction involves a performance obligation to be satisfied over time.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When the right of return exists and a seller cannot make reliable estimates of future returns, the installment sales method can be used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under IFRS, revenue for a product sale should occur when:

A) Inventory production is complete.

B) Warranty fulfillment is viewed as unlikely.

C) The seller has transferred to the buyer the risks and rewards of ownership and doesn't effectively manage or control the goods.

D) The buyer has paid a preponderance of installment amounts due.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an indicator that the constraint on recognizing variable consideration should be applied?

A) Poor (limited) evidence on which to base an estimate

B) A broad range of outcomes that could occur

C) A short delay before uncertainty resolves

D) A history of the seller changing payment terms on similar contracts

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

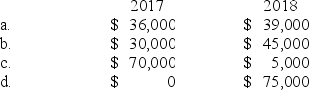

Arizona Desert Homes (ADH) constructed a new subdivision during 2017 and 2018 under contract with Cactus Development Co. Relevant data are summarized below:  ADH recognizes revenue over time with respect to these contracts. What would be the journal entry made in 2017 to record revenue?

ADH recognizes revenue over time with respect to these contracts. What would be the journal entry made in 2017 to record revenue?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Vendor-specific objective evidence of separate sales prices is required for multiple-element software contracts, but estimated selling prices can be used for other multiple-element contracts under U.S. GAAP.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a contract includes variable consideration, the probability-weighted amount must be used when there are different probabilities of occurrence.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the realization principle, revenue should not be recognized until the earnings process is deemed virtually complete and:

A) Revenue is realized.

B) Any receivable is collected.

C) Collection is reasonably certain.

D) Collection is absolutely assured.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Ultimate Frisbee League (UFL) licenses its trademark to Tank-Skin Apparel. Under the license arrangement, Tank-Skin pays the UFL a $1 million initial license fee plus a bonus when annual sales of Tank-Skin merchandise reach a threshold. The license agreement is for 4 years. How much of the $1 million initial license fee should the UFL recognize as revenue in the first year of the contract?

A) $0

B) $250,000

C) $1,000,000

D) Cannot tell from information given.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A license to use a company trademark should be viewed as an access right, with revenue recognized over the license period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sanjeev enters into a contract offering variable consideration. The contract pays him $1,000/month for six months of continuous consulting services. In addition, there is a 60% chance the contract will pay an additional $2,000 and a 40% chance the contract will pay an additional $3,000, depending on the outcome of the consulting contract. Sanjeev concludes that this contract qualifies for revenue recognition over time. -Assume Sanjeev estimates variable consideration as the most likely amount. What is the amount of revenue Sanjeev would recognize for the first month of the contract?

A) $1,000

B) $1,333

C) $1,400

D) $1,200

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The same revenue recognition requirements always apply to franchise arrangements that apply to other selling arrangements.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The residual approach to estimate stand-alone selling prices is often used for goods or services that are sold separately and that have stable prices.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the seller is a principal, the seller typically is not vulnerable to risks associated with delivering the product or service.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

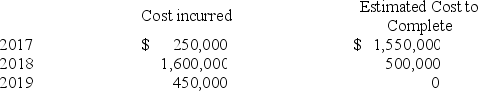

JRE2 Inc. entered into a contract to install a pipeline for a fixed price of $2,200,000. JRE2 recognizes revenue upon contract completion.  - In 2018, JRE2 would report gross profit (loss) of:

- In 2018, JRE2 would report gross profit (loss) of:

A) $(223,000) .

B) $(150,000) .

C) $(206,000) .

D) $0.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 316

Related Exams