A) Cannot be determined

B) No gain or loss

C) Gain of $ 5,000

D) Gain of $55,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An estimate of the amount which an asset can be sold at the end of its useful life is called residual value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The calculation for annual depreciation using the straight-line depreciation method is

A) initial cost / estimated useful life

B) depreciable cost / estimated useful life

C) depreciable cost * estimated useful life

D) initial cost * estimated useful life

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a fixed asset,such as a computer,were purchased on January 1st for $3,750 with an estimated life of 3 years and a salvage or residual value of $150,the journal entry for monthly expense under straight-line depreciation is: (Note: EOM indicates the last day of each month. )

A) EOM Depreciation Expense 100 Accumulated Depreciation 100

B) EOM Depreciation Expense 1,200 Accumulated Depreciation 1,200

C) EOM Accumulated Depreciation 1,200 Depreciation Expense 1,200

D) EOM Accumulated Depreciation 100 Depreciation Expense 100

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

To a major resort,timeshare properties would be classified as property,plant and equipment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true?

A) If using the double-declining-balance the total amount of depreciation expense during the life of the asset will be the highest.

B) If using the units-of-production method,it is possible to depreciate more than the depreciable cost.

C) If using the straight line method,the amount of depreciation expense during the first year is higher than that of the double-declining-balance.

D) Regardless of the depreciation method,the amount of total depreciation expense during the life of the asset will be the same.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following below is an example of a capital expenditure?

A) cleaning the carpet in the front room

B) tune-up for a company truck

C) replacing an engine in a company car

D) replacing all burned-out light bulbs in the factory

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company replaces a component of property,plant and equipment,which statement below does not account for one of the steps in the process?

A) book value of the replaced component is written off to depreciation expense

B) the asset cost of the replaced component is credited

C) any cost to remove the old component is charged to expense

D) the identifiable direct costs associated with the new component are capitalized

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company exchanges machinery and receives a trade-in allowance less than the book value,this transaction would be recorded with the following entry:

A) debit Machinery and Accumulated Depreciation;credit Machinery and Cash

B) debit Cash and Machinery;credit Accumulated Depreciation

C) debit Cash and Machinery;credit Accumulated Depreciation and Machinery

D) debit Machinery,Accumulated Depreciation,and Loss on Disposal;credit Machinery and Cash

F) A) and B)

Correct Answer

verified

Correct Answer

verified

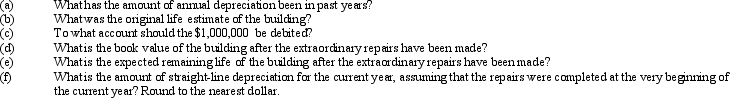

Essay

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate.The original cost of the building was $6,552,000,and it has been depreciated by the straight-line method for 25 years.Estimated residual value is negligible and has been ignored.The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.

Correct Answer

verified

Correct Answer

verified

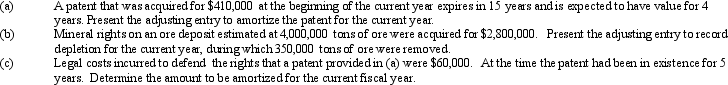

Essay

Prepare the following journal entries and calculations:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in the cost of constructing a building?

A) insurance costs during construction

B) cost of paving parking lot

C) cost of repairing vandalism damage during construction

D) cost of removing the demolished building existing on the land when it was purchased

F) A) and B)

Correct Answer

verified

Correct Answer

verified

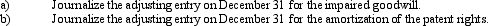

Essay

On December 31 it was estimated that goodwill of $65,000 was impaired.In addition,a patent with an estimated useful economic life of 10 years was acquired for $60,000 on July 1.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The exclusive right to use a certain name or symbol is called a

A) goodwill

B) patent

C) trademark

D) copyright

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The normal balance of the accumulated depreciation account is debit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The formula for depreciable cost is

A) initial cost + residual value

B) initial cost - residual value

C) initial cost - accumulated depreciation

D) depreciable cost = initial cost

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company discards machinery that is fully depreciated,this transaction would be recorded with the following entry

A) debit Accumulated Depreciation;credit Machinery

B) debit Machinery;credit Accumulated Depreciation

C) debit Cash;credit Accumulated Depreciation

D) debit Depreciation Expense;credit Accumulated Depreciation

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When cities give land or buildings to a company to locate in the community,no entry is made since there is no cost to the company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be included in the acquisition cost of a piece of equipment?

A) transportation costs

B) installation costs

C) testing costs prior to placing the equipment into production

D) all are correct

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of depreciation expense for the first full year of use of a fixed asset costing $95,000,with an estimated residual value of $5,000 and a useful life of 5 years,is $19,000 by the straight-line method.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 174

Related Exams