Correct Answer

verified

$123,900. The net unrealized built-in ga...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

The Section 179 expense deduction is a Schedule K item on the Form 1120S.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The passive investment income of an S corporation includes gains from the sale of securities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which, if any, of the following items has no effect on the stock basis of an S corporation shareholder?

A) Operating income.

B) Long-term capital gain.

C) Cost of goods sold.

D) Short-term capital loss.

E) The 20% QBI deduction.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A corporation may alternate between S corporation and C corporation status each year, depending on which results in more tax savings.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The termination of an S election occurs on the day after a corporation ceases to be a qualifying S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Persons who were S shareholders during any part of the year before the election date, but were not shareholders when the election was made, also must consent to an S election.

B) False

Correct Answer

verified

Correct Answer

verified

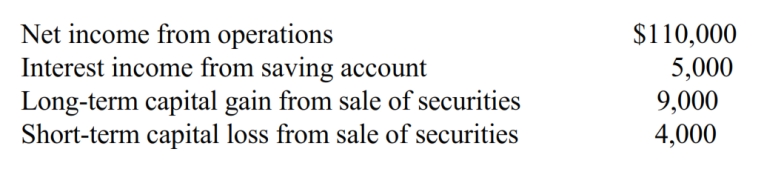

Multiple Choice

Lemon Corporation incurs the following transactions.  Lemon maintains a valid S election and does not distribute any dividends to its shareholder, Patty. As a result, Patty must recognize (ignore the 20% QBI deduction) :

Lemon maintains a valid S election and does not distribute any dividends to its shareholder, Patty. As a result, Patty must recognize (ignore the 20% QBI deduction) :

A) Ordinary income of $115,000 and long-term capital gain of $5,000

B) Ordinary income of $115,000, long-term capital gain of $9,000, and $4,000 short-term capital loss.

C) Ordinary income of $120,000.

D) Capital gain of $120,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An estate may be a shareholder of an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What method is used to allocate S corporation income or losses (unless an election to the contrary is made) ?

A) Any method agreed to by all of the shareholders.

B) Per-day allocation.

C) FIFO method.

D) LIFO method.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

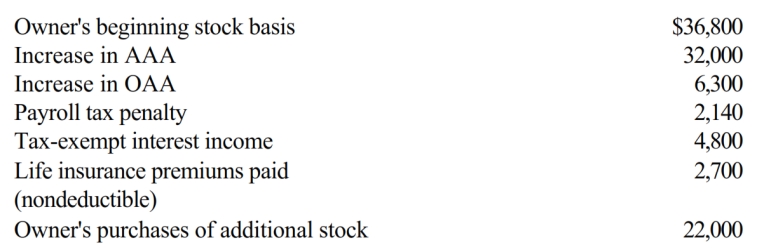

Multiple Choice

You are given the following facts about a 40% owner of an S corporation, and you are asked to prepare her ending stock basis.

A) $71,600

B) $74,120

C) $76,220

D) $78,920

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When loss assets are distributed by an S corporation, a shareholder's basis is equal to the asset's fair market value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of distribution from an S corporation is taxed at ordinary income rates?

A) AAA.

B) OAA

C) AEP

D) None of the above items is taxed as ordinary income.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An item that appears in the "Other Adjustments Account" affects stock basis, but not AAA, such as tax-exempt interest.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item does not appear on Schedule K of Form 1120S?

A) Intangible drilling costs.

B) Foreign loss.

C) Utilities expense.

D) Recovery of a tax benefit.

E) All of the above items appear on Schedule K.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Form 1120S provides an S shareholder's computation of his or her stock basis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Depreciation recapture income is a Schedule K item on the Form 1120S.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The passive investment income of an S corporation includes net capital gains from the sale of stocks and securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A one person LLC can be a shareholder of an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which, if any, of the following can be eligible shareholders of an S corporation?

A) A partnership.

B) A nonresident alien.

C) A three-person LLC.

D) The estate of a deceased shareholder.

E) None of the above are eligible shareholders.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 129

Related Exams