B) False

Correct Answer

verified

Correct Answer

verified

True/False

Manufacturers must conform to the Robinson-Patman Act which prohibits price discrimination within the United States unless differences in prices can be justified by different costs of serving different customers.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

An unfinished desk is produced for $36.00 and sold for $65.00. A finished desk can be sold for $75.00. The additional processing cost to complete the finished desk is $5.95. Provide a differential analysis for further processing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of income that would result from an alternative use of cash is called:

A) differential income

B) sunk cost

C) differential revenue

D) opportunity cost

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Swan Company produces their product at a total cost of $43 per unit. Of this amount $8 per unit is selling and administrative costs. The total variable cost is $30 per unit The desired profit is $20 per unit. Determine the mark up percentage on total cost.

A) 100%

B) 110%

C) 80%

D) 46.5%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A cost that will not be affected by later decisions is termed an opportunity cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using the variable cost concept of applying the cost-plus approach to product pricing, what is included in the markup?

A) Total costs plus desired profit

B) Desired profit

C) Total selling and administrative expenses plus desired profit

D) Total fixed manufacturing costs, total fixed selling and administrative expenses, and desired profit

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A bottleneck begins when demand for the company's product exceeds the ability to produce the product.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

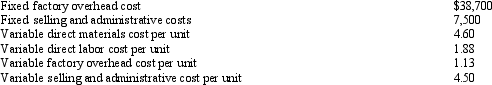

Magpie Corporation uses the total cost concept of product pricing. Below is cost information for the production and sale of 60,000 units of its sole product. Magpie desires a profit equal to a 25% rate of return on invested assets of $700,000.  The cost per unit for the production and sale of the company's product is:

The cost per unit for the production and sale of the company's product is:

A) $12.11

B) $12.88

C) $15

D) $13.50

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

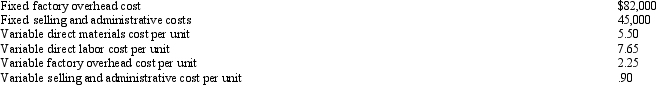

Mallard Corporation uses the product cost concept of product pricing. Below is cost information for the production and sale of 45,000 units of its sole product. Mallard desires a profit equal to a 12% rate of return on invested assets of $800,000.  The markup percentage on product cost for the company's product is:

The markup percentage on product cost for the company's product is:

A) 23.4%

B) 10.98%

C) 26.1%

D) 18%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business is operating at 90% of capacity and is currently purchasing a part used in its manufacturing operations for $15 per unit. The unit cost for the business to make the part is $20, including fixed costs, and $12, not including fixed costs. If 30,000 units of the part are normally purchased during the year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease from making the part rather than purchasing it?

A) $150,000 cost increase

B) $ 90,000 cost decrease

C) $150,000 cost decrease

D) $ 90,000 cost increase

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Product J is one of the many products manufactured and sold by Oceanside Company. An income statement by product line for the past year indicated a net loss for Product J of $12,250. This net loss resulted from sales of $275,000, cost of goods sold of $186,500, and operating expenses of $85,750. It is estimated that 30% of the cost of goods sold represents fixed factory overhead costs and that 40% of the operating expense is fixed. If Product J is retained, the revenue, costs, and expenses are not expected to change significantly from those of the current year. Because of the large number of products manufactured, the total fixed costs and expenses are not expected to decline significantly if Product J is discontinued. Prepare a differential analysis report, dated February 8 of the current year, on the proposal to discontinue Product J.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mighty Safe Fire Alarm is currently buying 50,000 motherboard from MotherBoard, Inc. at a price of $65 per board. Mighty Safe is considering making its own boards. The costs to make the board are as follows: Direct Materials $32 per unit, Direct labor $10 per unit, Variable Factory Overhead $16.00, Fixed Costs for the plant would increase by $75,000. Which option should be selected and why?

A) Buy - $75,000 more in profits

B) Make - $275,000 increase in profits

C) Buy - $275,000 more in profits

D) Make - $350,000 increase in profits

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

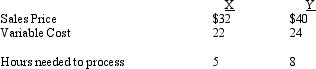

Paint Company manufactures Paint X and Paint Y and can sell all it can make of either. Based on the following data, assuming the number of hours is a constraint, which statement is true,?

A) X is more profitable than Y

B) Y is more profitable than X

C) Neither X nor Y is profitable.

D) X and Y are equally profitable.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the variable cost concept determine the mark-up per unit for 30,000 units using the following data: Variable cost per unit $15.00, total fixed costs $90,000 and desired profit $150,000.

A) $10

B) $15

C) $8

D) $23

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Discontinuing a product or segment is a huge decision that must be carefully analyzed. Which of the following would be a valid reason not to discontinue an operation?

A) The losses are minimal.

B) The variable costs are less than revenues.

C) The variable costs are more than revenues.

D) The allocated fixed costs are more than revenues.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business is considering a cash outlay of $300,000 for the purchase of land, which it could lease for $36,000 per year. If alternative investments are available which yield an 18% return, the opportunity cost of the purchase of the land is:

A) $54,000

B) $36,000

C) $18,000

D) $72,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

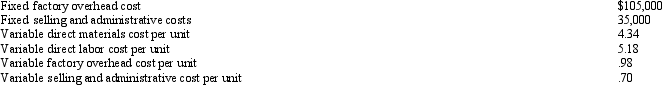

Dotterel Corporation uses the variable cost concept of product pricing. Below is cost information for the production and sale of 35,000 units of its sole product. Dotterel desires a profit equal to a 11.2% rate of return on invested assets of $350,000.  The markup percentage for the sale of the company's product is:

The markup percentage for the sale of the company's product is:

A) 14%

B) 5.6%

C) 45.71%

D) 11.2%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of increase or decrease in cost that is expected from a particular course of action as compared with an alternative is termed:

A) period cost

B) product cost

C) differential cost

D) discretionary cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What cost concept used in applying the cost-plus approach to product pricing includes only total manufacturing costs in the "cost" amount to which the markup is added?

A) Variable cost concept

B) Total cost concept

C) Product cost concept

D) Opportunity cost concept

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 163

Related Exams