A) boat manufacturing

B) a chain of beauty salons

C) home building

D) all of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The contribution margin and the manufacturing margin are usually equal.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Property taxes on a factory building would be included as part of the cost of products manufactured under the absorption costing concept.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In variable costing, fixed costs do not become part of the cost of goods manufactured, but are considered an expense of the period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The relative distribution of sales among various products sold is referred to as the:

A) by-product mix

B) joint product mix

C) profit mix

D) sales mix

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

The beginning inventory is 5,000 units. All of the units manufactured during the period and 3,000 units of the beginning inventory were sold. The beginning inventory fixed costs are $25 per unit, and variable costs are $55 per unit. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption income from operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

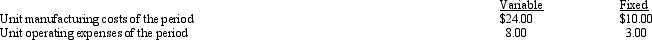

The level of inventory of a manufactured product has increased by 8,000 units during a period. The following data are also available:  What would be the effect on income from operations if variable costing is used rather than absorption costing?

What would be the effect on income from operations if variable costing is used rather than absorption costing?

A) $80,000 decrease

B) $80,000 increase

C) $104,000 decrease

D) $104,000 increase

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Management should focus its sales and production efforts on the product or products that will provide

A) the highest sales revenue

B) the lowest product costs

C) the maximum contribution margin

D) the lowest direct labor hours

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What term is commonly used to describe the concept whereby the cost of manufactured products is composed of direct materials cost, direct labor cost, and variable factory overhead cost?

A) Absorption costing

B) Differential costing

C) Standard costing

D) Variable costing

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

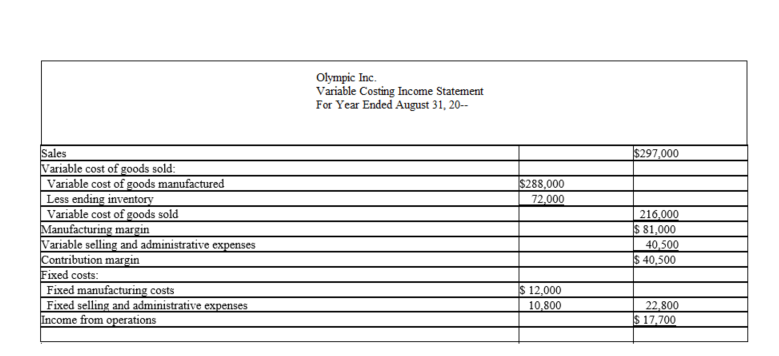

On August 31, the end of the first year of operations, during which 18,000 units were manufactured and 13,500 units were sold, Olympic Inc. prepared the following income statement based on the variable costing concept:

Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.

Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.

Correct Answer

verified

Correct Answer

verified

True/False

In a service firm, it may be necessary to have several activity bases to properly match the change in costs with the changes in various activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Costs that can be influenced by management at a specific level of management are called:

A) direct costs.

B) indirect costs.

C) noncontrollable costs.

D) controllable costs.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the absorption costing income statement, deduction of the cost of goods sold from sales yields contribution margin.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under absorption costing, which of the following costs would not be included in finished goods inventory?

A) hourly wages of assembly worker

B) straight-line depreciation on factory equipment

C) overtime wages paid to factory workers

D) advertising costs for a furniture manufacturer

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

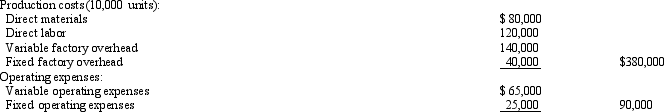

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,000 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the absorption costing balance sheet?

If 1,000 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the absorption costing balance sheet?

A) $38,000

B) $40,500

C) $34,000

D) $47,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

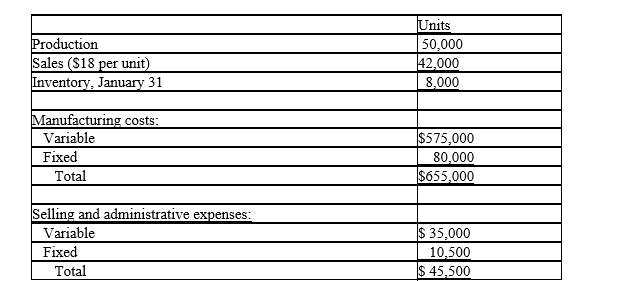

On January 1 of the current year, Townsend Co. commenced operations. It operated its plant at 100% of capacity during January. The following data summarized the results for January:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It would be acceptable to have the selling price of a product just above the variable costs and expenses of making and selling it in:

A) the long run

B) the short run

C) both the short run and long run

D) monopoly situations

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The systematic examination of the differences between planned and actual contribution margin is termed the:

A) gross profit analysis

B) contribution margin analysis

C) sales mix analysis

D) volume variance analysis

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If variable selling and administrative expenses totaled $120,000 for the year (80,000 units at $1.50 each) and the planned variable selling and administrative expenses totaled $136,500 (78,000 units at $1.75 each) , the effect of the unit cost factor on the change in variable selling and administrative expenses is:

A) $19,500 decrease

B) $19,500 increase

C) $20,000 decrease

D) $20,000 increase

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Sales mix is generally defined as the relative distribution of sales among the various products sold.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 154

Related Exams