A) $30,000

B) $45,000

C) $15,000

D) $3,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The date on which a cash dividend becomes a binding legal obligation is the

A) declaration date

B) date of record

C) payment date

D) last day of the fiscal year

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the current year ended, ABC had the following transactions: Issued 10,000 shares of $2 par common stock for $12 per share.Issued 3,000 shares of $50 par, 6% preferred stock for $70 per share.Purchased 1,000 shares of previously issued common stock for $15 per share.Reported net income of $200,000. Declared and paid a total dividend of $40,000. Assume that retained earnings had a beginning balance of $75,000. Match the following amounts to the appropriate term (a-h) . -$100,000

A) Treasury stock

B) Retained earnings

C) Preferred stock

D) Excess of issue price over par (preferred)

E) Common stock

F) Total paid-in capital

G) Excess of issue price over par (common)

H) Total stockholders' equity

J) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If 100 shares of treasury stock were purchased for $50 per share and then sold at $60 per share,$1,000 of income is reported on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On February 13,Epperson Company issued for cash 75,000 shares of no-par common stock (with a stated value of $125)at $140.On September 9,Epperson issued at par 15,000 shares of 1%,$60 par preferred stock at par for cash.On November 23,Epperson issued for cash 8,000 shares of 1%,$60 par preferred stock at $70.Journalize the entries to record the February 13,September 9,and November 23 transactions.

Correct Answer

verified

Correct Answer

verified

True/False

Twenty percent of all businesses in the United States are corporations,and they account for 80% of the total business dollars generated.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

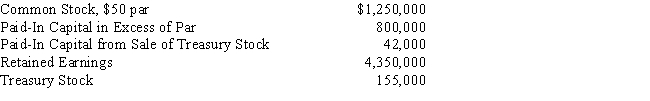

Using the following information,prepare the Stockholders' equity section of the balance sheet.Seventy thousand shares of common stock are authorized and 7,000 shares have been reacquired.

Correct Answer

verified

Correct Answer

verified

Essay

Using the following accounts and balances,prepare the Stockholders' equity section of the balance sheet.Fifty thousand shares of common stock are authorized,and 5,000 shares have been reacquired.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company with 100,000 authorized shares of $4 par common stock issued 40,000 shares at $8.Subsequently,the company declared a 2% stock dividend on a date when the market price was $11 per share.What is the amount transferred from the retained earnings account to paid-in capital accounts as a result of the stock dividend?

A) $3,200

B) $6,400

C) $4,800

D) $8,800

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of a corporation?

A) The financial loss that a stockholder may suffer from owning stock in a public company is limited.

B) Cash dividends paid by a corporation are deductible as expenses by the corporation.

C) A corporation can own property in its name.

D) Corporations are required to file federal income tax returns.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would appear as a prior period adjustment?

A) loss resulting from the sale of fixed assets

B) difference between the actual and estimated uncollectible accounts receivable

C) error in the computation of depreciation expense in the preceding year

D) loss from the restructuring of assets

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The net increase or decrease in Retained Earnings for a period is recorded by closing entries.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nevada Corporation has 30,000 shares of $25 par stock outstanding that has a current market value of $120.If the corporation issues a 5-for-1 stock split,the number of shares outstanding will be

A) 60,000

B) 6,000

C) 150,000

D) 15,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stockholders must receive their current-year dividends before the common stockholders can receive any dividends.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If paid-in capital in excess of par/preferred stock is $30,000,preferred stock is $200,000,paid-in capital in excess of par/common stock is $20,000,common stock is $525,000,and retained earnings is $105,000 (deficit),total stockholders' equity is $880,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The amount of capital paid in by the stockholders of the corporation is called legal capital.

B) False

Correct Answer

verified

Correct Answer

verified

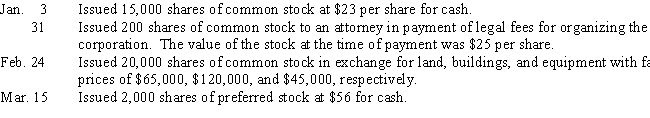

Essay

A corporation was organized on January 1 of the current year,with an authorization of 20,000 shares of 4%,$12 par preferred stock,and 100,000 shares of $3 par common stock.The following selected transactions were completed during the first year of operations:  Journalize the transactions.

Journalize the transactions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following stockholders' equity concepts to the most appropriate term (a-h) . -A class of stock having first rights to dividends of a corporation

A) Authorized shares

B) Issued shares

C) Outstanding shares

D) Par value

E) Common stock

F) Preferred stock

G) Paid-In Capital in Excess of Par

H) Transfer agent

J) E) and F)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the main disadvantages of the corporate form is the

A) professional management

B) double taxation of dividends

C) charter

D) requirement to stock

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be considered an advantage of the corporate form of organization?

A) government regulation

B) separate legal existence

C) continuous life

D) limited liability of stockholders

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 215

Related Exams