A) Apply the matching concept

B) Design a system of internal control

C) Exercise judgment

D) Be as uniform as possible

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rushmore Company provided services for $45,000 cash during Year 1.Rushmore incurred $36,000 of operating expenses on account during Year 1,and by the end of the year,$9,000 of that amount had been paid with cash.If these are the only accounting events that affected Rushmore during Year 1,which of the following statements is true?

A) The amount of net loss shown on the income statement is $9,000.

B) The amount of net income shown on the income statement is $27,000.

C) The amount of net income shown on the income statement is $9,000.

D) The amount of net cash flow from operating activities shown on the statement of cash flows is $18,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Asset use transactions always involve the payment of cash.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following financial statements is impacted most significantly by the matching concept?

A) Balance sheet

B) Income statement

C) Statement of changes in stockholders' equity

D) Statement of cash flows

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bledsoe Company acquired $17,000 cash by issuing common stock on January 1,Year 1.During Year 1,Bledsoe earned $8,500 of revenue on account.The company collected $6,000 cash from customers in partial settlement of its accounts receivable and paid $5,400 cash for operating expenses.Based on this information alone,what was the impact on total assets during Year 1?

A) Total assets increased by $20,100.

B) Total assets increased by $600.

C) Total assets increased by $26,100.

D) Total assets did not change.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The matching concept leads accountants to select the recognition alternative that produces the lowest amount of net income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Certified public accountants are obligated to act in a way that serves the public interest.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts would not appear on a balance sheet?

A) Service Revenue

B) Salaries Payable

C) Unearned Revenue

D) Interest Payable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What do accountants commonly do when the connection between an expense and the corresponding revenue is vague?

A) Accelerate revenue recognition and delay expense recognition.

B) Match the expense with the period in which it is incurred.

C) Recognize the expense at the time payment is made.

D) Delay expense recognition until it can be matched with revenue.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is frequently used to describe the expenses that are matched in the same accounting period in which they are incurred?

A) Market expenses

B) Matching expenses

C) Period costs

D) Working costs

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mize Company provided $45,500 of services on account,and collected $38,000 from customers during the year.The company also incurred $37,000 of expenses on account,and paid $32,400 against its payables.How do these events impact the elements of the financial statements model?

A) Total assets would increase.

B) Total liabilities would increase.

C) Total equity would increase.

D) All of these answer choices are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Joseph Company purchased a delivery van on January 1,Year 1 for $35,000.The van is estimated to have a 5-year useful life and a $5,000 salvage value.How much expense should Joseph recognize in Year 1 related to the use of the van?

A) $6,000

B) $7,000

C) $30,000

D) $5,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The balances of the temporary accounts are transferred to Net Income,a permanent account,during the closing process.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The collection of an account receivable is a claims exchange transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 1,Year 1,Jack's Snow Removal Company received $6,000 of cash in advance from a customer and promised to provide services for that customer during the months of December,January,and February.How will the Year 1 year-end adjustment to recognize the partial expiration of the contract impact the elements of the financial statements model?

A) Total assets will increase by $2,000.

B) Equity will increase by $2,000.

C) Total liabilities will increase by $2,000.

D) Total assets will increase by $2,000 and equity will increase by $2,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

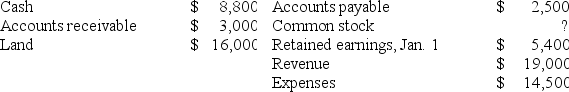

The following account balances were drawn from the Year 1 financial statements of Grayson Company:

What is the balance of the Common Stock account?

What is the balance of the Common Stock account?

A) $15,400

B) $19,900

C) $900

D) $20,800

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Nelson Company experienced the following transactions during Year 1, its first year in operation. Acquired $12,000 cash by issuing common stock Provided $4,600 of services on account Paid $3,200 cash for operating expenses Collected $3,800 of cash from customers in partial settlement of its accounts receivable Paid a $200 cash dividend to stockholders -What is the amount of net cash flows from operating activities that will be reported on the Year 1 statement of cash flows?

A) $400

B) $600

C) $1,400

D) $1,200

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Providing services to customers on account is an asset exchange transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are "matched" under the matching concept?

A) Expenses and revenues

B) Expenses and liabilities

C) Assets and equity

D) Assets and liabilities

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

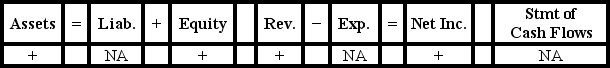

Addison Company experienced an accounting event that affected its financial statements as indicated below:

Which of the following accounting events could have caused these effects on Addison's statements?

Which of the following accounting events could have caused these effects on Addison's statements?

A) Issued common stock

B) Earned revenue on account

C) Earned cash revenue

D) Collected cash from customers in partial settlement of its accounts receivable.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 92

Related Exams