A) $2,000

B) $3,000

C) $6,000

D) $12,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Jing Company purchased office equipment that cost $34,000 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $2,000. The equipment had a five-year useful life and a $12,000 expected salvage value. -Assume that Jing Company earned $30,000 cash revenue and incurred $19,000 in cash expenses in Year 3.The company uses the straight-line method.The office equipment was sold on December 31,Year 3 for $16,000.What is the company's net income (loss) for Year 3?

A) ($6,600)

B) $6,600

C) $600

D) $5,400

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following industries would most likely have the highest value for the ratio of sales to property,plant,and equipment?

A) Airline

B) Consumer product manufacturing company

C) Electric utility

D) Stock brokerage

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Madison Company owned an asset that had cost $44,000.The company sold the asset for $16,000.Accumulated depreciation on the day of sale amounted to $32,000.Which of the following statements is true?

A) A $16,000 cash inflow in the investing activities section of the cash flow statement.

B) A $16,000 increase in total assets.

C) A $4,000 gain in the investing activities section of the statement of cash flows.

D) A $4,000 cash inflow in the financing activities section of the cash flow statement.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

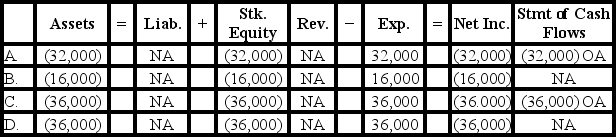

Flagler Company purchased equipment that cost $90,000.The equipment had a useful life of 5 years and a $10,000 salvage value.Flagler uses the double-declining-balance method.Which of the following choices accurately reflects how the recognition of the first year's depreciation would affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goodwill may be recorded in which of the following circumstances?

A) When the property,plant and equipment of a business increase in value

B) When a business earns a very high net income

C) When a business sells property for more than its book value

D) When one business acquires another business

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 2 Boothe Company paid $12,000 cash to extend the useful life of a machine.Which of the following general journal entries would be required to recognize this expenditure?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

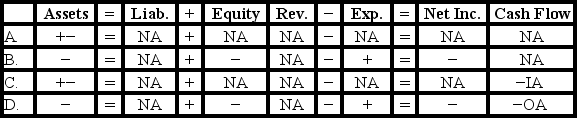

Good Company paid cash to purchase mineral rights on a large parcel of land.Which of the following choices accurately reflects how this event would affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Emir Company purchased equipment that cost $110,000 cash on January 1,Year 1.The equipment had an expected useful life of six years and an estimated salvage value of $8,000.Emir depreciates its assets under the straight-line method.What are the amounts of depreciation expense during Year 3 and the accumulated depreciation at December 31,Year 3,respectively?

A) $17,000 and $17,000

B) $17,000 and $68,000

C) $68,000 and $17,000

D) $17,000 and $51,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Friedman Company purchased a truck that cost $48,000.The truck had an expected useful life of 8 years and an $8,000 salvage value.Friedman uses the double-declining-balance method.What is the book value of the truck at the end of Year 1?

A) $43,000

B) $38,000

C) $40,000

D) $36,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 110 of 110

Related Exams