A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a bond issuer's bond ratings drop,the company probably will have to pay higher interest rates on bonds that have already been issued.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Bluestone Company issued bonds with a face value of $500,000 at 90.Which of the following journal entries would be required to record the bond issue?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If bonds are issued at a premium,the bond issuer will pay the bondholders an amount lower than the issue price at maturity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry used to record the issuance of the bond and the receipt of cash would be:

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes a callable bond?

A) Can be called for early retirement at the option of the issuer

B) Can be called for early retirement at the option of the bondholder

C) Convertible to common stock at the option of the bondholder

D) convertible to common stock at the option of the issuer

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a common restrictive covenant included in bond indentures to reduce risk to the investor?

A) Restrictions on increases in executive salaries

B) Restrictions on additional borrowing activities

C) Requirements that the names and addresses of the bondholders be registered with the bond issuer

D) Limitations on the payment of dividends

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses the effective interest method to amortize a bond premium.Which of the following statements is true regarding the carrying value of the bond?

A) The carrying value will decrease by equal amounts each year.

B) The carrying value will decrease by smaller amounts each year.

C) The carrying value will decrease by larger amounts each year.

D) The carrying value will be lower than the face value of the bond until maturity.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Bonds sold as separate components of a single issue may have different maturity dates.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Weller Company issued bonds with a $400,000 face value, a stated rate of interest of 10%, and a 10-year term to maturity. Weller uses the effective interest method to amortize bond discounts and premiums. The market rate of interest on the date of issuance was 8%. Interest is paid annually on December 31. -Assuming Weller issued the bonds for $431,940,what is the carrying value of the bonds on the December 31,Year 3?

A) $420,615

B) $426,495

C) $414,264

D) $404,800

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Mahoney Company borrowed $324,000 cash from Sun Bank by issuing a 5-year, 8% term note. The principal and interest are repaid by making annual payments beginning on December 31, Year 1. The annual payment on the loan equals $81,150. -What is the amount of principal repayment included in the payment made on December 31,Year 1?

A) $25,920

B) $81,150

C) $74,658

D) $55,230

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

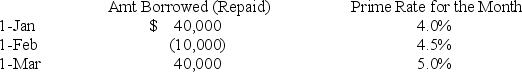

Franklin Company obtained a $160,000 line of credit from State Bank on January 1,Year 1.The company agreed to accept a variable interest rate that was set at 2% above the bank's prime lending rate.The bank's prime rate of interest and the amounts borrowed or repaid during the first three months of Year 1 are shown in the following table.Assume that Franklin borrows or repays on the first day of each month.

What is the amount of interest expense recognized in March?

What is the amount of interest expense recognized in March?

A) $232

B) $262

C) $292

D) $408

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

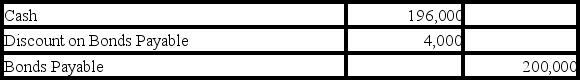

On January 1,Year 1,Burton Corporation recorded the following journal entry:

Which of the following correctly describes the related transaction?

Which of the following correctly describes the related transaction?

A) Burton issued bonds at 102.

B) Burton issued bonds at 98.

C) Burton issued bonds at a $4,000 premium.

D) Burton signed a note payable for $196,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Jones Company issued bonds with a $200,000 face value, a stated rate of interest of 7.5%, and a 5-year term to maturity. The bonds were issued at 97. Interest is payable in cash on December 31st of each year. The company amortizes bond discounts and premiums using the straight-line method. -What is the amount of cash outflow from operating activities shown on Jones' statement of cash flows for the year ending December 31,Year 2?

A) $15,000

B) $16,200

C) $13,800

D) $17,400

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Eureka Company issued $100,000 of five-year,7% bonds at face value.The annual cash payment for interest is due on January 1 of each year beginning January 1,Year 2.Based on this information,what is the total amount of liabilities related to these bonds that will be reported on the balance sheet at December 31,Year 1? (Hint: Consider the interest that might be owed to bondholders at December 31,Year 1. )

A) $100,000

B) $7,000

C) $99,300

D) $107,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A line of credit is an agreement that allows a company to borrow a set amount of money for a period of one year or more.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Williams Corporation issued $200,000 of callable bonds at face value.The bonds carried a 2% call premium.If Williams calls the bonds,how would this event affect the company's accounting equation?

A) Decrease stockholders' equity by $4,000.

B) Decrease liabilities by $200,000.

C) Decrease assets by $204,000.

D) All of these answer choices are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the stated rate of interest is true if a bond is sold at 101?

A) The stated rate equals the market rate.

B) The state rate is unrelated to the market rate.

C) The stated rate is higher than the market rate.

D) The stated rate is lower than the market rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Wayne Company issued bonds with a face value of $600,000, a 6% stated rate of interest, and a 10-year term. Interest is payable in cash on December 31 of each year. Wayne uses the straight-line method to amortize bond discounts and premiums. -Which of the following statements is true if Wayne issued the bonds for 96?

A) The market rate of interest was equal to the stated rate of interest.

B) The market rate of interest was lower than the stated rate of interest.

C) The market rate of interest was higher than the stated interest rate.

D) The bonds carried a variable or floating rate that changed in response to market conditions.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes what happens when bonds are issued when the market interest rate is less than the stated interest rate?

A) The bonds are issued at a premium.

B) The bonds are issued at less than their face value.

C) It raises the effective interest rate above the stated rate of interest.

D) The bonds are issued at a premium and the effective interest rate is higher than the stated rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 105

Related Exams