A) It is subtracted from net income in the cash flows from operating activities section.

B) It is subtracted from current liabilities in the cash flows from financing activities section.

C) It is added to net income in the cash flows from operating activities section.

D) It is added to equipment purchases in the cash flows from investing activities section.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During Year 1,Mallard Company earned $165,000 of sales revenue on account and accrued $122,500 of operating expenses.The company also earned $26,400 of service revenue that had previously been recorded as unearned revenue.In addition,a $2,200 stock dividend was issued to the stockholders.What can be said about cash flows considering these transactions?

A) Cash outflows from financing activities are $2,200.

B) Cash inflows from operating activities are $68,900.

C) Cash inflows from operating activities are $42,500.

D) There are no cash inflows or outflows as a result of these activities.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Phillips Co.reported total credit sales of $460,000 for Year 2.Its accounts receivable totaled $70,000 and $100,000 at the beginning and end of the year,respectively.What was the cash collected from customers during Year 2?

A) $530,000

B) $460,000

C) $490,000

D) $430,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On August 1, Year 1, Jackson Company issued a one-year $80,000 face value interest-bearing note with a stated interest rate of 9% to Galaxy Bank. Jackson accrues interest expense on December 31, Year 1, its calendar year-end. -What is the amount of interest expense and the total cash outflow related to the note during the year ending December 31,Year 2? Interest Expense Cash Outflow

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

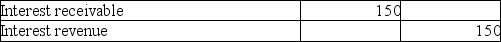

What effect does the following journal entry have on the amount of cash generated by operating activities?

A) Decreases it

B) Increases it

C) Has no effect

D) Cannot be determined from the information given

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The investing activities section of the statement of cash flows distinguishes between acquisitions of long-term assets that expand operating capacity and those that replace old,worn-out assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The three main sections of the statement of cash flows are,in order,operating activities,investing activities,and financing activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions would be disclosed on a schedule of noncash investing and financing activities?

A) A building acquired by issuing a mortgage note

B) Recording depreciation expense

C) The issuance of bonds for cash

D) All of these answer choices are correct

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 88 of 88

Related Exams