A) differential income.

B) sunk cost.

C) differential revenue.

D) opportunity cost.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dinkins Inc.is considering disposing of a machine with a book value of $50,000 and an estimated remaining life of five years.The old machine can be sold for $15,000.A new machine with a purchase price of $150,000 is being considered as a replacement.It will have a useful life of five years and no residual value.It is estimated that variable manufacturing costs will be reduced from $70,000 to $45,000 if the new machine is purchased.The net differential increase or decrease in cost for the entire five years for the new equipment is

A) $10,000 increase.

B) $25,000 decrease.

C) $10,000 decrease.

D) $25,000 increase.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business is operating at 90% of capacity and is currently purchasing a part used in its manufacturing operations for $15 per unit.The unit cost for the business to make the part is $20,including fixed costs,and $12,not including fixed costs.If 30,000 units of the part are normally purchased during the year but could be manufactured using unused capacity,what would be the amount of differential cost increase or decrease from making the part rather than purchasing it?

A) $150,000 cost increase

B) $ 90,000 cost decrease

C) $150,000 cost decrease

D) $ 90,000 cost increase

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The highest contribution margin per scarce resource is the most profitable.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Hill Co.can further process Product O to produce Product P.Product O is currently selling for $65 per pound and costs $42 per pound to produce.Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential revenue of producing Product P is $17 per pound.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A practical approach that is frequently used by managers when setting normal long-run prices is the cost-plus approach.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

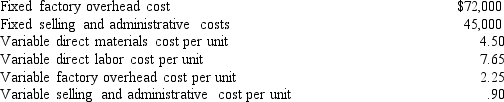

Bythel Corporation uses the product cost concept of product pricing.Below is cost information for the production and sale of 45,000 units of its sole product.Bythel desires

a profit equal to a 10.8% rate of return on invested assets of $900,000.

-The dollar amount of desired profit from the production and sale of the company's product is

-The dollar amount of desired profit from the production and sale of the company's product is

A) $97,200.

B) $67,200.

C) $73,500.

D) $96,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the differential revenue of producing Product D?

A) $14 per pound

B) $8.75 per pound

C) $7 per pound

D) $5.25 per pound

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the differential cost of producing Product D?

A) $7 per pound

B) $5.25 per pound

C) $14 per pound

D) $8.75 per pound

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Target costing is arrived at by

A) taking the selling price and subtracting desired profit.

B) taking the selling price and adding desired profit.

C) taking the selling price and subtracting the budget standard cost.

D) taking the budget standard cost and reducing it by 10%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When standard costs are used in applying the cost-plus approach to product pricing,the standards should be based upon normal levels of performance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In contrast to the total product and variable cost concepts used in setting seller's prices,the target cost approach assumes that

A) a markup is added to total cost.

B) selling price is set by the marketplace.

C) a markup is added to variable cost.

D) a markup is added to product cost.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business is considering a cash outlay of $200,000 for the purchase of land,which it could lease for $35,000 per year.If alternative investments are available that yield an 18% return,the opportunity cost of the purchase of the land is

A) $35,000.

B) $36,000.

C) $1,000.

D) $37,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

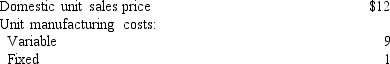

A business received an offer from an exporter for 5,000 units of product at $10 per unit.

The acceptance of the offer will not affect normal production or domestic sales prices.

The following data are available:

-What is the differential revenue from the acceptance of the offer?

-What is the differential revenue from the acceptance of the offer?

A) $45,000

B) $40,000

C) $50,000

D) $60,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If the total unit cost of manufacturing Product Y is currently $40 and the total unit cost after modifying the style is estimated to be $48,the differential cost for this situation is $48.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What cost concept used in applying the cost-plus approach to product pricing includes total manufacturing costs and total selling and administrative expenses in the "cost" amount to which the markup is added?

A) Variable cost concept

B) Total cost concept

C) Product cost concept

D) Opportunity cost concept

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Frank Co.is currently operating at 80% of capacity and is currently purchasing a part used in its manufacturing operations for $25 unit.The unit cost for Frank Co.to make the part is $30,which includes $3 of fixed costs.If 20,000 units of the part are normally purchased each year but could be manufactured using unused capacity,what would be the amount of differential cost increase or decrease for making the part rather than purchasing it?

A) $60,000 cost decrease

B) $40,000 cost decrease

C) $40,000 cost increase

D) $60,000 cost increase

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A cost that will not be affected by later decisions is termed a sunk cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In deciding whether to accept business at a special price,the short- run price should be set high enough to cover all variable costs and expenses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What cost concept used in applying the cost-plus approach to product pricing includes only total manufacturing costs in the "cost" amount to which the markup is added?

A) Variable cost concept

B) Total cost concept

C) Product cost concept

D) Opportunity cost concept

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 102

Related Exams