A) 7.5

B) 13.4

C) 12.1

D) 8.5

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each ratio that follows to its use (items a-h) .Items may be used more than once. -ratio of liabilities to stockholders' equity

A) assess the profitability of the assets

B) assess how effectively assets are used

C) indicate the ability to pay current liabilities

D) indicate how much of the company is financed by debt and equity

E) indicate instant debt-paying ability

F) assess the profitability of the investment by common stockholders

G) indicate future earnings prospects

H) indicate the extent to which earnings are being distributed to common stockholders

![]()

J) D) and E)

Correct Answer

verified

Correct Answer

verified

Essay

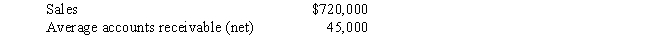

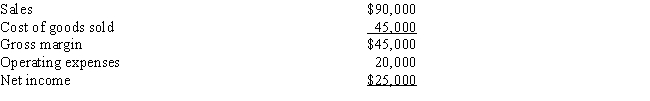

A company reports the following:

Determine the (a)accounts receivable turnover,and (b)number of days' sales in receivables.Round your answer to one decimal place.

Determine the (a)accounts receivable turnover,and (b)number of days' sales in receivables.Round your answer to one decimal place.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the return on total assets for Diane Company?

A) 10.0%

B) 8.0%

C) 0.10%

D) 1.0%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the data for Privett Company,what is the quick ratio,rounded to one decimal point?

A) 1.7

B) 2.9

C) 1.1

D) 1.0

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The report on internal control required by the Sarbanes-Oxley Act of 2002 may be prepared by either management or the company's auditors.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Unusual items affecting the current period's income statement consist of changes in accounting principles and discontinued operations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each ratio that follows to its use (items a-h) .Items may be used more than once. -working capital

A) assess the profitability of the assets

B) assess how effectively assets are used

C) indicate the ability to pay current liabilities

D) indicate how much of the company is financed by debt and equity

E) indicate instant debt-paying ability

F) assess the profitability of the investment by common stockholders

G) indicate future earnings prospects

H) indicate the extent to which earnings are being distributed to common stockholders

![]()

J) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Comparative financial statements are designed to compare the financial statements of two or more corporations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The ratio of fixed assets to long-term liabilities provides a measure of a firm's ability to pay dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

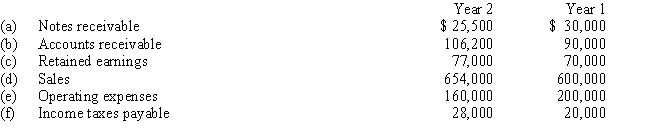

A company reports the following:

Determine the (a)accounts receivable turnover,and (b)number of days' sales in receivables.Round your answer to one

decimal place.

Determine the (a)accounts receivable turnover,and (b)number of days' sales in receivables.Round your answer to one

decimal place.

Correct Answer

verified

Correct Answer

verified

True/False

A firm selling food should have higher inventory turnover rate than a firm selling office furniture.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The relationship of each asset item as a percent of total assets is an example of vertical analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The numerator of the return on total assets is

A) net income

B) net income plus tax expense

C) net income plus interest expense

D) net income minus preferred dividends

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

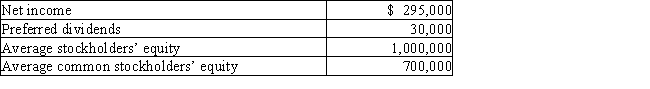

Abigail Company reports the following:

Determine the (a)return on stockholders' equity,and (b)return on common stockholders' equity.Round your answer to one decimal place.

Determine the (a)return on stockholders' equity,and (b)return on common stockholders' equity.Round your answer to one decimal place.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

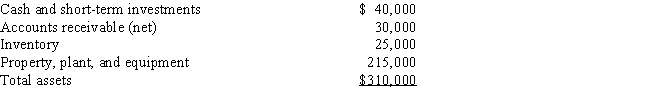

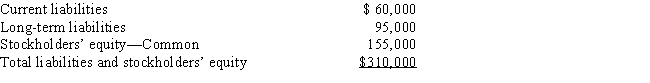

Brock Company's financial information is listed below.Assume that all balance sheet amounts represent both average and ending balance figures and that all sales were on credit. Assets

Liabilities and Stockholders' Equity

Liabilities and Stockholders' Equity

Income Statement

Income Statement

What is the current ratio?

What is the current ratio?

A) 1.42

B) 1.17

C) 1.58

D) 0.67

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

On a common-sized income statement,all items are stated as a percent of total assets or equities at year-end.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios provides a solvency measure that shows the margin of safety of bondholders and also gives an indication of the potential ability of the business to borrow additional funds on a long-term basis?

A) ratio of fixed assets to long-term liabilities

B) asset turnover ratio

C) number of days' sales in receivables

D) return on stockholders' equity

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Comparative information taken from the Friction Company's financial statements is shown below:

Using horizontal analysis,show the percentage change and direction (increase or decrease)from Year 1 to Year 2 with Year 1 as the base year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are the dividends per common share for Diane Company?

A) $20.00

B) $3.00

C) $0.67

D) $1.50

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 189

Related Exams