A) stockholders' equity is overstated

B) cost of goods sold is overstated

C) gross profit is understated

D) net income is understated

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

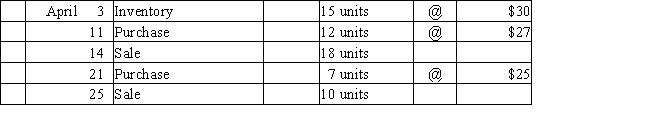

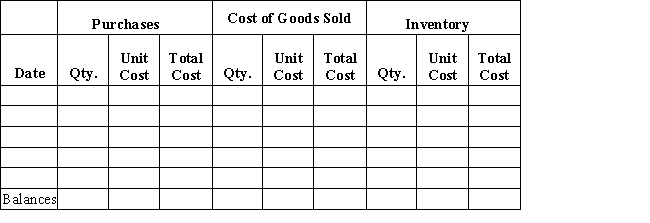

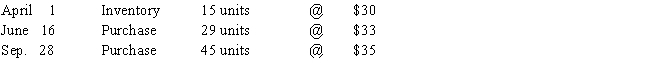

Beginning inventory,purchases,and sales data for widgets are as follows:

Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of goods sold and ending inventory using LIFO.

Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of goods sold and ending inventory using LIFO.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The method of estimating inventory that uses records of the selling prices of the merchandise is called

A) retail method

B) gross profit method

C) inventory turnover method

D) average cost method

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Use of the retail inventory method requires taking a physical count of inventory.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The lower of cost or market is a method of inventory valuation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The inventory method that assigns the most recent costs to cost of goods sold is

A) FIFO

B) LIFO

C) weighted average

D) specific identification

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taking a physical count of inventory

A) is not necessary when a periodic inventory system is used

B) should be done near year-end

C) has no internal control relevance

D) is not necessary when a perpetual inventory system is used

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is used to analyze the efficiency and effectiveness of inventory management?

A) inventory turnover only

B) number of days' sales in inventory only

C) both inventory turnover and number of days' sales in inventory

D) neither inventory turnover or number of days' sales in inventory

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the amount of cost of goods sold for the year according to the FIFO method?

A) $1,380

B) $1,375

C) $1,510

D) $1,250

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A physical inventory should be taken at the end of every month.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The firm uses the periodic system,and there are 20 units of the commodity on hand at the end of the year.What is the amount of inventory at the end of the year according to the FIFO method?

A) $655

B) $620

C) $690

D) $659

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The inventory costing method that reports the earliest costs in ending inventory is

A) FIFO

B) LIFO

C) weighted average

D) specific identification

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stevens Company started the year with an inventory cost of $145,000.During the month of January,Stevens purchased inventory that cost $53,000.January sales totaled $140,000.Estimated gross profit is 35%.The estimated ending inventory as of January 31 is

A) $58,000

B) $91,000

C) $107,000

D) $69,300

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming that the company uses the perpetual inventory system,determine the ending inventory value for the month of May using the FIFO inventory cost method.

A) $364

B) $372

C) $324

D) $320

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Under the periodic inventory system,the inventory account continuously discloses the amount of inventory on hand.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Garrison Company uses the retail method of inventory costing.It started the year with an inventory that had a retail cost of $45,000.During the year,Garrison purchased an inventory with a retail sales value of $300,000.After performing a physical inventory,Garrison calculated the inventory at retail to be $80,000.The markup is 100% of cost.Determine the ending inventory at its estimated cost.

A) $160,000

B) $80,000

C) $40,000

D) $45,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the estimated rate of gross profit is 30%,what is the estimated cost of the inventory on September 30,based on the following data?

A) $320,000

B) $192,500

C) $275,000

D) $105,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Addison uses LIFO,the cost of the ending inventory on September 30 is

A) $800

B) $650

C) $750

D) $700

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

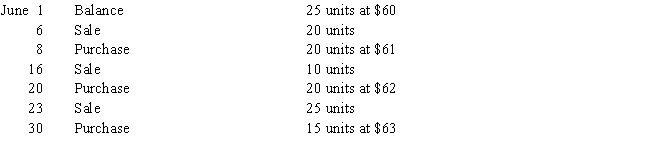

The following data regarding purchases and sales of a commodity were taken from the related perpetual inventory account:

Correct Answer

verified

Correct Answer

verified

Essay

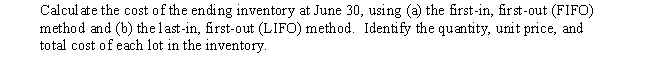

The units of Product Green-2 available for sale during the year were as follows:

There are 17 units of the product in the physical inventory at September 30.The periodic inventory system is used.Determine the cost of goods sold by (a)FIFO,(b)LIFO,and (c)average cost methods.

There are 17 units of the product in the physical inventory at September 30.The periodic inventory system is used.Determine the cost of goods sold by (a)FIFO,(b)LIFO,and (c)average cost methods.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 161

Related Exams