A) Erosion of personal use land due to rain or wind.

B) Termite infestation of a personal residence over a several year period.

C) Damages to personal automobile resulting from a taxpayer's willful negligence.

D) A misplaced diamond ring.

E) None of the above.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If personal casualty gains exceed personal casualty losses (after deducting the $100 floor),there is no itemized deduction.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

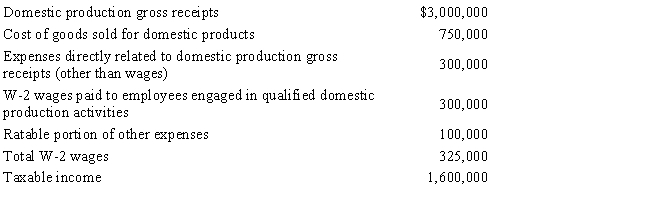

Green,Inc.,manufactures and sells widgets.During the current year,an examination of the company records showed the following items:

Determine Green's domestic production activities deduction for the current year.

Determine Green's domestic production activities deduction for the current year.

Correct Answer

verified

Correct Answer

verified

True/False

"Other casualty" means casualties similar to those associated with fires,storms,or shipwrecks.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The domestic production activities deduction (DPAD) for a sole proprietor is calculated by multiplying a percentage rate (currently 9%) times adjusted gross income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

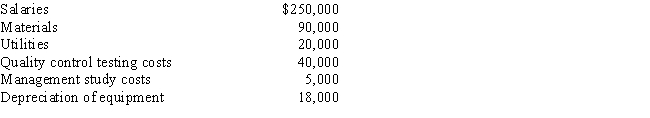

Last year,Green Corporation incurred the following expenditures in the development of a new plant process:

During the current year,benefits from the project began being realized in May.If Green Corporation elects a 60 month deferral and amortization period,determine the amount of the deduction for the current year.

During the current year,benefits from the project began being realized in May.If Green Corporation elects a 60 month deferral and amortization period,determine the amount of the deduction for the current year.

A) $48,000

B) $50,400

C) $54,667

D) $57,067

E) None of the above

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

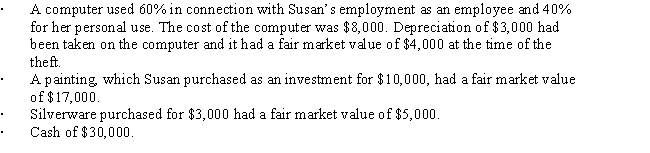

While Susan was on vacation during the current year,someone broke into her home and stole the following items:

Susan's adjusted gross income,before considering any of the above items,is $60,000.

Determine the total amount of Susan's itemized deductions resulting from the theft.

Susan's adjusted gross income,before considering any of the above items,is $60,000.

Determine the total amount of Susan's itemized deductions resulting from the theft.

Correct Answer

verified

Correct Answer

verified

Essay

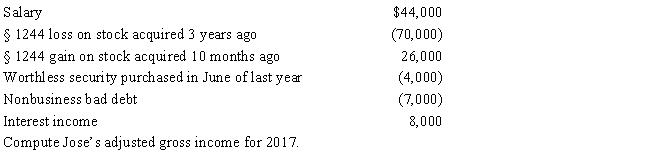

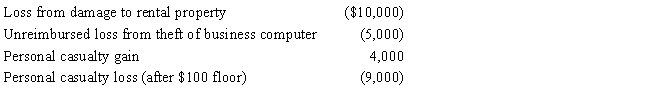

Jose,single,had the following items for 2017:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jim had a car accident in 2017 in which his car was completely destroyed.At the time of the accident,the car had a fair market value of $30,000 and an adjusted basis of $40,000.Jim used the car 100% of the time for business use.Jim received an insurance recovery of 70% of the value of the car at the time of the accident.If Jim's AGI for the year is $60,000,determine his deductible loss on the car.

A) $900

B) $2,900

C) $3,000

D) $9,000

E) None of the above

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2017,Theo,an employee,had a salary of $30,000 and experienced the following losses:

Determine the amount of Theo's itemized deduction from these losses.

Determine the amount of Theo's itemized deduction from these losses.

A) $0

B) $2,800

C) $2,900

D) $4,580

E) None of the above

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An individual may deduct a loss on rental property even if it does not meet the definition of a casualty loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two years ago,Gina loaned Tom $50,000.Tom signed a note the terms of which called for monthly payments of $2,000 plus 6% interest on the outstanding balance.Last year,when the balance owing on the loan was $18,000,Tom defaulted on the note.As of the end of last year,there appeared to be no reasonable prospect of Gina recovering the $18,000.As a consequence,Gina claimed the $18,000 as a nonbusiness bad debt.Last year,Gina had AGI of a negative $6,000 which included $5,000 net long-term capital gains and $4,000 of qualified dividends.Gina did not itemize her deductions.During the current year,Tom paid Gina $13,000 in final settlement of the loan.How should Gina account for the payment in the current year?

A) File an amended tax return for last year.

B) Report no income for the current year.

C) Report $8,000 of income for the current year.

D) Report $12,000 of income for the current year.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Essay

Roger,an individual,owns a proprietorship called Green Thing.For the year 2017,Roger has the following items: ∙ Business income-$200,000. ∙ Business expense-$150,000. ∙ Loss on a completely destroyed business machine.The machine had an adjusted basis of $25,000 and a fair market value of $20,000. ∙ Loss on a business truck.The truck had an adjusted basis of $8,000.The repairs to fix the truck cost $10,000. Determine Roger's adjusted gross income for 2017.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary incurred a $20,000 nonbusiness bad debt last year.She also had an $8,000 long-term capital gain last year.Her taxable income for last year was an NOL of $15,000.During the current year,she unexpectedly collected $12,000 on the debt.How should Mary account for the collection?

A) $0 income

B) $8,000 income

C) $11,000 income

D) $12,000 income

E) None of the above

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Research and experimental expenditures do not include the cost of consumer surveys.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 95 of 95

Related Exams