A) Some or all of the asset is included in the decedent's gross estate.

B) None of the asset is included in the decedent's gross estate.

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

For Federal estate tax purposes,the gross estate does not include property that will pass to a surviving spouse.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Classify each statement appearing below. -Homer purchases a U.S.savings bond listing title as: "Homer,payable to Bernice upon Homer's death." Bernice is Homer's sister.

A) No taxable transfer occurs

B) Gift tax applies

C) Estate tax applies

E) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Concerning the Federal estate tax deduction for asset transfers to charity:

A) The deduction is allowed only if the decedent had a valid will.

B) A deduction is allowed for a gift to the cemetery association.

C) A deduction is disallowed if the gift is made to the United Way of Bosnia.

D) All of the above statements are true.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the time of his death,Tom owned some common stock.

If the alternate valuation date is properly elected,the value of Tom's estate as to these stocks is:

If the alternate valuation date is properly elected,the value of Tom's estate as to these stocks is:

A) $2,300,000.

B) $2,400,000.

C) $2,500,000.

D) $2,700,000.

F) A) and C)

Correct Answer

verified

C

Correct Answer

verified

Essay

At the time of her death in an automobile accident,Laura left a modest probate estate,most of which she had inherited from her mother several years ago.Comment on Laura's Federal estate tax position in connection with each of the following points. a.Probate estate versus gross estate. b.Credit for the tax on prior transfers.

Correct Answer

verified

Correct Answer

verified

True/False

Using his separate funds,Wilbur purchases an annuity which pays him a specified amount until death.Upon Wilbur's death,a reduced amount is to be paid to Marcia for her life.Marcia predeceases Wilbur.Nothing concerning the annuity contract is included in Marcia's gross estate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Classify each statement appearing below. -Using his own funds,Horace establishes a savings account designating ownership as follows: "Horace and Nadine as joint tenants with right of survivorship." Horace predeceases Nadine.

A) No taxable transfer occurs

B) Gift tax applies

C) Estate tax applies

E) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Sandy pays a local college for her non-dependent boyfriend's tuition.The payment is subject to the Federal gift tax.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Kim,a resident and citizen of Korea,dies during an operation at the Mayo Clinic in Rochester (MN).Because Kim died in the U.S.,she will be subject to the Federal estate tax.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

At the time of Dylan's death,he was a resident of the United States.He owns land located in a foreign country,which is subject to that country's estate tax.This same land also can be subject to the Federal estate tax.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

In most cases,the gross estate of a decedent is larger than the probate estate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which,if any,of the following is not a characteristic of the Federal estate tax?

A) A foreign tax credit is available.

B) A credit for tax on prior transfers may be available.

C) A charitable deduction is available.

D) All of the above.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Walt dies intestate (i.e.,without a will) in the current year with a gross estate valued at $4,000,000.Under applicable state law,Walt's property passes to Kelly or to Belle,in that order.Kelly has an estimated net worth of $3,000,000 while Belle's is zero.From a tax planning standpoint,what course of action might be advisable?

Correct Answer

verified

This might be a good situation to make use of § 2518.Thus,Kelly could disclaim some of the $4,000,000 inheritance and,in effect,pass it to Belle free of any transfer tax to Kelly (i.e.,estate or gift tax).This presumes that Kelly would otherwise transfer some of her wealth to Belle in the future in a taxable transfer.

Correct Answer

verified

Multiple Choice

Setting up a trust to benefit a minor can:

A) Gain an annual exclusion even though no present interest is conveyed.

B) Protect the donor against the minor's unwise use of the funds.

C) Accumulate income for future use, like college tuition.

D) All of the above.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Concerning the election to split gifts,which of the following statements is incorrect?

A) The election can be made even if the parties are not married for the entire year of the gift.

B) The election doubles the number of annual exclusions available.

C) The election has no utility in a community property jurisdiction.

D) The election can be made even if the parties are divorced as long as neither spouse has remarried by the end of the year.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

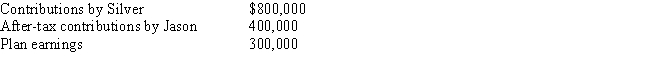

At the time of his death,Jason was a participant in Silver Corporation's qualified pension plan and group term life insurance.The balance of the survivorship feature in his pension plan is:

The term insurance has a maturity value of $100,000.All amounts are paid to Pam,Jason's daughter.One result of these transactions is:

The term insurance has a maturity value of $100,000.All amounts are paid to Pam,Jason's daughter.One result of these transactions is:

A) Pam must pay income tax on $300,000.

B) Pam must pay income tax on $1,100,000.

C) Jason's gross estate must include $1,200,000.

D) Jason's gross estate must include $1,500,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

For both the Federal gift and estate tax,a deduction is allowed for certain transfers to a spouse.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Paul,a U.S.citizen,will avoid the Federal estate tax if he becomes a Canadian resident and owns no property located in the U.S.at the time of his death.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pursuant to Corey's will,Emma (Corey's sister) inherits his property.Emma dies in a later tax year.The estate tax attributable to the inclusion of the property in Corey's gross estate was $300,000.The estate tax attributable to the inclusion of the property in Emma's gross estate is $400,000.Emma's credit for the tax on prior transfers is:

A) $0 if Emma died 9 1/2 years after Corey.

B) $300,000 if Emma died 3 years after Corey.

C) $400,000 if Emma died 1 year after Corey.

D) $240,000 if Emma died 5 1/2 years after Corey.

E) The credit as computed is some other amount.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 167

Related Exams