Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item has no effect on an S corporation's AAA?

A) Capital loss.

B) Administrative expenses.

C) Cost of goods sold.

D) Stock purchase by a shareholder.

E) All of the above modify AAA.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

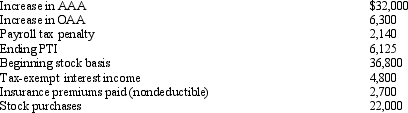

You are given the following facts about a 40% owner of an S corporation, and you are asked to prepare her ending stock basis.

A) $77,950.

B) $82,750.

C) $97,100.

D) $103,225.

E) Some other answer.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An S corporation with substantial AEP has operating revenues of $410,000, taxable interest income of $390,000, operating expenses of $260,000, and deductions attributable to the interest of $150,000. The passive income penalty tax payable, if any, is:

A) $0.

B) $40,923.

C) $116,923.

D) $136,500.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

There is no limit on the amount of passive investment income that an S corporation can receive during the year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Tax-exempt income is a Schedule K item for an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

An S corporation recognizes a gain on any distribution of ____________________ property.

Correct Answer

verified

Correct Answer

verified

Short Answer

Stock basis first is increased by income items, then ____________________ by distributions, and finally decreased by ____________________.

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's basis in his or her stock can be reduced below zero.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Discuss the two methods of allocating S items to shareholders.

Correct Answer

verified

A per-day, per-share method must be used...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

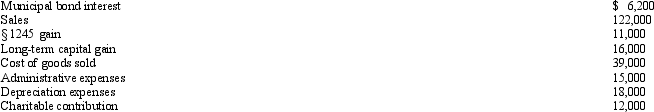

Simmen, Inc., a calendar year S corporation, incurred the following items in 2011.

Calculate Simmen's nonseparately computed income.

Calculate Simmen's nonseparately computed income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which, if any, of the following can be an eligible shareholder of an S corporation?

A) A resident alien.

B) Limited liability company.

C) A foreign corporation.

D) A Roth IRA.

E) None of the above can own S corporation stock.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The Schedule M-3 is the same for a C corporation and an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

S corporation income is taxed at the ____________________ level and not at the ____________________ level. or

Correct Answer

verified

shareholde...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

Rents always are considered to be passive investment income in S status.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Any distribution of cash or property by a corporation that does not exceed the balance of AAA with respect to the stock during a post-termination transition period of approximately one year is applied against and reduces the adjusted basis of the stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An estate can be an S corporation shareholder.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An S corporation must possess the following characteristic(s) :

A) No more than 100 shareholders.

B) Corporation organized in the U.S.

C) Only one class of stock.

D) All of the above are required of S corporations.

E) None of the above is required for S corporations.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

If an S corporation shareholder's basis in a loan to the entity has been reduced, the shareholder recognizes gross income when the S corporation ____________________ the shareholder.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which could constitute a second class of stock under the S corporation rules?

A) Treasury stock.

B) Phantom stock.

C) Unexercised stock options.

D) Warrants.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 157

Related Exams