B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For Year 2,the Sacramento Corporation had beginning and ending Retained Earnings balances of $208,054 and $231,012,respectively.Also during Year 2,the board of directors declared cash dividends of $29,000,which were paid during Year 2.The board also declared a stock dividend,which was issued and required a transfer in the amount of $16,000 to paid-in capital.Total expenses during Year 2 were $32,916.Based on this information,what was the amount of total revenue for Year 2?

A) $68,158

B) $143,154

C) $100,874

D) $179,132

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Powell Corporation had $10 par stock with a market price of $60,when it declared a 2-for-1 stock split.After the stock split,the number of shares outstanding will double,and the market price of the stock should drop to about $30.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A corporation is a legal entity created by the authority of a state government,separate and distinct from its owners.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

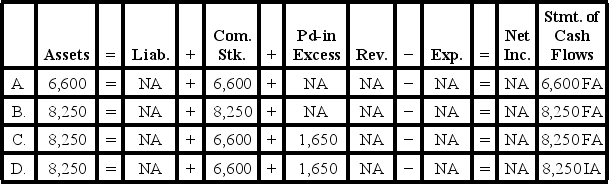

On January 12,Year 1,Gilliam Corporation issued 550 shares of $12 par-value common stock for $15 per share.The number of shares authorized is 5,000,and the number of shares outstanding prior to this transaction was 1,200.Which of the following describes the effect of the January 12 transaction on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

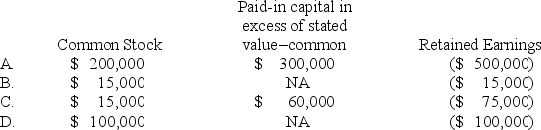

Multiple Choice

Rocco Corporation decides to issue a 7.5% stock dividend on 20,000 outstanding shares of $10 stated value common stock.The distribution is made at the time the market value of the stock is $50 a share.How will the entry to record this transaction affect the company's stockholders' equity accounts?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flagler Corporation shows a total of $660,000 in its Common Stock account and $1,600,000 in its Paid-in Capital Excess account.The par value of Flagler's common stock is $8.How many shares of Flagler stock have been issued?

A) 117,500

B) 200,000

C) 82,500

D) The number of shares cannot be determined using the information provided.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Weller Corporation issued 10,000 shares of no-par common stock for $25 per share.For this transaction,Common Stock should be increased by $250,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a disadvantage of a sole proprietorship?

A) Entrenched management

B) Double taxation

C) Personal liability

D) Excessive regulation

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances:

![[The following information applies to the questions displayed below.] Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances: At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share. -What is the amount of retained earnings that will be transferred to paid-in capital as a result of the stock dividend issued by Gilligan Corporation? A) $60,500 B) $16,500 C) $44,000 D) $108,500](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f20_f0a1_ace2_5568a00c35de_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.

-What is the amount of retained earnings that will be transferred to paid-in capital as a result of the stock dividend issued by Gilligan Corporation?

At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.

-What is the amount of retained earnings that will be transferred to paid-in capital as a result of the stock dividend issued by Gilligan Corporation?

A) $60,500

B) $16,500

C) $44,000

D) $108,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The Securities and Exchange Commission (SEC)has the authority to set and enforce auditing,attestation,quality control,and ethics standards for auditors of public companies.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The book value of a share of stock is equal to the market or selling price of the stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

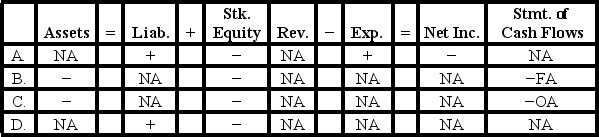

How does the payment of a previously declared cash dividend affect the elements of the financial statements?

A) Decreases assets and stockholders' equity

B) Increases liabilities and decreases stockholders' equity

C) Decreases liabilities and increases stockholders' equity

D) None of these answer choices are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

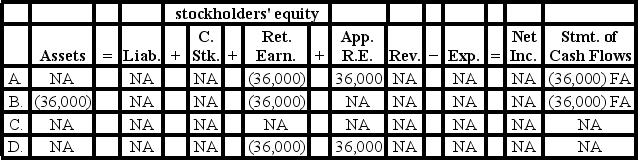

Multiple Choice

On July 1,Year 1,Village Bookstore,Inc.appropriated retained earnings in the amount of $36,000 for a future remodeling project in the basement of the bookstore.On June 30,Year 1,the balance of Retained Earnings was $82,800 and the Cash balance was $43,200.Which of the following answers shows the effect of the July 1 event on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

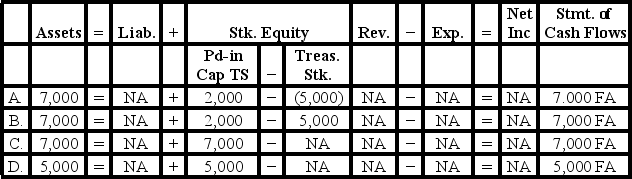

Multiple Choice

Voiles Company reissued 200 shares of its treasury stock.The treasury stock originally cost $25 per share and was reissued for $35 per share.Select the answer that accurately reflects how the reissue of the treasury stock would affect the elements of Voiles financial statements.

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The class or type of stock that every corporation must have is preferred stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fixit Corporation issued 20,000 shares of $20 par value common stock at its current market price of $32.How does this event affect total stockholders' equity?

A) It increases by $640,000.

B) It is unaffected.

C) It increases by $240,000.

D) It increases by $400,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The stock market crash in 1929 led to the beginning of the extensive regulation of trading stock on stock exchanges.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The board of directors of Chandler Company declared a cash dividend.Which of the following choices accurately reflects how this event would affect the elements of the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An advantage of the corporate form of business organization is that corporations are free from double taxation.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 88

Related Exams