A) present value.

B) future value.

C) return.

D) standard deviation.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the future value of $750 one year from today if the interest rate is 2.5 percent?

A) $766.50

B) $768.75

C) $770.23

D) None of the above are correct to the nearest cent.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Writing in the Wall Street Journal in 2009,economist Jeremy Siegel pointed out that the efficient markets hypothesis

A) was responsible for the financial crisis of 2008-2009.

B) was responsible for the Great Depression of the 1930s.

C) claims that prices observed in financial markets are always "right."

D) claims that prices observed in financial markets are mostly "wrong."

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions best illustrates adverse selection?

A) A person purposely chooses bonds of corporations with high default risk because of the high returns.

B) A person dislikes losing $400 more than he likes winning $400.

C) After obtaining automobile insurance a person drives less carefully than before.

D) A person intending to take up dangerous hobbies applies for life insurance.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

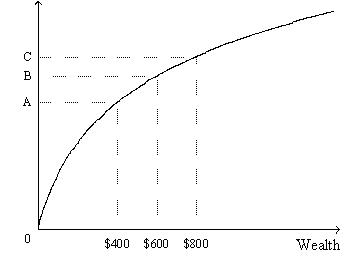

Figure 19-1.The figure shows a utility function.  -Refer to Figure 19-1.Which distance along the vertical axis represents the marginal utility of an increase in wealth from $600 to $800?

-Refer to Figure 19-1.Which distance along the vertical axis represents the marginal utility of an increase in wealth from $600 to $800?

A) the distance between the origin and point B

B) the distance between the origin and point C

C) the distance between point A and point C

D) the distance between point B and point C

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lucky Hardware Store considered building a store in a new location.The owners and their accountants decided that this was not the profitable thing to do.However,soon after they made this decision,both the interest rate and the cost of building the store changed.In which case do these changes both make it more likely that they will now build the store?

A) Interest rates rise and the cost of building the store rises.

B) Interest rates rise and the cost of building the store falls.

C) Interest rates fall and the cost of building the store rises.

D) Interest rates fall and the cost of building the store falls.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When he was 18,Hussam put $100 into an account at an interest rate of 8 percent.He now has $158.69 in this account.For how many years did Hussam leave this money in his account?

A) 5 years

B) 6 years

C) 7 years

D) 8 years

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct way to compute the future value of $100 put into an account that earns 4 percent interest for 10 years?

A) $100(1 + .0410)

B) $100(1 + .0410)

C) $100 * 10(1 + .04)

D) $100(1 + .04) 10

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Historically the return on stocks has been higher than the return on bonds.In part this reflects the higher risk from holding stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rita puts $10,000 into each of two different assets.The first asset pays 10 percent interest and the second pays 5 percent.According to the rule of 70,what is the approximate difference in the value of the two assets after 14 years?

A) $12,000

B) $14,000

C) $15,500

D) $20,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the efficient markets hypothesis is correct,then

A) the number of shares of stock offered for sale exceeds the number of shares of stock that people want to buy.

B) the stock market is informationally efficient.

C) stock prices never follow a random walk.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the interest rate is 8 percent.Consider three payment options: 1.$200 today. 2) $220 one year from today. 3) $240 two years from today. Which of the following is correct?

A) Option 1 has the highest present value and Option 2 has the lowest.

B) Option 2 has the highest present value and Option 3 has the lowest.

C) Option 3 has the highest present value and Option 1 has the lowest.

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $183.60 two years from today equal to about $173.06 today?

A) 2 percent

B) 3 percent

C) 4 percent

D) 5 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You receive $500 today which you plan to save for two years.Also,in two years you will be given another $500.If the interest rate is 5 percent,what is the present value of the payment of $500 today and the $500 in two years?

A) $500(1.05) 2 + $500/(1.05) 2

B) $500(1.05) 2 + $500

C) $500 + $500/(1.05) 2

D) $500 + $500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your accountant tells you that if you can continue to earn the current interest rate on your balance of $500 for ten years,you will have about $983.58.If your accountant is correct,what is the current rate of interest?

A) 5 percent

B) 6 percent

C) 7 percent

D) 8 percent

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Al,Ralph,and Stan are all intending to retire.Each currently has $1 million in assets.Al will earn 16% interest and retire in two years.Ralph will earn 8% interest and retire in four years.Stan will earn 4% interest and retire in eight years.Who will have the largest sum when he retires?

A) Al

B) Ralph

C) Stan

D) They all retire with the same amount.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

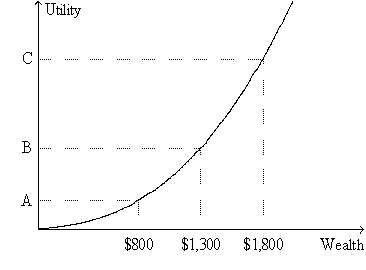

Figure 19-4.The figure shows a utility function for Dexter.  -Refer to Figure 19-4.In what way(s) does the graph differ from the usual case?

-Refer to Figure 19-4.In what way(s) does the graph differ from the usual case?

A) The utility function shown here is upward-sloping,whereas in the usual case the utility function is downward-sloping.

B) The utility function shown here is bowed downward (convex) ,whereas in the usual case the utility function is bowed upward (concave) .

C) On the graph shown here,wealth is measured along the horizontal axis,whereas in the usual case saving is measured along the horizontal axis.

D) On the graph shown here,utility is measured along the vertical axis,whereas in the usual case satisfaction is measured along the vertical axis.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fundamental analysis shows that stock in Garske Software Corporation has a present value that is higher than its price.

A) This stock is overvalued; you should consider adding it to your portfolio.

B) This stock is overvalued; you shouldn't consider adding it to your portfolio.

C) This stock is undervalued; you should consider adding it to your portfolio.

D) This stock is undervalued; you shouldn't consider adding it to your portfolio.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

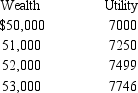

Matt's Utility Function  If Matt's current wealth is $51,000,then

If Matt's current wealth is $51,000,then

A) his gain in utility from gaining $1,000 is greater than his loss in utility from losing $1,000.Matt is risk averse.

B) his gain in utility from gaining $1,000 is greater than his loss in utility from losing $1,000.Matt is not risk averse.

C) his gain in utility from gaining $1,000 is less than his loss in utility from losing $1,000.Matt is risk averse.

D) his gain in utility from gaining $1,000 is less than his loss in utility from losing $1,000.Matt is not risk averse.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The future value of a deposit in a savings account will be larger

A) the longer a person waits to withdraw the funds.

B) the higher the interest rate is.

C) the larger the initial deposit is.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 421

Related Exams