A) $30 billion

B) $25 billion

C) $20 billion

D) $15 billion

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a closed economy,each unit of output is either consumed or invested.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) In the national income accounts,investment and private saving refer to the same thing.

B) In a closed economy if national saving is greater than zero,then everyone must be saving.

C) The financial system channels funds from savers to borrowers.

D) People whose consumption exceeds their income are savers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are effects of an increased budget deficit?

A) the supply of loanable funds does not change; a higher interest rate reduces private saving

B) the supply of loanable funds does not change; a higher interest rate raises private saving

C) at any interest rate the supply of loanable funds is less; a higher interest rate reduces private saving

D) at any interest rate the supply of loanable funds is less; a higher interest rate raises private saving

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a certificate of indebtedness?

A) stocks and bonds

B) stocks but not bonds

C) bonds but not stocks

D) neither stocks nor bonds

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

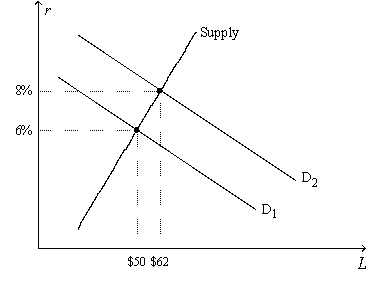

Figure 18-4.On the horizontal axis of the graph,L represents the quantity of loanable funds in billions of dollars.  -Refer to Figure 18-4.The position and/or slope of the Supply curve are influenced by

-Refer to Figure 18-4.The position and/or slope of the Supply curve are influenced by

A) the level of public saving.

B) the level of national saving.

C) decisions made by people who have extra income they want to save and lend out.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The source of the supply of loanable funds is

A) saving,and the source of the demand for loanable funds is investment.

B) consumption,and the source of the demand for loanable funds is investment.

C) investment,and the source of the demand for loanable funds is saving.

D) the interest rate,and the source of the demand for loanable funds is saving.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an economy is closed and if it has no government,then

A) national saving = 0.

B) national saving = private saving.

C) public saving = investment.

D) gross domestic product = consumption.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a country had a smaller increase in debt in 2011 than it had in 2010.Then other things the same,we would expect

A) lower interest rates and investment in 2011 than in 2010.

B) lower interest rates and greater investment in 2011 than in 2010.

C) higher interest rates and greater investment in 2011 than in 2010.

D) higher interest rates and lower investment in 2011 than in 2010.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the language of macroeconomics,investment refers to

A) saving.

B) the purchase of new capital.

C) the purchase of stocks,bonds,or mutual funds.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A certificate of indebtedness that specifies the obligations of the borrower to the holder is called a

A) bond.

B) stock.

C) mutual fund.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government runs a budget deficit,

A) interest rates are lower than they would be if the budget were balanced.

B) national saving is higher than it would be if the budget were balanced.

C) investment is lower than it would be if the budget were balanced.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are thinking of buying a bond from Bluestone Corporation.You know that this bond is long term and you know that Bluestone's business ventures are risky and uncertain.You then consider another bond with a shorter term to maturity issued by a company with good prospects and an established reputation.Which of the following is correct?

A) The longer term would tend to make the interest rate on the bond issued by Bluestone higher,while the higher risk would tend to make the interest rate lower.

B) The longer term would tend to make the interest rate on the bond issued by Bluestone lower,while the higher risk would tend to make the interest rate higher.

C) Both the longer term and the higher risk would tend to make the interest rate lower on the bond issued by Bluestone.

D) Both the longer term and the higher risk would tend to make the interest rate higher on the bond issued by Bluestone.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A mutual fund

A) is a financial market where small firms mutually agree to sell stocks and bonds to raise funds.

B) is funds set aside by local governments to lend to small firms who want to invest in projects that are mutually beneficial to the firm and community.

C) sells stocks and bonds on behalf of small and less known firms who would otherwise have to pay high interest to obtain credit.

D) is an institution that sells shares to the public and uses the proceeds to buy a selection of various types of stocks,bonds,or both stocks and bonds.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are financial intermediaries?

A) both banks and mutual funds

B) banks but not mutual funds

C) mutual funds but not banks

D) neither banks or mutual funds

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009 and 2010,the federal government's budget deficit was about

A) 5 percent of GDP,and this was the highest debt-GDP ratio in U.S history.

B) 10 percent of GDP,and this was the highest debt-GDP ratio in U.S history.

C) 5 percent of GDP,and this was the highest debt-GDP ratio since World War II.

D) 10 percent of GDP,and this was the highest debt-GDP ratio since World War II.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

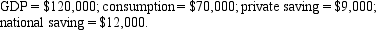

Scenario 18-1.Assume the following information for an imaginary,closed economy.

-Refer to Scenario 18-1.For this economy,government purchases amount to

-Refer to Scenario 18-1.For this economy,government purchases amount to

A) $12,000.

B) $18,000.

C) $28,000.

D) $38,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bolivia had a smaller budget deficit in 2003 than in 2002.Other things the same,we would expect this reduction in the budget deficit to have

A) increased both interest rates and investment.

B) increased interest rates and decreased investment.

C) decreased interest rates and increased investment.

D) decreased both interest rates and investment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the tax rate fell,holding municipal bonds would be less desirable so the interest rates on them would fall.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the budget deficit would cause a

A) shortage of loanable funds at the original interest rate,which would lead to falling interest rates.

B) surplus of loanable funds at the original interest rate,which would lead to rising interest rates.

C) shortage of loanable funds at the original interest rate,which would lead to rising interest rates.

D) surplus of loanable funds at the original interest rate,which would lead to falling interest rates.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 421 - 440 of 470

Related Exams