A) buyers bearing the same share of the tax burden.

B) sellers bearing the same share of the tax burden.

C) the same amount of tax revenue for the government.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Who bears the majority of a tax burden depends on whether the tax is placed on the buyers or the sellers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

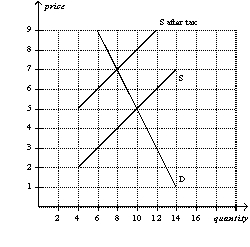

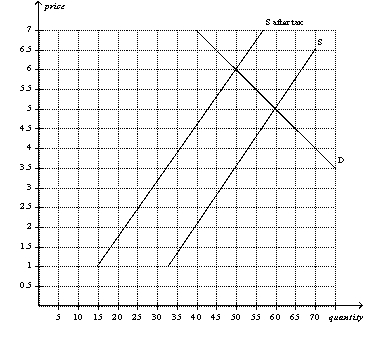

Figure 6-19  -Refer to Figure 6-19.For every unit of the good that is sold,sellers are required to send

-Refer to Figure 6-19.For every unit of the good that is sold,sellers are required to send

A) one dollar to the government,and buyers are required to send two dollars to the government.

B) two dollars to the government,and buyers are required to send one dollar to the government.

C) three dollars to the government,and buyers are required to send nothing to the government.

D) nothing to the government,and buyers are required to send two dollars to the government.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

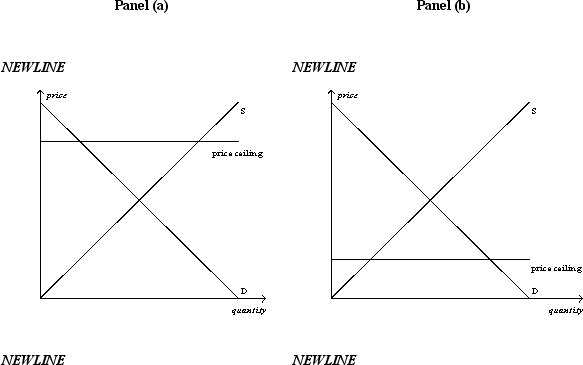

Figure 6-1

-Refer to Figure 6-1.In which panel(s) of the figure would there be a shortage of the good at the price ceiling?

-Refer to Figure 6-1.In which panel(s) of the figure would there be a shortage of the good at the price ceiling?

A) panel (a) only

B) panel (b) only

C) both panel (a) and panel (b)

D) neither panel (a) nor panel (b)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Rent subsidies and wage subsidies are better than price controls at helping the poor because they have no costs associated with them.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a tax is imposed on the sellers of a product,then the tax burden will fall entirely on the sellers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $5 tax per ticket on buyers of NFL game tickets,then the price paid by buyers of NFL game tickets would

A) increase by less than $5.

B) increase by exactly $5.

C) increase by more than $5.

D) decrease by an indeterminate amount.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The term tax incidence refers to how the burden of a tax is distributed among the various people who make up the economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the housing market,supply and demand are

A) more elastic in the short run than in the long run,and so rent control leads to a larger shortage of apartments in the short run than in the long run.

B) more elastic in the short run than in the long run,and so rent control leads to a larger shortage of apartments in the long run than in the short run.

C) more elastic in the long run than in the short run,and so rent control leads to a larger shortage of apartments in the short run than in the long run.

D) more elastic in the long run than in the short run,and so rent control leads to a larger shortage of apartments in the long run than in the short run.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A price floor set below the equilibrium price causes a surplus in the market.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling is always a binding price control,whereas a price floor may be either binding or not binding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

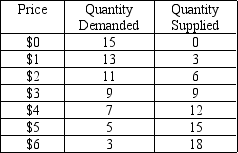

Table 6-4

The following table contains the demand schedule and supply schedule for a market for a particular good.Suppose sellers of the good successfully lobby Congress to impose a price floor $3 above the equilibrium price in this market.

-Refer to Table 6-4.Following the imposition of a price floor $3 above the equilibrium price,irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor.The resulting shortage is

-Refer to Table 6-4.Following the imposition of a price floor $3 above the equilibrium price,irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor.The resulting shortage is

A) 0 units.

B) 4 units.

C) 5 units.

D) 10 units.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

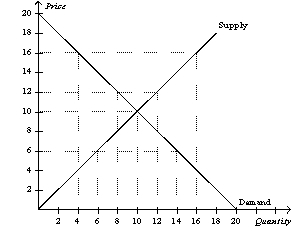

Figure 6-4  -Refer to Figure 6-4.A government-imposed price of $12 in this market is an example of a

-Refer to Figure 6-4.A government-imposed price of $12 in this market is an example of a

A) binding price ceiling that creates a shortage.

B) non-binding price ceiling that creates a shortage.

C) binding price floor that creates a surplus.

D) non-binding price floor that creates a surplus.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-18  -Refer to Figure 6-18.How much tax revenue does this tax generate for the government?

-Refer to Figure 6-18.How much tax revenue does this tax generate for the government?

A) $75

B) $125

C) $175

D) $300

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A tax of $1 on buyers shifts the demand curve downward by exactly $1.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers usually causes buyers to pay more for the good and sellers to receive less for the good than they did before the tax was levied.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009,the U.S.minimum wage according to federal law was

A) $4.25 per hour.

B) $5.15 per hour.

C) $5.75 per hour.

D) $7.25 per hour.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The minimum wage has its greatest impact on the market for teenage labor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government wants to encourage Americans to exercise more,so it imposes a binding price ceiling on the market for in-home treadmills.As a result,

A) the demand for treadmills will increase.

B) the supply of treadmills will decrease.

C) a shortage of treadmills will develop.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The minimum wage was instituted to ensure workers

A) a middle-class standard of living.

B) employment.

C) a minimally adequate standard of living.

D) unemployment compensation.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 421 - 440 of 553

Related Exams