A) 24.1%

B) 26.4%

C) 27.8%

D) 30.9%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In choosing the form of a tax, there is often a tradeoff between

A) allocative and productive efficiency.

B) profits and revenues.

C) efficiency and fairness.

D) fairness and profits.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax system with little deadweight loss and a small administrative burden would be described as

A) equitable.

B) communistic.

C) capitalistic.

D) efficient.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Max values a concert ticket at $45. Charles values the same concert ticket at $40. The pre-tax price of a concert ticket is $30. The government imposes a tax of $5 on each concert ticket, and the price rises to $35. The deadweight loss from the tax is

A) $15.

B) $10.

C) $5.

D) $0.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"A $1,000 tax paid by a poor person may be a larger sacrifice than a $10,000 tax paid by a wealthy person" is an argument in favor of

A) the horizontal equity principle.

B) the benefits principle.

C) a regressive tax argument.

D) the ability-to-pay principle.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a poor family has three children in public school and a rich family has two children in private school, the benefits principle would suggest that

A) the poor family should pay more in taxes to pay for public education than the rich family.

B) the rich family should pay more in taxes to pay for public education than the poor family.

C) the benefits of private school exceed those of public school.

D) public schools should be financed by property taxes.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country is using a proportional tax when

A) its marginal tax rate equals its average tax rate.

B) its marginal tax rate is less than its average tax rate.

C) its marginal tax rate is greater than its average tax rate.

D) it uses a lump-sum tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Luke values a scoop of Italian gelato at $4. Leia values a scoop of Italian gelato at $6. The pre-tax price of a scoop of Italian gelato is $2. The government imposes a "fat tax" of $3 on each scoop of Italian gelato, and the price rises to $5. The deadweight loss from the tax is

A) $1.

B) $2.

C) $3.

D) $4.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

In 2011, the largest source of receipts for state and local governments was individual income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

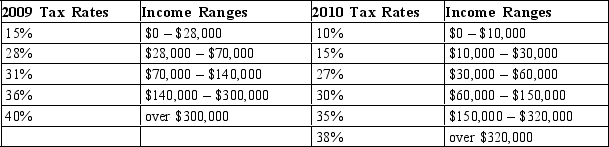

Table 12-18

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-18. What type of tax structure did the United States have in 2009 for single individuals?

-Refer to Table 12-18. What type of tax structure did the United States have in 2009 for single individuals?

A) a proportional tax structure

B) a regressive tax structure

C) a progressive tax structure

D) a lump-sum tax structure

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability-to-pay principle claims that a person should pay taxes according to

A) the level of public education that the person has received throughout his lifetime.

B) how many government services that person will receive.

C) how well that person can shoulder the tax burden.

D) the level of debt that the person has.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tax system requires higher-income taxpayers to have lower tax rates, even though they pay a larger amount of tax when compared to lower-income taxpayers?

A) a proportional tax

B) a progressive tax

C) a regressive tax

D) a lump-sum tax

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government taxes 30 percent of the first $70,000 and 50 percent of all income above $70,000. For a person earning $200,000, the marginal tax rate is

A) 30 percent, and the average tax rate is 50 percent.

B) 30 percent, and the average tax rate is 43 percent.

C) 50 percent, and the average tax rate is 40 percent.

D) 50 percent, and the average tax rate is 43 percent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Ken places a $20 value on a cigar, and Mark places a $17 value on it. The equilibrium price for this brand of cigar is $15. -Refer to Scenario 12-1. Suppose the government levies a tax of $3 on each cigar, and the equilibrium price of a cigar increases to $18. Because total consumer surplus has

A) fallen by more than the tax revenue, the tax has a deadweight loss

B) fallen by less than the tax revenue, the tax has no dead weight loss.

C) fallen by exactly the amount of the tax revenue, the tax has no deadweight loss.

D) increased by less than the tax revenue, the tax has a deadweight loss.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Public schools, which educate most students through high school, are paid for primarily by

A) state governments.

B) local governments.

C) the federal government.

D) taxpayers directly.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Lump-sum taxes are equitable but not efficient.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Who pays a corporate income tax?

A) owners of the corporation

B) customers of the corporation

C) workers of the corporation

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of income tax owed by a family is

A) not simply proportional to its total income.

B) unaffected by deductions.

C) total income minus tax credits.

D) a constant fraction of income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From 1950 to today, government spending on Social Security, Medicare, and Medicaid as a percentage of GDP has

A) decreased from about ten percent to less than one percent.

B) increased from less than one percent to about ten percent.

C) remained constant at less than one percent.

D) remained constant at about ten percent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a characteristic of a more efficient tax system?

A) The system minimizes deadweight loss.

B) The system raises the same amount of revenue at a lower cost.

C) The system minimizes administrative burdens.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 551

Related Exams