B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists disagree on whether labor taxes cause small or large deadweight losses. This disagreement arises primarily because economists hold different views about

A) the size of labor taxes.

B) the importance of labor taxes imposed by the federal government relative to the importance of labor taxes imposed by the various states.

C) the elasticity of labor supply.

D) the elasticity of labor demand.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax of $0.10 per unit on a good creates a deadweight loss of $100. If the tax is increased to $0.25 per unit, the deadweight loss from the new tax would be

A) $200.

B) $250.

C) $475.

D) $625.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the tax on a good is doubled, the deadweight loss of the tax

A) increases by 50 percent.

B) doubles.

C) triples.

D) quadruples.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

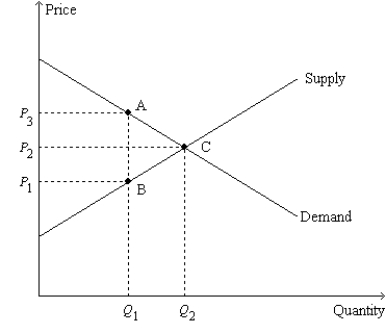

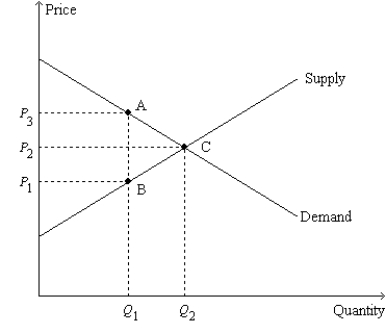

Figure 8-11  -Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then, when the tax is imposed,

-Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then, when the tax is imposed,

A) consumer surplus decreases by $13.

B) producer surplus decreases by $13.

C) the deadweight loss amounts to $6.

D) the amount of the good that is sold remains unchanged.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a country is on the downward-sloping side of the Laffer curves, a cut in the tax rate will

A) decrease tax revenue and decrease the deadweight loss.

B) decrease tax revenue and increase the deadweight loss.

C) increase tax revenue and decrease the deadweight loss.

D) increase tax revenue and increase the deadweight loss.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

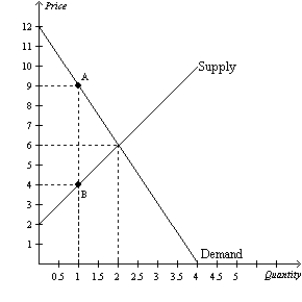

Figure 8-2

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-2. The loss of producer surplus as a result of the tax is

-Refer to Figure 8-2. The loss of producer surplus as a result of the tax is

A) $1.

B) $2.

C) $3.

D) $4.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-11  -Refer to Figure 8-11. The deadweight loss of the tax is represented by the

-Refer to Figure 8-11. The deadweight loss of the tax is represented by the

A) length of the line segment connecting points A and B.

B) length of the line segment connecting points A and C.

C) length of the line segment connecting points B and C.

D) area of the triangle bounded by the points A, B, and d.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the market for widgets, the supply curve is the typical upward-sloping straight line, and the demand curve is the typical downward-sloping straight line. The equilibrium quantity in the market for widgets is 200 per month when there is no tax. Then a tax of $5 per widget is imposed. The price paid by buyers increases by $2 and the after-tax price received by sellers falls by $3. The government is able to raise $750 per month in revenue from the tax. The deadweight loss from the tax is

A) $250.

B) $125.

C) $75.

D) $50.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

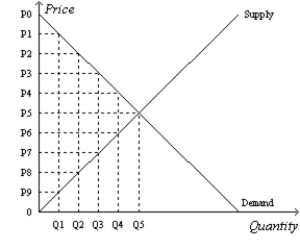

Figure 8-10  -Refer to Figure 8-10. Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2. The price that sellers receive is

-Refer to Figure 8-10. Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2. The price that sellers receive is

A) P0.

B) P2.

C) P5.

D) P8.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Tax revenue equals the size of the tax multiplied by the quantity sold in the market after the tax is levied.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 501 - 511 of 511

Related Exams