B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sellers of a good bear the larger share of the tax burden when a tax is placed on a product for which the (i) supply is more elastic than the demand. (ii) demand in more elastic than the supply. (iii) tax is placed on the sellers of the product. (iv) tax is placed on the buyers of the product.

A) (i) only

B) (ii) only

C) (i) and (iv) only

D) (ii) and (iii) only

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A binding price ceiling may not help all consumers, but it does not hurt any consumers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the buyers of sofas

A) increases the size of the sofa market.

B) decreases the size of the sofa market.

C) has no effect on the size of the sofa market.

D) may increase, decrease, or have no effect on the size of the sofa market.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price ceilings and price floors that are binding

A) are desirable because they make markets more efficient and more fair.

B) cause surpluses and shortages to persist because price cannot adjust to the market equilibrium price.

C) can have the effect of restoring a market to equilibrium.

D) are imposed because they can make the poor in the economy better off without causing adverse effects.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the equilibrium wage is $4 per hour and the minimum wage is $5.15 per hour, then a shortage of labor will exist.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

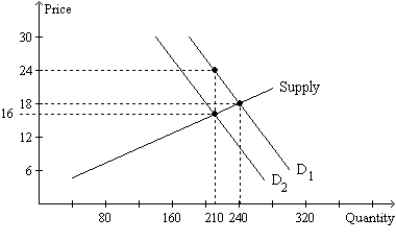

Figure 6-24  -Refer to Figure 6-24. What is the amount of the tax per unit?

-Refer to Figure 6-24. What is the amount of the tax per unit?

A) $8

B) $6

C) $4

D) $2

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The goal of rent control is to help the poor by making housing more affordable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price floor is not binding, then

A) the equilibrium price is above the price floor.

B) the equilibrium price is below the price floor.

C) there will be a surplus in the market.

D) there will be a shortage in the market.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

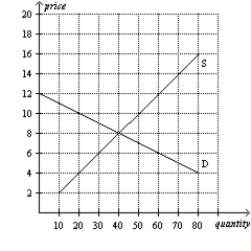

Figure 6-6  -Refer to Figure 6-6. If the government imposes a price ceiling of $8 on this market, then there will be

-Refer to Figure 6-6. If the government imposes a price ceiling of $8 on this market, then there will be

A) no shortage.

B) a shortage of 10 units.

C) a shortage of 20 units.

D) a shortage of 40 units.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price ceiling is binding when it is set

A) above the equilibrium price, causing a shortage.

B) above the equilibrium price, causing a surplus.

C) below the equilibrium price, causing a shortage.

D) below the equilibrium price, causing a surplus.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the demand for digital cameras is elastic, and the supply of digital cameras is inelastic. A tax of $20 per camera levied on digital cameras will decrease the effective price received by sellers of digital cameras by

A) less than $10

B) $10.

C) between $10 and $20.

D) $20.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A price floor set below the equilibrium price causes a surplus in the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price ceiling is imposed on a market to benefit buyers,

A) no buyers actually benefit.

B) some buyers benefit, but no buyers are harmed.

C) some buyers benefit, and some buyers are harmed.

D) all buyers benefit.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price controls are usually enacted

A) as a means of raising revenue for public purposes.

B) when policymakers believe that the market price of a good or service is unfair to buyers or sellers.

C) when policymakers tax a good.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product, then there will be a(n)

A) downward shift of the supply curve.

B) upward shift of the supply curve.

C) movement up and to the right along the supply curve.

D) movement down and to the left along the supply curve.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government wants to reduce smoking, it should impose a tax on

A) buyers of cigarettes.

B) sellers of cigarettes.

C) either buyers or sellers of cigarettes.

D) whichever side of the market is less elastid.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

One common example of a price floor is the minimum wage.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In an unregulated labor market, the wage adjusts to balance labor supply and labor demand.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Price floors are typically imposed to benefit sellers.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 401 - 420 of 644

Related Exams