A) Milk and cream used to make the ice cream.

B) Ice cream that has been made but is freezing to the level required for shipping.

C) Frozen ice cream that is waiting to be shipped to retailers.

D) Ice cream that is in the freezers of retailers awaiting sale to consumers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mountain Made uses a periodic inventory system.The company started the month with 3 quilts in its beginning inventory that cost $200 each.During the month,Mountain Made purchased 20 additional quilts for $210 each.At the end of the month,Mountain Made counted its inventory and found that 5 quilts remained unsold.If Mountain Made uses LIFO periodic,its cost of goods sold for the month is:

A) $1,020.

B) $3,780.

C) $3,750.

D) $1,050.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The specific identification method would probably be most appropriate for which of the following goods?

A) Boxes of brass 4-inch drywall screws at Home Depot.

B) Bottles of suntan lotion in Wal-Mart's central warehouse.

C) Sets of tires at the Goodyear plant.

D) Diamond necklaces at a Tiffany & Co.jewelry store.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Consignment inventory is reported on the balance sheet of the company holding the inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) FIFO results in a lower net income than LIFO when costs are rising.

B) LIFO results in a higher net income than FIFO when costs are rising.

C) LIFO results in a higher net income than FIFO when costs are falling.

D) LIFO results in the same net income as FIFO when costs are rising.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about inventory classifications is not correct?

A) Inventory may include materials used in producing goods for sale.

B) Manufacturers hold three types of inventory that are referred to as raw materials inventory,work in process inventory,and finished goods inventory.

C) Inventory is classified as a long-term asset on the balance sheet.

D) Merchandisers buy inventory in finished form ready for resale.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

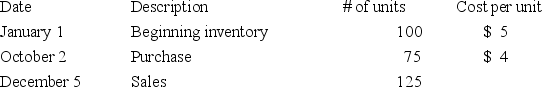

Mansfield Company has a periodic inventory system and uses the LIFO method to assign costs to inventory and cost of goods sold.Consider the following information:  What amounts would be reported as the cost of goods sold and ending inventory balances for the period?

What amounts would be reported as the cost of goods sold and ending inventory balances for the period?

A) Cost of goods sold $625;Ending inventory $175

B) Cost of goods sold $755;Ending inventory $225

C) Cost of goods sold $550;Ending inventory $250

D) Cost of goods sold $600;Ending inventory $200

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term to the appropriate definition.There are more definitions than terms. -Lower of Cost or Market/Net Realizable Value Rule

A) Inventory costing method that uses the weighted average unit cost of the goods available for sale for both cost of goods sold and ending inventory.

B) The inventory that starts the manufacturing process.

C) Inventory costing method that assumes that the costs of the last goods purchased are the costs of the first goods sold.

D) Beginning Inventory + Purchases - Ending Inventory

E) Inventory costing method that identifies the cost of the specific item that was sold.

F) A valuation rule that requires Inventory to be written down when its market value falls below its cost.

G) Goods that are held for sale in the normal course of business or are used to produce other goods for sale.

H) The difference between net sales and cost of goods sold.

I) Inventory that was in process and now is completed and ready for sale.

J) Beginning Inventory + Purchases - Cost of Goods Sold

K) Requires that if LIFO is used on the income tax return,it also must be used in financial statement reporting.

L) Goods that are in the process of being manufactured.

M) The expense that follows directly after Net Sales on a multiple step income statement.

N) Consists of products acquired in a finished condition,ready for sale without further processing.

O) Inventory costing method that assumes that the costs of the first goods purchased are the costs of the first goods sold.

P) A measure of the average number of days from the time inventory is bought to the time it is sold.

Q) Inventory items being transported.

R) Goods a company is holding on behalf of the goods' owner.

S) How many times (on average) that inventory has been bought or sold.

U) I) and P)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eaton Electronics uses a periodic inventory system.On March 31,Eaton has two plasma TVs on hand at a cost of $1,500 each (serial numbers 11534892 and 11534894) .In April,the company purchases four more identical TVs from Toshiba for $1,450 each (serial numbers 11542631 through 11542634) .In May,the company purchases five more identical TVs for $1,600 each (serial numbers 11550964 through 11550968) .In June,Eaton sells two of these TVs (serial numbers 11534894 and 11542631) .There were no additional purchases or sales during the remainder of the year. Eaton Electronics uses the specific identification method.What is its cost of goods sold?

A) $3,000

B) $2,950

C) $3,200

D) $3,033

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the four companies listed below,which company is more likely to use specific identification to value their inventory and cost of goods sold?

A) Wedding cake baker

B) Dog biscuit manufacturer

C) Grocery store

D) Bulk candy merchandiser

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An adjustment to ending inventory under the lower of cost or market/net realizable value (LCM/NRV) rule would be least likely to be recorded by a company that sells:

A) a household staple like laundry detergent.

B) a fad product like Slap Wraps bracelets.

C) seasonal items like snow blowers.

D) high-tech goods like cell phones.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decreasing inventory turnover ratio indicates:

A) a longer time span between the ordering and receiving of inventory.

B) a shorter time span between the ordering and receiving of inventory.

C) a longer time span between the purchase and sale of inventory.

D) a shorter time span between the purchase and sale of inventory.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The assumption that a company makes about its inventory cost flow can affect cost of goods sold on its ________ and inventory on its ________ .

A) income statement;balance sheet

B) balance sheet;income statement

C) income statement;income statement

D) balance sheet;balance sheet

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pacific Company starts the year with a beginning inventory of 6,000 units at $5 per unit.The company purchases 10,000 units at $4 each in February and 4,000 units at $6 each in March.Pacific sells 3,000 units during this quarter.Pacific has a perpetual inventory system and uses the FIFO inventory costing method.What is the cost of goods sold for the quarter?

A) $12,000.

B) $18,680.

C) $15,000.

D) $18,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At year end,CurlZ,Inc.'s inventory consists of 200 bottles of CleanZ at $1 per bottle and 100 boxes of DyeZ at $10 per box.Market values are $1.20 per bottle for CleanZ and $8 per box for DyeZ.CurlZ should report its inventory at:

A) $1,000.

B) $1,200.

C) $1,040.

D) $1,240.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the inventory costing method that adds together the total cost of all goods available for sale during the period,and then divides that by the number of units available for sale to get a value to assign to all goods sold and all goods remaining in inventory?

A) Weighted average

B) Cost

C) FIFO

D) LIFO

E) Specific identification

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Delta Diamonds uses a periodic inventory system.The company had five one-carat diamonds available for sale this year: one was purchased on June 1 for $500,two were purchased on July 9 for $550 each,and two were purchased on September 23 for $600 each.On December 24,it sold one of the diamonds that was purchased on July 9.Using the FIFO method,its cost of goods sold for the year ended is:

A) $1,100.

B) $600.

C) $1,200.

D) $500.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sugar,Inc.sells $938,600 of goods during the year that have a cost of $797,200.Inventory was $59,566 at the beginning of the year and $68,076 at the end of the year. What is the inventory turnover ratio?

A) 12.5 times

B) 13.4 times

C) 14.7 times

D) 2.2 times

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Delta Diamonds uses a periodic inventory system.The company had five one-carat diamonds available for sale this year: one was purchased on June 1 for $500,two were purchased on July 9 for $550 each,and two were purchased on September 23 for $600 each.On December 24,it sold one of the diamonds that was purchased on July 9.Using the LIFO method,its ending inventory (after the December 24 sale) equals:

A) $2,300.

B) $2,250.

C) $600.

D) $2,200.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A declining inventory turnover ratio may mean that:

A) goods are not selling as fast as they were in the past.

B) the company is expecting to sell more in the future.

C) goods are selling,but it is taking longer to collect payment.

D) goods cannot be shipped fast enough.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 218

Related Exams