A) 0.75 and the multiplier is 1 1/3.

B) 0.75 and the multiplier is 4.

C) 0.25 and the multiplier is 1 1/3.

D) 0.25 and the multiplier is 4.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Supply-side economists believe that changes in government purchases affect

A) only aggregate demand.

B) only aggregate supply.

C) both aggregate demand and aggregate supply.

D) neither aggregate demand nor aggregate supply.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed conducts open-market sales,which of the following quantities increase(s) ?

A) interest rates,prices,and investment spending

B) interest rates and prices,but not investment spending

C) interest rates and investment,but not prices

D) interest rates,but not investment or prices

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The wealth effect helps explain the slope of the aggregate-demand curve.This effect is

A) relatively important in the United States because expenditures on consumer durables is very responsive to changes in wealth.

B) relatively important in the United States because consumption spending is a large part of GDP.

C) relatively unimportant in the United States because money holdings are a small part of consumer wealth.

D) relatively unimportant because it takes a large change in wealth to cause a significant change in interest rates.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a multiplier effect,but no crowding-out or investment-accelerator effects,a $100 billion increase in government expenditures shifts aggregate

A) demand rightward by more than $100 billion.

B) demand rightward by less than $100 billion.

C) supply leftward by more than $100 billion.

D) supply leftward by less than $100 billion.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

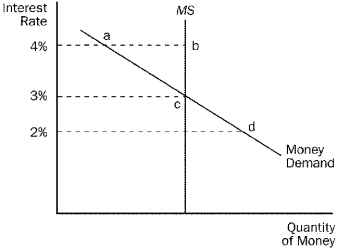

Figure 34-1  -Refer to Figure 34-1.There is an excess demand for money at an interest rate of

-Refer to Figure 34-1.There is an excess demand for money at an interest rate of

A) 2 percent.

B) 3 percent.

C) 4 percent.

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Other things the same,an increase in the price level causes the real value of the dollar to fall in the market for foreign-currency exchange.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Permanent tax cuts shift the AD curve

A) farther to the right than do temporary tax cuts.

B) not as far to the right as do temporary tax cuts.

C) farther to the left than do temporary tax cuts.

D) not as far to the left as do temporary tax cuts.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the MPC is 0.75.There are no crowding out or investment accelerator effects.If the government increases its expenditures by $200 billion,then by how much does aggregate demand shift to the right? If the government decreases taxes by $200 billion,then by how far does aggregate demand shift to the right?

A) $800 billion and $800 billion

B) $800 billion and $600 billion

C) $600 billion and $600 billion

D) $600 billion and $450 billion

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there were a large decline in net exports.If the Fed wanted to stabilize output,it could

A) buy bonds to raise interest rates.

B) buy bonds to lower interest rates.

C) sell bonds to raise interest rates.

D) sell bonds to lower interest rates.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the money supply shifts the aggregate-supply curve to the right.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest-rate effect

A) depends on the idea that increases in interest rates decrease the quantity of goods and services demanded.

B) depends on the idea that increases in interest rates decrease the quantity of goods and services supplied.

C) is responsible for the downward slope of the money-demand curve.

D) is the least important reason,in the case of the United States,for the downward slope of the aggregate-demand curve.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal propensity to consume (MPC) is defined as the fraction of

A) extra income that a household consumes rather than saves.

B) extra income that a household either consumes or saves.

C) total income that a household consumes rather than saves.

D) total income that a household either consumes or saves.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to liquidity preference theory,an increase in money demand for some reason other than a change in the price level causes

A) the interest rate to fall,so aggregate demand shifts right.

B) the interest rate to fall,so aggregate demand shifts left.

C) the interest rate to rise,so aggregate demand shifts right.

D) the interest rate to rise,so aggregate demand shifts left.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the long run,the level of output

A) depends on the money supply.

B) depends on the price level.

C) is determined by supply-side factors.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Supply-side economists focus more than other economists on

A) how fiscal policy affects consumption.

B) the multiplier affect of fiscal policy.

C) how fiscal policy affects aggregate supply.

D) the money supply.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to John Maynard Keynes,

A) the demand for money in a country is determined entirely by that nation's central bank.

B) the supply of money in a country is determined by the overall wealth of the citizens of that country.

C) the interest rate adjusts to balance the supply of,and demand for,money.

D) the interest rate adjusts to balance the supply of,and demand for,goods and services.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tends to make aggregate demand shift further to the right than the amount by which government expenditures increase?

A) the crowding-out effect

B) the multiplier effect

C) the exchange-rate effect

D) the interest-rate effect

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the MPC is 0.60.Assume there are no crowding out or investment accelerator effects.If the government increases expenditures by $200 billion,then by how much does aggregate demand shift to the right? If the government decreases taxes by $200 billion,then by how much does aggregate demand shift to the right?

A) $300 billion and $180 billion

B) $300 billion and $300 billion

C) $500 billion and $300 billion

D) $500 billion and $500 billion

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following shifts aggregate demand to the right?

A) an increase in the price level

B) an increase in the money supply

C) a decrease in the price level

D) a decrease in the money supply

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 334

Related Exams