A) 5 percent

B) 20 percent

C) 80 percent

D) 95 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

U.S.income data over the last seventy years suggests that the distribution of income

A) has gradually become more equal over the entire time period.

B) has gradually become less equal over the entire time period.

C) gradually became less equal until about 1970,then became more equal from 1970 to 2005.

D) gradually became more equal until about 1970,then became less equal from 1970 to 2005.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that young people often borrow and then repay the loans when they are older.These actions relate to which problem in measuring inequality?

A) In-kind transfers.

B) Economic life cycle.

C) Negative income tax.

D) Economic mobility.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which political philosophy believes that the government should equalize the incomes of all members of society?

A) Utilitarianism.

B) Liberalism.

C) Libertarianism.

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicaid and food stamps are

A) available only to the elderly.

B) forms of in-kind assistance.

C) forms of cash assistance.

D) transfer payments.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

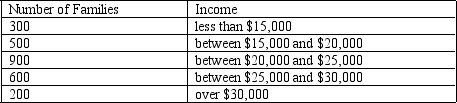

The distribution of income for Abbyville is as follows:

Where would the government in Abbyville set the poverty line to generate a poverty rate of 12 percent?

Where would the government in Abbyville set the poverty line to generate a poverty rate of 12 percent?

A) $15,000.

B) $20,000.

C) $25,000.

D) $30,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The country that has the most income equality is

A) Japan.

B) Brazil.

C) South Africa.

D) the United States.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whether or not policymakers should try to make our society more egalitarian is largely a matter of

A) economic efficiency.

B) political philosophy.

C) egalitarian principles.

D) enhanced opportunity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following does not explain why data on income distribution and the poverty rate give an incomplete picture of inequality?

A) in-kind transfers

B) economic life cycle

C) transitory income

D) All of the above contribute to an incomplete picture of inequality.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements illustrates diminishing marginal utility?

A) An extra dollar of income to a poor person provides that person with more additional utility than does an extra dollar to a rich person.

B) An extra dollar of income to a poor person provides that person with less additional utility than does an extra dollar to a rich person.

C) An extra dollar of income to a poor person provides that person with the same additional utility as does an extra dollar to a rich person.

D) An extra dollar of income to a poor person provides that person with the same total utility as does an extra dollar to a rich person.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The economic life cycle describes how young people usually have higher savings rates than middle-aged people.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the government proposes a negative income tax that calculates the taxes owed as follows: Taxes Owed = (1/3*Income) - 10,000.A family that earns an income of $60,000 will

A) pay $10,000 in taxes.

B) receive an income subsidy of $3,000.

C) receive an income subsidy of $10,000.

D) neither pay taxes nor receive an income subsidy.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If society chose to maximize average utility rather than minimum utility,

A) society would achieve perfect income equality.

B) society would achieve the maximin objective.

C) its justice would be more utilitarian than Rawlsian.

D) its justice would be more Rawlsian than utilitarian.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A common criticism of government programs that are designed to assist the poor is that

A) those who receive assistance rarely meet the criterion for eligibility.

B) the majority of those below the poverty line refuse to accept government assistance.

C) they create incentives for people to become "needy."

D) they typically account for a majority of annual government expenditures.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Governments can never improve market outcomes.

B) Governments can sometimes improve market outcomes.

C) Governments can always improve market outcomes.

D) Government can never make the income distribution more equal.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The United States has more income inequality than Brazil and South Africa.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the minimum wage is correct?

A) An increase in the minimum wage enhances the well-being of all unskilled workers.

B) An increase in the minimum wage has no effect on the well-being of middle-class families.

C) Advocates of the minimum wage argue that the demand for labor is relatively inelastic.

D) Critics of the minimum wage argue that it is an undesirable way of helping the poor because it is costly to the government.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poverty is found to be correlated with

A) age and race but not family composition.

B) race only.

C) race and family composition but not age.

D) age,race,and family composition.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which political philosophy believes in balancing the gains from greater equality against the losses from distorted incentives?

A) Utilitarianism.

B) Liberalism.

C) Libertarianism.

D) Secularism.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The calculation of the poverty line includes adjustments for

A) energy costs.

B) child care costs.

C) the level of prices.

D) the Earned Income Tax Credit.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 312

Related Exams