B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

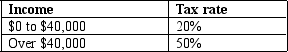

Table 12-5

-Refer to Table 12-5.What is the marginal tax rate for a person who makes $35,000?

-Refer to Table 12-5.What is the marginal tax rate for a person who makes $35,000?

A) 20%

B) 30%

C) 40%

D) 50%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Tax evasion is illegal,but tax avoidance is legal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

European countries tend to rely on which type of tax more so than the United States does?

A) An income tax

B) A lump-sum tax

C) A value-added tax

D) A corrective tax

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One reason that deadweight losses are so difficult to avoid is that

A) taxes affect the decisions that people make.

B) income taxes are not paid by everyone.

C) consumption taxes must be universally applied to all commodities.

D) the administrative burden is hard to calculate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In choosing the form of a tax,there is often a tradeoff between

A) allocative and productive efficiency.

B) profits and revenues.

C) efficiency and fairness.

D) fairness and profits.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Suppose Jim and Joan receive great satisfaction from their consumption of cheesecake.Joan would be willing to purchase only one slice and would pay up to $6 for it.Jim would be willing to pay $9 for his first slice,$7 for his second slice,and $3 for his third slice.The current market price is $3 per slice. -Refer to Scenario 12-1.Assume that the government places a $2 tax on each slice of cheesecake and that the new equilibrium price is $5.What is the deadweight loss of the tax?

A) zero

B) $3

C) $6

D) $8

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adam,Barb,and Carli each like to read novels.The current bestseller costs $10.Adam values it at $15,Barb at $13,and Carli at $11.Suppose that if the government taxes books at $2 each,the selling price will rise to $12.A consequence of the tax is that

A) consumer surplus shrinks by $4 and tax revenues increase by $6,so there is a deadweight loss of $2.

B) consumer surplus shrinks by $6 and tax revenues increase by $6,so there is no deadweight loss.

C) consumer surplus shrinks by $5 and tax revenues increase by $6,so there is no deadweight loss.

D) consumer surplus shrinks by $5 and tax revenues increase by $4,so there is a deadweight loss of $1.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a nation gets richer,the government typically takes

A) a constant share of income in taxes.

B) a smaller share of income in taxes.

C) a larger share of income in taxes.

D) There is little evidence of a relationship between income and taxes for most countries.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payroll tax differs from the individual income tax because the payroll tax is primarily earmarked to pay for

A) employer-provided pensions.

B) Social Security and Medicare.

C) employer-provided health benefits.

D) job loss and training programs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2007,which category represented the largest category of spending for the U.S.federal government?

A) Medicare

B) Social Security

C) National defense

D) Net interest

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

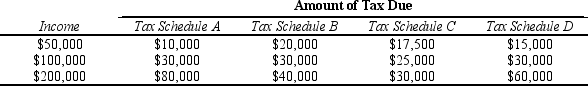

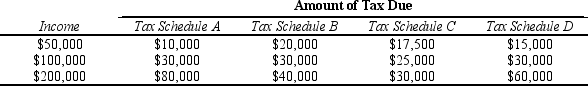

Table 12-14

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-The notion that similar taxpayers should pay similar amounts of taxes is known as

-The notion that similar taxpayers should pay similar amounts of taxes is known as

A) vertical equity.

B) the benefits principle.

C) horizontal equity.

D) taxpayer efficiency.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If your income is $40,000 and your income tax liability is $5,000,your marginal tax rate is

A) 8 percent.

B) 12.5 percent.

C) 20 percent.

D) unknown.We do not have enough information to answer this question.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A transfer payment is a government payment

A) to companies that provide goods or services to government agencies.

B) designed to transfer funds from one government agency to another.

C) which transfers revenue from the federal government to state government.

D) not made in exchange for a good or service.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One tax system is less efficient than another if it

A) places a lower tax burden on lower-income families than on higher-income families.

B) places a higher tax burden on lower-income families than on higher-income families.

C) raises the same amount of revenue at a higher cost to taxpayers.

D) raises less revenue at a lower cost to taxpayers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-14

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-14.Which tax schedules are progressive?

-Refer to Table 12-14.Which tax schedules are progressive?

A) Tax Schedule A only

B) Tax Schedule A and Tax Schedule B

C) Tax Schedule A,Tax Schedule B,and Tax Schedule C

D) All four Tax Schedules are progressive.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An income tax in which the average tax rate is the same for all taxpayers would be considered a

A) progressive tax.

B) regressive tax.

C) distortion-free tax.

D) proportional tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) A gasoline tax can be an example of a benefits tax.

B) A progressive tax attempts to achieve vertical equity.

C) A progressive tax can be an example of the ability-to-pay principle.

D) A regressive tax attempts to achieve horizontal equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a regressive tax system,

A) the marginal tax rate for high income taxpayers is higher than the marginal tax rate for low income taxpayers.

B) the marginal tax rate for high income taxpayers is the same as the marginal tax rate for low income taxpayers.

C) the marginal tax rate for high income taxpayers is lower than the marginal tax rate for low income taxpayers.

D) Any of the above could be true under a regressive tax system.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

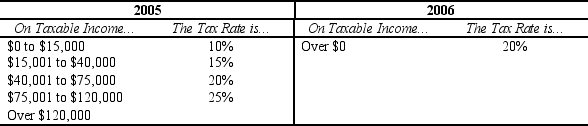

Table 12-13

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-13.Which of the following best describes the tax schedule in 2005?

-Refer to Table 12-13.Which of the following best describes the tax schedule in 2005?

A) Proportional tax

B) Progressive tax

C) Regressive tax

D) Vertical tax

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 397

Related Exams