A) is paid only by the state's residents.

B) occasionally excludes items that are deemed to be necessities.

C) is commonly levied on labor services.

D) applies to wholesale purchases but not retail purchases.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If Christopher earns $80,000 in taxable income and pays $20,000 in taxes,his average tax rate is 20 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

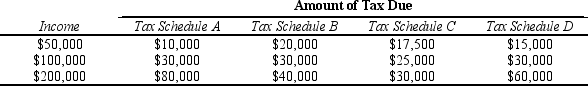

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.For an individual with $200,000 in taxable income,which tax schedule has the highest average tax rate?

-Refer to Table 12-11.For an individual with $200,000 in taxable income,which tax schedule has the highest average tax rate?

A) Tax Schedule A

B) Tax Schedule B

C) Tax Schedule C

D) Tax Schedule D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

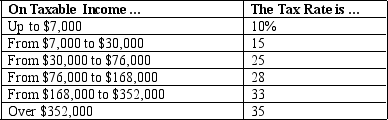

Table 12-1

-Refer to Table 12-1.If Andrea has $85,000 in taxable income,her average tax rate is

-Refer to Table 12-1.If Andrea has $85,000 in taxable income,her average tax rate is

A) 19.7%.

B) 20.3%.

C) 21.4%.

D) 22.6%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2007,approximately how much of federal government spending went to Social Security?

A) 10%

B) 20%

C) 30%

D) 40%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Poor countries such as India and Pakistan usually have low tax burdens.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Individual Retirement Accounts and 401(k) plans make the current U.S.tax system

A) less like European tax systems than it otherwise would be.

B) more like a payroll tax than it otherwise would be.

C) more like an income tax than it otherwise would be.

D) more like a consumption tax than it otherwise would be.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal equity refers to a tax system in which individuals with similar incomes pay similar taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

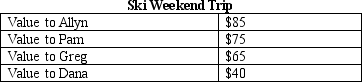

Table 12-3

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $38 and that the price reflects the actual unit cost of providing a weekend of skiing.What is the value of the surplus that accrues to all four skiers from their weekend trip?

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $38 and that the price reflects the actual unit cost of providing a weekend of skiing.What is the value of the surplus that accrues to all four skiers from their weekend trip?

A) $105

B) $113

C) $140

D) $265

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tax system requires all taxpayers to pay the same percentage of their income in taxes?

A) A regressive tax

B) A proportional tax

C) A progressive tax

D) A horizontal equity tax

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

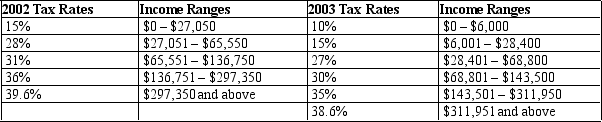

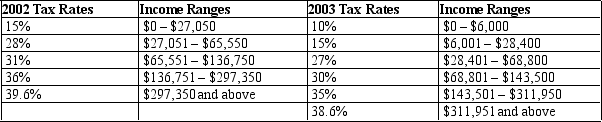

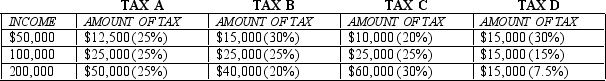

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Charles is a single person whose taxable income is $35,000 a year.What happened to his marginal tax rate between 2002 and 2003?

-Refer to Table 12-12.Charles is a single person whose taxable income is $35,000 a year.What happened to his marginal tax rate between 2002 and 2003?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A family's income tax liability is

A) a standard percentage of all income earned.

B) determined by wage income rather than dividend and interest income.

C) based on total income.

D) constant from year to year.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax system with little deadweight loss and a small administrative burden would be described as

A) equitable.

B) communistic.

C) capitalistic.

D) efficient.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

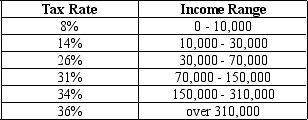

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Max has taxable income of $227,000,his average tax rate is

-Refer to Table 12-2.If Max has taxable income of $227,000,his average tax rate is

A) 15.7%.

B) 26.8%.

C) 27.8%.

D) 28.6%.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal and vertical equity are the two primary measures of efficiency of a tax system.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If all taxpayers pay the same percentage of income in taxes,the tax system is proportional.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2007,social insurance taxes represented approximately what percentage of total receipts for the federal government?

A) 15%

B) 25%

C) 35%

D) 45%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-4

-The deadweight loss associated with a tax on a commodity is generated by

-The deadweight loss associated with a tax on a commodity is generated by

A) the consumers who still choose to consume the commodity but pay a higher price that reflects the tax.

B) the consumers who choose to not consume the commodity that is taxed.

C) all citizens who are able to use services provided by government.

D) the consumers who are unable to avoid paying the tax.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Samantha is a single person whose taxable income is $100,000 a year.What is her average tax rate in 2003?

-Refer to Table 12-12.Samantha is a single person whose taxable income is $100,000 a year.What is her average tax rate in 2003?

A) 24.2%

B) 26.4%

C) 27.8%

D) 30%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-17

-Refer to Table 12-17.A proportional tax is illustrated by tax

-Refer to Table 12-17.A proportional tax is illustrated by tax

A) A.

B) B.

C) C.

D) D.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 397

Related Exams