A) buyers only.

B) sellers only.

C) buyers and sellers only.

D) buyers,sellers,and the government.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Economists use the government's tax revenue to measure the public benefit from a tax.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

As the size of a tax increases,the government's tax revenue rises,then falls.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the market for widgets,the supply curve is the typical upward-sloping straight line,and the demand curve is the typical downward-sloping straight line.The equilibrium quantity in the market for widgets is 200 per month when there is no tax.Then a tax of $5 per widget is imposed.As a result,the government is able to raise $750 per month in tax revenue.We can conclude that the equilibrium quantity of widgets has fallen by

A) 25 per month.

B) 50 per month.

C) 75 per month.

D) 100 per month.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Unlike the supply of raw land,the supply of improvements

A) is perfectly inelastic.

B) has an elasticity that is greater than zero.

C) cannot be taxed,even if an attempt were made to tax it.

D) is exempt from taxation under current law.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the size of a tax triples,the deadweight loss increases by a factor of six.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The greater the elasticity of demand,the smaller the deadweight loss of a tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the labor supply curve is very elastic,a tax on labor

A) has a large deadweight loss.

B) raises enough tax revenue to offset the loss in welfare.

C) has a relatively small impact on the number of hours that workers choose to work.

D) results in a large tax burden on the firms that hire labor.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

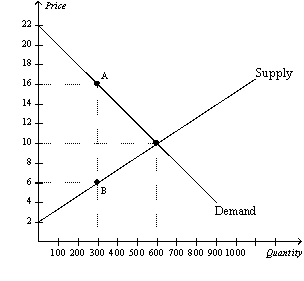

Figure 8-2

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-2.The amount of deadweight loss as a result of the tax is

-Refer to Figure 8-2.The amount of deadweight loss as a result of the tax is

A) $2.50.

B) $5.

C) $7.50.

D) $10.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ideas is the most plausible?

A) Tax revenue is more likely to increase when a low tax rate is increased than when a high tax rate is increased.

B) Tax revenue is less likely to increase when a low tax rate is increased than when a high tax rate is increased.

C) Tax revenue is likely to increase by the same amount when a low tax rate is increased and when a high tax rate is increased.

D) Decreasing a tax rate can never increase tax revenue.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Laffer curve illustrates how taxes in markets with greater elasticities of demand compare to taxes in markets with smaller elasticities of supply.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct regarding the imposition of a tax on gasoline?

A) The incidence of the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

B) The incidence of the tax depends upon the price elasticities of demand and supply.

C) The amount of tax revenue raised by the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

D) The amount of tax revenue raised by the tax does not depend upon the amount of the tax per unit.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For good X,the supply curve is the typical upward-sloping straight line,and the demand curve is the typical downward-sloping straight line.A tax of $10 per unit is imposed on good X.The tax reduces the equilibrium quantity in the market by 200 units.The deadweight loss from the tax is

A) $2,000.

B) $1,000.

C) $500.

D) $250.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the labor supply curve is nearly vertical,a tax on labor

A) has a large deadweight loss.

B) raises a small amount of tax revenue.

C) has little impact on the amount of work that workers are willing to do.

D) results in a large tax burden on the firms that hire labor.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ronald Reagan believed that reducing income tax rates would

A) do little,if anything,to encourage hard work.

B) result in large increases in deadweight losses.

C) raise economic well-being and perhaps even tax revenue.

D) lower economic well-being,even though tax revenue could possibly increase.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

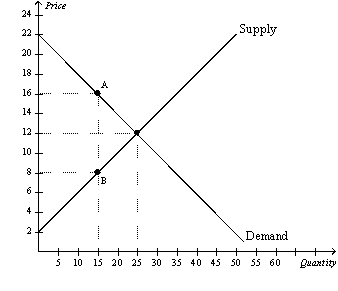

Figure 8-6

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-6.Total surplus with the tax in place is

-Refer to Figure 8-6.Total surplus with the tax in place is

A) $1,500.

B) $3,600.

C) $4,500.

D) $6,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-7

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-7.Which of the following statements is correct?

-Refer to Figure 8-7.Which of the following statements is correct?

A) The loss of producer surplus that is associated with some sellers dropping out of the market as a result of the tax is $30.

B) The loss of consumer surplus for those buyers of the good who continue to buy it after the tax is imposed is $60.

C) The loss of consumer surplus caused by this tax exceeds the loss of producer surplus caused by this tax.

D) This tax produces $200 in tax revenue for the government.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

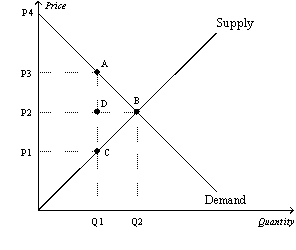

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3.The price that buyers effectively pay after the tax is imposed is

-Refer to Figure 8-3.The price that buyers effectively pay after the tax is imposed is

A) P1.

B) P2.

C) P3.

D) P4.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax of $1 per unit is imposed on a good.The more elastic the supply of the good,other things equal,the

A) smaller is the response of quantity supplied to the tax.

B) larger is the tax burden on sellers relative to the tax burden on buyers.

C) larger is the deadweight loss of the tax.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a good to which a per-unit tax applies.The size of the deadweight that results from the tax is smaller,the

A) less elastic is the demand for the good.

B) less elastic is the supply of the good.

C) smaller is the amount of the tax.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 353

Related Exams