A) upward by exactly $2.00.

B) upward by less than $2.00.

C) downward by exactly $2.00.

D) downward by less than $2.00.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

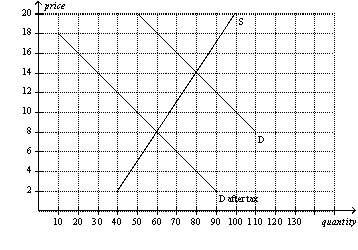

Figure 6-10  -Refer to Figure 6-10.The per-unit burden of the tax is

-Refer to Figure 6-10.The per-unit burden of the tax is

A) $4 on buyers and $6 on sellers.

B) $5 on buyers and $5 on sellers.

C) $6 on buyers and $4 on sellers.

D) $10 on buyers and $0 on sellers.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over time,housing shortages caused by rent control

A) increase,because the demand for and supply of housing are less elastic in the long run.

B) increase,because the demand for and supply of housing are more elastic in the long run.

C) decrease,because the demand for and supply of housing are less elastic in the long run.

D) decrease,because the demand for and supply of housing are more elastic in the long run.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the demand for macaroni is inelastic and the supply of macaroni is elastic,and the demand for cigarettes is inelastic and the supply of cigarettes is elastic.If a tax were levied on the sellers of both of these commodities,we would expect that the

A) burden of both taxes would fall more heavily on the buyers than on the sellers.

B) burden of the macaroni tax would fall more heavily on the sellers than on the buyers,and the burden of the cigarette tax would fall more heavily on the buyers than on the sellers.

C) burden of the macaroni tax would fall more heavily on the buyers than on the sellers,and the burden of the cigarette tax would fall more heavily on the sellers than on the buyers.

D) burden of both taxes would fall more heavily on the sellers than on the buyers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most labor economists believe that the supply of labor is

A) less elastic than the demand and,therefore,firms bear most of the burden of the payroll tax.

B) less elastic than the demand and,therefore,workers bear most of the burden of the payroll tax.

C) more elastic than the demand and,therefore,workers bear most of the burden of the payroll tax.

D) more elastic than the demand and,therefore,firms bear most of the burden of the payroll tax.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Most of the burden of a luxury tax falls on the middle class workers who produce luxury goods rather than on the rich who buy them.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Most labor economists believe that the supply of labor is much more elastic than the demand.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Minimum-wage laws dictate the lowest wage that firms may pay workers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

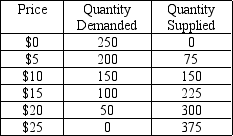

Table 6-2

-Refer to Table 6-2.Which of the following statements is correct?

-Refer to Table 6-2.Which of the following statements is correct?

A) A price ceiling set at $15 will be binding and will result in a shortage of 50 units.

B) A price ceiling set at $15 will be binding and will result in a shortage of 100 units.

C) A price ceiling set at $15 will be binding and will result in a shortage of 125 units.

D) A price ceiling set at $15 will not be binding.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the effects of rent control is correct?

A) The short-run effect of rent control is a surplus of apartments,and the long-run effect of rent control is a shortage of apartments.

B) The short-run effect of rent control is a relatively small shortage of apartments,and the long-run effect of rent control is a larger shortage of apartments.

C) In the long run,rent control leads to a shortage of apartments and an improvement in the quality of available apartments.

D) The effects of rent control are very noticeable to the public in the short run because the primary effects of rent control occur very quickly.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

One common example of a price floor is the minimum wage.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax levied on the sellers of blueberries

A) increases sellers' costs,reduces profits,and shifts the supply curve up.

B) increases sellers' costs,reduces profits,and shifts the supply curve down.

C) decreases sellers' costs,increases profits,and shifts the supply curve up.

D) decreases sellers' costs,increases profits,and shifts the supply curve down.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price ceiling is imposed on a market,

A) price no longer serves as a rationing device.

B) the quantity supplied at the price ceiling exceeds the quantity that would have been supplied without the price ceiling.

C) all buyers benefit.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum-wage laws dictate the

A) average price employers must pay for labor.

B) highest price employers may pay for labor.

C) lowest price employers may pay for labor.

D) the highest and lowest prices employers may pay for labor.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The goal of the minimum wage is to ensure workers a minimally adequate standard of living.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose sellers of liquor are required to send $1.00 to the government for every bottle of liquor they sell.Further,suppose this tax causes the price paid by buyers of liquor to rise by $0.60 per bottle.Which of the following statements is correct?

A) The effective price received by sellers is $0.40 per bottle less than it was before the tax.

B) Sixty percent of the burden of the tax falls on sellers.

C) This tax causes the demand curve for liquor to shift downward by $1.00 at each quantity of liquor.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the final analysis,tax incidence

A) depends on the legislated burden.

B) is entirely random.

C) depends on the forces of supply and demand.

D) falls entirely on buyers or entirely on sellers.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a competitive market free of government regulation,

A) price adjusts until quantity demanded is greater than quantity supplied.

B) price adjusts until quantity demanded is less than quantity supplied.

C) price adjusts until quantity demanded equals quantity supplied.

D) supply adjusts to meet demand at every price.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on golf clubs will cause buyers of golf clubs to pay a higher price,sellers of golf clubs to receive a lower price,and fewer golf clubs to be sold.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers increases the size of a market.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 459

Related Exams