A) open market operations

B) reserve requirements

C) changing the discount rate

D) increasing the government budget deficit

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During recessions, banks typically choose to hold more excess reserves relative to their deposits. This action

A) increases the money multiplier and increases the money supply.

B) decreases the money multiplier and decreases the money supply.

C) does not change the money multiplier, but increases the money supply.

D) does not change the money multiplier, but decreases the money supply.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Federal Reserve was created in 1913 after a series of bank failures in 1907.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

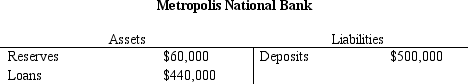

Table 16-7

Metropolis National Bank is currently holding 2% of its deposits as excess reserves.  -Refer to Balance Sheet of Metropolis National Bank. Metropolis National Bank is currently holding 2% of deposits as excess reserves. Assuming that all banks have the same required reserve ratio, and then none want to hold excess reserves what is the value of the money multiplier?

-Refer to Balance Sheet of Metropolis National Bank. Metropolis National Bank is currently holding 2% of deposits as excess reserves. Assuming that all banks have the same required reserve ratio, and then none want to hold excess reserves what is the value of the money multiplier?

A) 8.25

B) 10

C) 12

D) 20

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed increases reserves if it conducts open market

A) purchases or auctions term credit.

B) purchases but not if it auctions term credit

C) sales or auctions term credit

D) sales but not if it auctions term credit

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

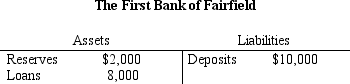

Table 16-3.  -Refer to Table 16-3. If $1,000 is deposited into the First Bank of Fairfield, and the bank takes no other actions, its

-Refer to Table 16-3. If $1,000 is deposited into the First Bank of Fairfield, and the bank takes no other actions, its

A) reserves will increase by $200.

B) liabilities will decrease by $1,000.

C) assets will increase by $1,000.

D) reserves will increase by $800.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following can banks use to borrow from the Federal Reserve?

A) the discount window or the term auction facility

B) the discount window but not the term auction facility

C) the term auction facility but not the discount window

D) Banks can not borrow from the Federal Reserve, only the government can.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 16-1.The monetary policy of Namdian is determined by the Namdian Central Bank. The local currency is the dia. Namdian banks collectively hold 100 million dias of required reserves, 25 million dias of excess reserves, 250 million dias of Namdian Treasury Bonds, and their customers hold 1,000 million dias of deposits. Namdians prefer to use only demand deposits and so the money supply consists of demand deposits. -Refer to Scenario 16-1. Assume that banks desire to continue holding the same ratio of excess reserves to deposits. What is the reserve requirement and what is the reserve ratio?

A) 2 percent, 8 percent

B) 8 percent, 10 percent

C) 10 percent, 12.5 percent

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Open Market Committee decides to increase the money supply, then the Federal Reserve

A) creates dollars and uses them to purchase government bonds from the public.

B) sells government bonds from its portfolio to the public.

C) creates dollars and uses them to purchase various types of stocks and bonds from the public.

D) sells various types of stocks and bonds from its portfolio to the public.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following does the Federal Reserve not do?

A) conduct monetary policy

B) act as a lender of last resort

C) convert Federal Reserve Notes into gold

D) serve as a bank regulator

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Sandra routinely uses currency to purchase her groceries. She is using money as a medium of exchange.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 16-2.The Monetary Policy of Tazi is controlled by the country's central bank known as the Bank of Tazi. The local unit of currency is the taz. Aggregate banking statistics show that collectively the banks of Tazi hold 300 million tazes of required reserves, 75 million tazes of excess reserves, have issued 7,500 million tazes of deposits, and hold 225 million tazes of Tazian Treasury bonds. Tazians prefer to use only demand deposits and so all money is on deposit at the bank. -Refer to Scenario 16-2. Suppose that the Bank of Tazi changes the reserve requirement to 3 percent. Assuming that the banks still want to hold the same percentage of excess reserves what is the value of the money supply after the change in the reserve requirement?

A) 9,375 million tazes

B) 10,000 million tazes

C) 12,500 million tazes

D) None of the above is correct to the nearest million tazes.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A problem that the Fed faces when it attempts to control the money supply is that

A) the 100-percent-reserve banking system in the U.S. makes it difficult for the Fed to carry out its monetary policy.

B) the Fed has to get the approval of the U.S. Treasury Department whenever it uses any of its monetary policy tools.

C) the Fed does not have a tool that it can use to change the money supply by either a small amount or a large amount.

D) the Fed does not control the amount of money that households choose to hold as deposits in banks.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the nation of Wiknam, the money supply is $80,000 and reserves are $18,000. Assuming that people hold only deposits and no currency, and that banks hold no excess reserves, then the reserve requirement is

A) 29 percent.

B) 22.5 percent.

C) 16 percent.

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The banking system currently has $200 billion of reserves, none of which are excess. People hold only deposits and no currency, and the reserve requirement is 4 percent. If the Fed raises the reserve requirement to 10 percent and at the same time buys $50 billion worth of bonds, then by how much does the money supply change?

A) It rises by $600 billion.

B) It rises by $125 billion.

C) It falls by $2,500 billion.

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal funds rate is the interest rate that

A) banks charge one another for loans.

B) banks charge the Fed for loans.

C) the Fed charges banks for loans.

D) the Fed charges Congress for loans.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Fractional reserve banking is a system where banks must hold an amount of cash based on a percentage of its loans.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most financial assets other than money function as

A) a medium of exchange, a unit of account, and a store of value.

B) a medium of exchange and a store of value, but not a unit of account.

C) a store of value and a unit of account, but not a mediuim of exchange.

D) a store of value, but not a unit of account nor a medium of exchange

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Bank runs and the accompanying increase in the money multiplier caused the U.S. money supply to rise by 28 percent from 1929 to 1933.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

M1 includes savings deposits.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 423

Related Exams