A) increase from $600 to $800.

B) decrease from $800 to $300.

C) decrease from $600 to $300.

D) remain unchanged at $600.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A tax raises the price received by sellers and lowers the price paid by buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10 ![Figure 8-10 -Refer to Figure 8-10. Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2. With the tax, the total surplus is A) [x (P0-P5) x Q5] + [x (P5-0) x Q5]. B) [x (P0-P2) x Q2] +[(P2-P8) x Q2] + [x (P8-0) x Q2]. C) (P2-P8) x Q2. D) x (P2-P8) x (Q5-Q2) .](https://d2lvgg3v3hfg70.cloudfront.net/TB4800/11ea67aa_efa6_5d1e_8b3b_4b4b0527e148_TB4800_00_TB4800_00_TB4800_00_TB4800_00_TB4800_00_TB4800_00_TB4800_00_TB4800_00_TB4800_00_TB4800_00_TB4800_00.jpg) -Refer to Figure 8-10. Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2. With the tax, the total surplus is

-Refer to Figure 8-10. Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2. With the tax, the total surplus is

A) [x (P0-P5) x Q5] + [x (P5-0) x Q5].

B) [x (P0-P2) x Q2] +[(P2-P8) x Q2] + [x (P8-0) x Q2].

C) (P2-P8) x Q2.

D) x (P2-P8) x (Q5-Q2) .

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buyers of a product will bear the larger part of the tax burden, and sellers will bear a smaller part of the tax burden, when the

A) tax is placed on the sellers of the product.

B) tax is placed on the buyers of the product.

C) supply of the product is more elastic than the demand for the product.

D) demand for the product is more elastic than the supply of the product.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When demand is relatively elastic, the deadweight loss of a tax is larger than when demand is relatively inelastic.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

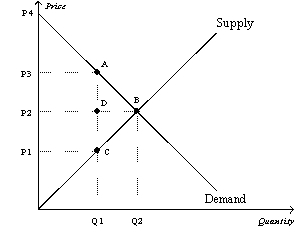

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3. The amount of deadweight loss associated with the tax is equal to

-Refer to Figure 8-3. The amount of deadweight loss associated with the tax is equal to

A) P3ACP1.

B) ABC.

C) P2ADP3.

D) P1DCP2.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

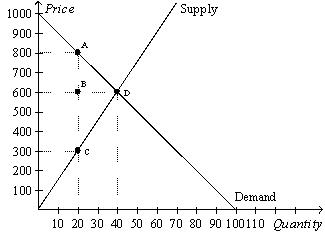

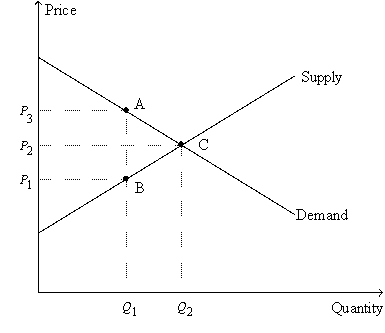

Figure 8-9

The vertical distance between points A and C represent a tax in the market.  -Refer to Figure 8-9. The imposition of the tax causes the quantity sold to

-Refer to Figure 8-9. The imposition of the tax causes the quantity sold to

A) increase by 20 units.

B) increase by 500 units.

C) decrease by 20 units.

D) decrease by 500 units.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

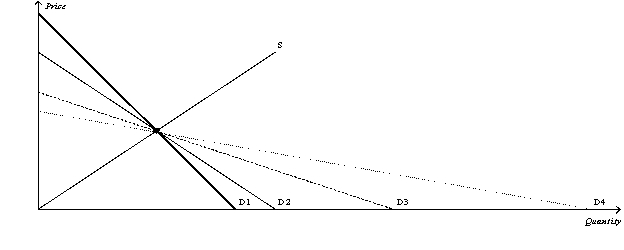

Figure 8-15  -Refer to Figure 8-15. Suppose the government imposes a $1 tax in each of the four markets represented by demand curves D1, D2, D3, and D4. The deadweight will be the largest in the market represented by

-Refer to Figure 8-15. Suppose the government imposes a $1 tax in each of the four markets represented by demand curves D1, D2, D3, and D4. The deadweight will be the largest in the market represented by

A) D1.

B) D2.

C) D3.

D) D4.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax placed on a good

A) causes the effective price to sellers to increase.

B) affects the welfare of buyers of the good but not the welfare of sellers.

C) causes the equilibrium quantity of the good to decrease.

D) creates a burden that is usually borne entirely by the sellers of the good.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

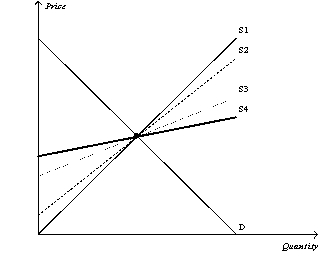

Figure 8-16  -Refer to Figure 8-16. Suppose the government imposes a $1 tax in each of the four markets represented by supply curves S1, S2, S3, and S4. The deadweight will be the largest in the market represented by

-Refer to Figure 8-16. Suppose the government imposes a $1 tax in each of the four markets represented by supply curves S1, S2, S3, and S4. The deadweight will be the largest in the market represented by

A) S1.

B) S2.

C) S3.

D) S4.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

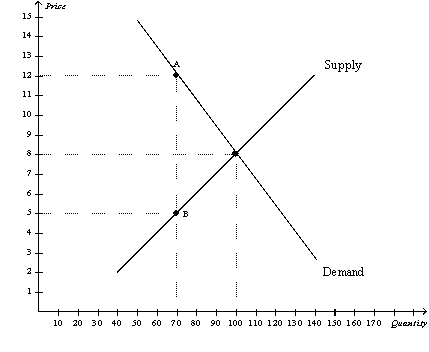

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4. The equilibrium price before the tax is imposed is

-Refer to Figure 8-4. The equilibrium price before the tax is imposed is

A) $12, and the equilibrium quantity is 70.

B) $8, and the equilibrium quantity is 100.

C) $5, and the equilibrium quantity is 70.

D) $5, and the equilibrium quantity is 100.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the labor supply curve is very elastic, a tax on labor

A) has a large deadweight loss.

B) raises enough tax revenue to offset the loss in welfare.

C) has a relatively small impact on the number of hours that workers choose to work.

D) results in a large tax burden on the firms that hire labor.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists generally agree that the most important tax in the U.S. economy is the

A) investment tax.

B) sales tax.

C) property tax.

D) labor tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andre walks Julia's dog once a day for $50 per week. Julia values this service at $60 per week, while the opportunity cost of Andre's time is $30 per week. The government places a tax of $35 per week on dog walkers. After the tax, what is the loss in total surplus?

A) $50

B) $30

C) $25

D) $0

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the tax on a good is increased from $0.15 per unit to $0.60 per unit, the deadweight loss from the tax

A) remains constant.

B) increases by a factor of 4.

C) increases by a factor of 9.

D) increases by a factor of 16.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

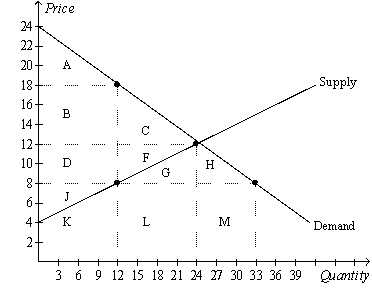

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.  -Refer to Figure 8-8. After the tax goes into effect, consumer surplus is the area

-Refer to Figure 8-8. After the tax goes into effect, consumer surplus is the area

A) A.

B) B+C.

C) A+B+C.

D) A+B+D+J+K.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a tax on labor?

A) Medicare tax

B) Social Security tax

C) federal income tax

D) All of the above are labor taxes.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

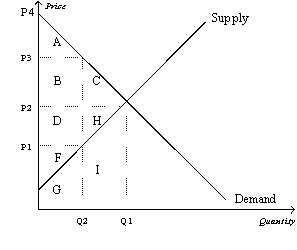

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5. The equilibrium price before the tax is imposed is

-Refer to Figure 8-5. The equilibrium price before the tax is imposed is

A) P1.

B) P2.

C) P3.

D) P4.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-11  -Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then, when the tax is imposed,

-Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then, when the tax is imposed,

A) consumer surplus decreases by $13.

B) producer surplus decreases by $13.

C) the deadweight loss amounts to $6.

D) the amount of the good that is sold remains unchanged.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the government imposes a tax on dairy products. The deadweight loss from this tax will likely be greater in the

A) first year after it is imposed than in the fifth year after it is imposed because demand and supply will be more elastic in the first year than in the fifth year.

B) first year after it is imposed than in the fifth year after it is imposed because demand and supply will be less elastic in the first year than in the fifth year.

C) fifth year after it is imposed than in the first year after it is imposed because demand and supply will be more elastic in the first year than in the fifth year.

D) fifth year after it is imposed than in the first year after it is imposed because demand and supply will be less elastic in the first year than in the fifth year.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 422

Related Exams