A) the quantity of the good supplied decreases by 20 units.

B) the demand curve shifts to the left so as to now pass through the point (quantity = 40, price = $5) .

C) buyers' total expenditure on the good decreases by $100.

D) the price of the good continues to serve as the rationing mechanism.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

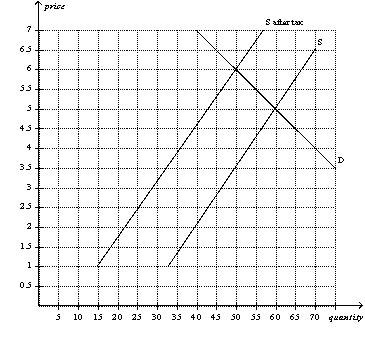

Figure 6-18  -Refer to Figure 6-18. Sellers pay how much of the tax per unit?

-Refer to Figure 6-18. Sellers pay how much of the tax per unit?

A) $1.00.

B) $1.50.

C) $2.50.

D) $3.50.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage raises the incomes of some workers, but it lowers the incomes of workers who cannot find jobs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price floor is imposed on a market,

A) price no longer serves as a rationing device.

B) the quantity demanded at the price floor exceeds the quantity that would have been demanded without the price floor.

C) all sellers benefit.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A tax of $1 on sellers shifts the supply curve upward by exactly $1.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

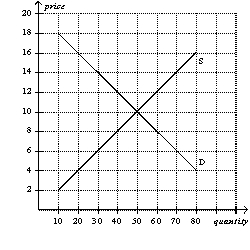

Figure 6-6  -Refer to Figure 6-6. If the government imposes a price floor of $6 on this market, then there will be

-Refer to Figure 6-6. If the government imposes a price floor of $6 on this market, then there will be

A) no surplus.

B) a surplus of 20 units.

C) a surplus of 30 units.

D) a surplus of 40 units.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product, then there will be a(n)

A) downward shift of the supply curve.

B) upward shift of the supply curve.

C) movement up and to the right along the supply curve.

D) movement down and to the left along the supply curve.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You receive a paycheck from your employer, and your pay stub indicates that $300 was deducted to pay the FICA (Social Security/Medicare) tax. Which of the following statements is correct?

A) The $300 that you paid is not necessarily the true burden of the tax that falls on you, the employee.

B) Your employer is required by law to pay $300 to match the $300 deducted from your check.

C) This type of tax is an example of a payroll tax.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding minimum wage

A) alters both the quantity demanded and quantity supplied of labor.

B) affects only the quantity of labor demanded; it does not affect the quantity of labor supplied.

C) has no effect on the quantity of labor demanded or the quantity of labor supplied.

D) causes only temporary unemployment because the market will adjust and eliminate any temporary surplus of workers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price ceiling is imposed on a market,

A) price no longer serves as a rationing device.

B) the quantity supplied at the price ceiling exceeds the quantity that would have been supplied without the price ceiling.

C) all buyers benefit.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a 50-cent tax on the sellers of packets of chewing gum. The tax would

A) shift the supply curve upward by less than 50 cents.

B) raise the equilibrium price by 50 cents.

C) create a 50-cent tax burden each for buyers and sellers.

D) discourage market activity.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lawmakers designed the burden of the FICA payroll tax to be split evenly between workers and firms. Labor economists believe that

A) lawmakers may have actually achieved their goal because statistics show that the tax burden is currently equally divided.

B) the tax raises too little revenue for the government, so it should be eliminated.

C) firms bear most of the burden of the tax.

D) workers bear most of the burden of the tax.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the equilibrium price of a tube of toothpaste is $2, and the government imposes a price floor of $3 per tube. As a result of the price floor, the

A) demand curve for toothpaste shifts to the left.

B) supply curve for toothpaste shifts to the right.

C) quantity demanded of toothpaste decreases, and the quantity of toothpaste that firms want to supply increases.

D) quantity supplied of toothpaste stays the same.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 6-2 -Refer to Table 6-2. A price floor set at $20 will

A) be binding and will result in a surplus of 50 units.

B) be binding and will result in a surplus of 100 units.

C) be binding and will result in a surplus of 250 units.

D) not be binding.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

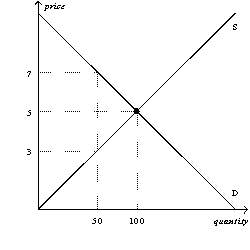

Figure 6-15  -Refer to Figure 6-15. Suppose a tax of $2 per unit is imposed on this market. How much will sellers receive per unit after the tax is imposed?

-Refer to Figure 6-15. Suppose a tax of $2 per unit is imposed on this market. How much will sellers receive per unit after the tax is imposed?

A) $3

B) between $3 and $5

C) between $5 and $7

D) $7

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The impact of the minimum wage depends on the skill and experience of the worker.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Minimum-wage laws are precise policy instruments that can specifically target workers whose family incomes are low.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers shifts the supply curve but not the demand curve.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Workers, rather than firms, bear most of the burden of the payroll tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the buyers of personal computer external hard drives encourages

A) sellers to supply a smaller quantity at every price.

B) buyers to demand a smaller quantity at every price.

C) buyers to demand a larger quantity at every price.

D) Both a) and b) are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 556

Related Exams