B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the market for watermelons. Buyers

A) and sellers would lobby for a price ceiling.

B) and sellers would lobby for a price floor.

C) would lobby for a price ceiling, whereas sellers would lobby for a price floor.

D) would lobby for a price floor, whereas sellers would lobby for a price ceiling.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Minimum-wage laws benefit society by creating a surplus of labor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the buyers of a product, buyers pay

A) more and sellers receive more than they did before the tax.

B) more and sellers receive less than they did before the tax.

C) less and sellers receive more than they did before the tax.

D) less and sellers receive less than they did before the tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Taxes levied on sellers and taxes levied on buyers are not equivalent.

B) A tax places a wedge between the price that buyers pay and the price that sellers receive.

C) The wedge between the buyers' price and the sellers' price is the same, regardless of whether the tax is levied on buyers or sellers.

D) In the new after-tax equilibrium, buyers and sellers share the burden of the tax.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price floor is imposed on a market to benefit sellers,

A) every seller in the market benefits.

B) all buyers and sellers benefit.

C) every seller who wants to sell the good will be able to do so, but only if he appeals to the personal biases of the buyers.

D) some sellers will not be able to sell any amount of the good.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

States in the U.S. may mandate minimum wages above the federal level.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists generally believe that rent control is

A) an efficient and fair way to help the poor.

B) inefficient but the best available means of solving a serious social problem.

C) a highly inefficient way to help the poor raise their standard of living.

D) an efficient way to allocate housing, but not a good way to help the poor.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is currently a tax of $50 per ticket on airline tickets. Sellers of airline tickets are required to pay the tax to the government. If the tax is reduced from $50 per ticket to $30 per ticket, then the

A) demand curve will shift upward by $20, and the effective price received by sellers will increase by $20.

B) demand curve will shift upward by $20, and the effective price received by sellers will increase by less than $20.

C) supply curve will shift downward by $20, and the price paid by buyers will decrease by $20.

D) supply curve will shift downward by $20, and the price paid by buyers will decrease by less than $20.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

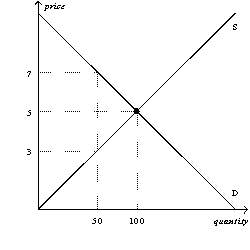

Figure 6-15  -Refer to Figure 6-15. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

-Refer to Figure 6-15. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

A) $3

B) between $3 and $5

C) between $5 and $7

D) $7

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

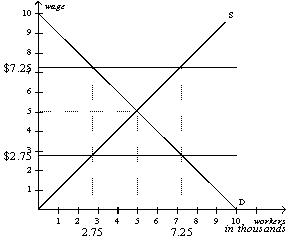

Figure 6-13  -Refer to Figure 6-13. In this market, a minimum wage of $2.75 is

-Refer to Figure 6-13. In this market, a minimum wage of $2.75 is

A) binding and creates a labor shortage.

B) binding and creates unemployment.

C) nonbinding and creates a labor shortage.

D) nonbinding and creates neither a labor shortage nor unemployment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers usually causes buyers to pay more for the good and sellers to receive less for the good than they did before the tax was levied.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax of $1 on sellers always increases the equilibrium price by $1.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

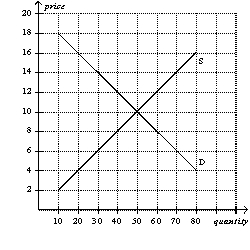

Figure 6-6  -Refer to Figure 6-6. Which of the following statements is correct?

-Refer to Figure 6-6. Which of the following statements is correct?

A) A price ceiling set at $12 would be binding, but a price ceiling set at $8 would not be binding.

B) A price floor set at $8 would be binding, but a price ceiling set at $8 would not be binding.

C) A price ceiling set at $9 would result in a surplus.

D) A price floor set at $11 would result in a surplus.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose buyers of vodka are required to send $1.00 to the government for every bottle of vodka they buy. Further, suppose this tax causes the effective price received by sellers of vodka to fall by $0.60 per bottle. Which of the following statements is correct?

A) This tax causes the supply curve for vodka to shift upward by $1.00 at each quantity of vodka.

B) The price paid by buyers is $0.40 per bottle more than it was before the tax.

C) Sixty percent of the burden of the tax falls on buyers.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $0.50 tax levied on the buyers of pomegranate juice will shift the demand curve

A) upward by exactly $0.50.

B) upward by less than $0.50.

C) downward by exactly $0.50.

D) downward by less than $0.50.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A binding price floor causes a shortage in the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

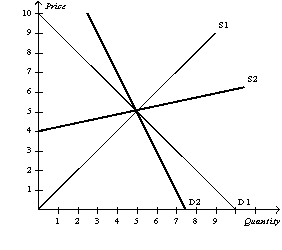

Figure 6-24

Suppose the government imposes a $2 on this market.  -Refer to Figure 6-24. Suppose D1 represents the demand curve for paperback novels, D2 represents the demand curve for gasoline, and S1 represents the supply curve for paperback novels and gasoline. After the imposition of the $2 on paperback novels and on gasoline, the

-Refer to Figure 6-24. Suppose D1 represents the demand curve for paperback novels, D2 represents the demand curve for gasoline, and S1 represents the supply curve for paperback novels and gasoline. After the imposition of the $2 on paperback novels and on gasoline, the

A) buyers of gasoline bear a higher burden of the $2 tax than buyers of paperback novels.

B) sellers of gasoline bear a higher burden of the $2 tax than sellers of paperback novels.

C) buyers of gasoline bear an equal burden of the $2 tax as buyers of paperback novels.

D) Both a) and b) are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Because the supply and demand of housing are inelastic in the short run, the initial shortage caused by rent control is large.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a tax on a good, then the quantity of the good sold will

A) increase.

B) decrease.

C) not change.

D) All of the above are possible.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 556

Related Exams